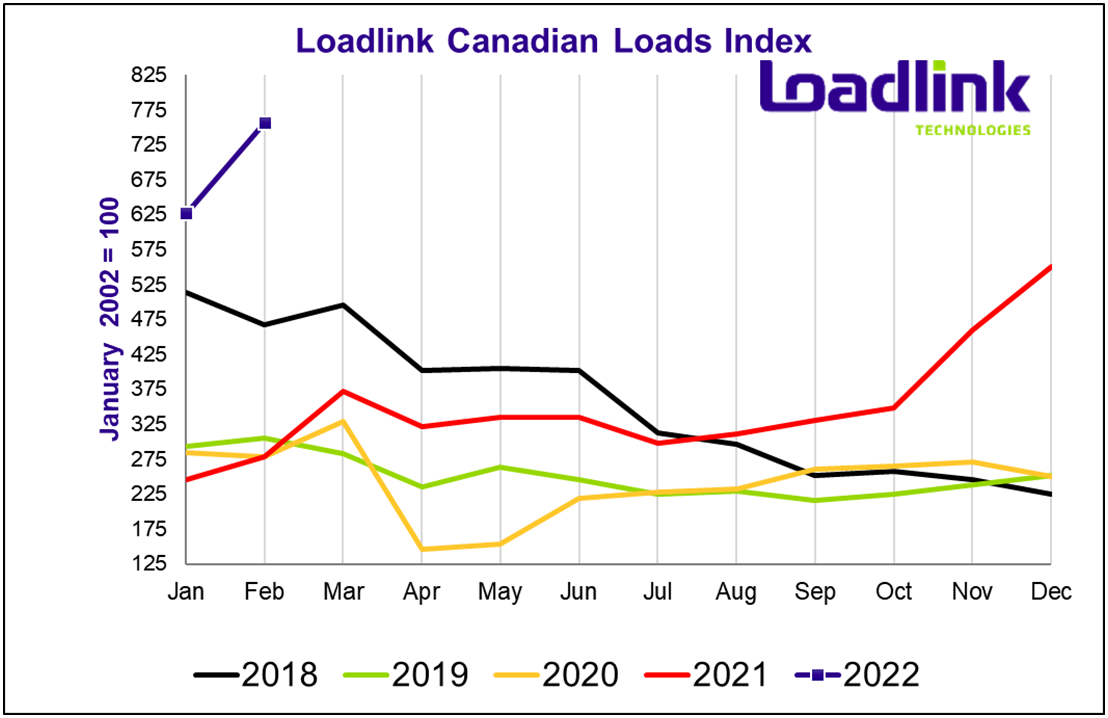

Whether you attribute the growth to eCommerce, global market shifts, or challenges with continental border flow, one thing is for certain – there is no shortage of loads available.

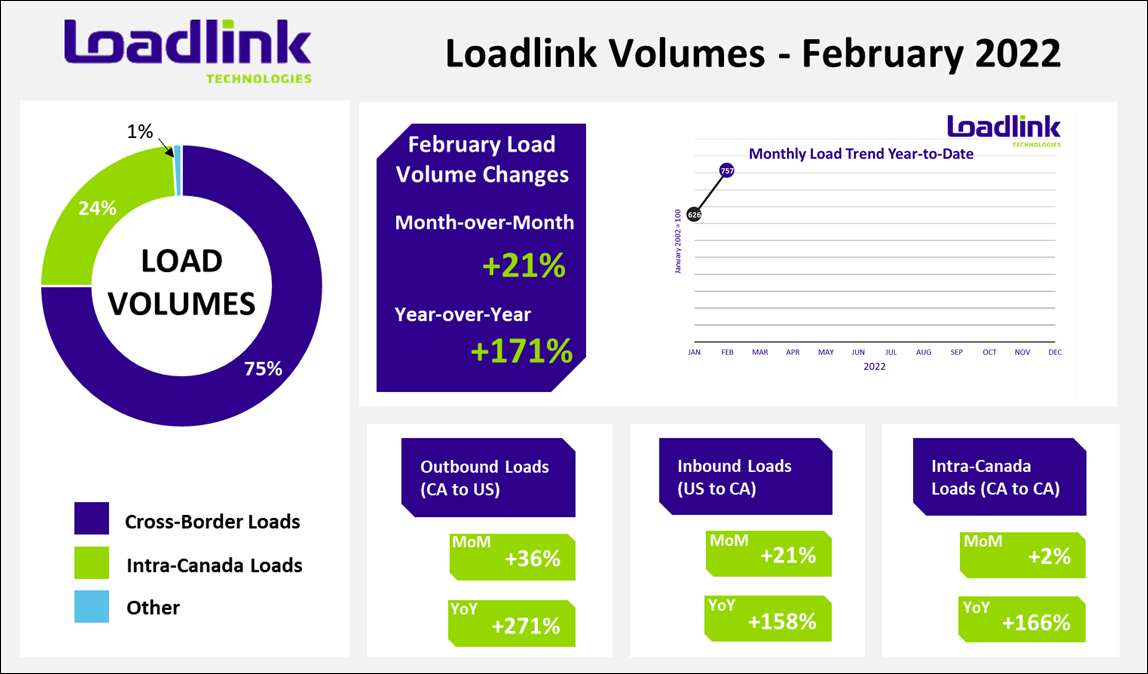

TORONTO – Loadlink Technologies’ Canadian spot market continues to grow at exponential rates this February, with no signs of slowing down any time soon. Compared to last February, volumes saw a striking increase of 171 percent year-over-year and even surpassed January’s all-time record by an additional 21 percent.

FEBRUARY SPOT FREIGHT HIGHLIGHTS

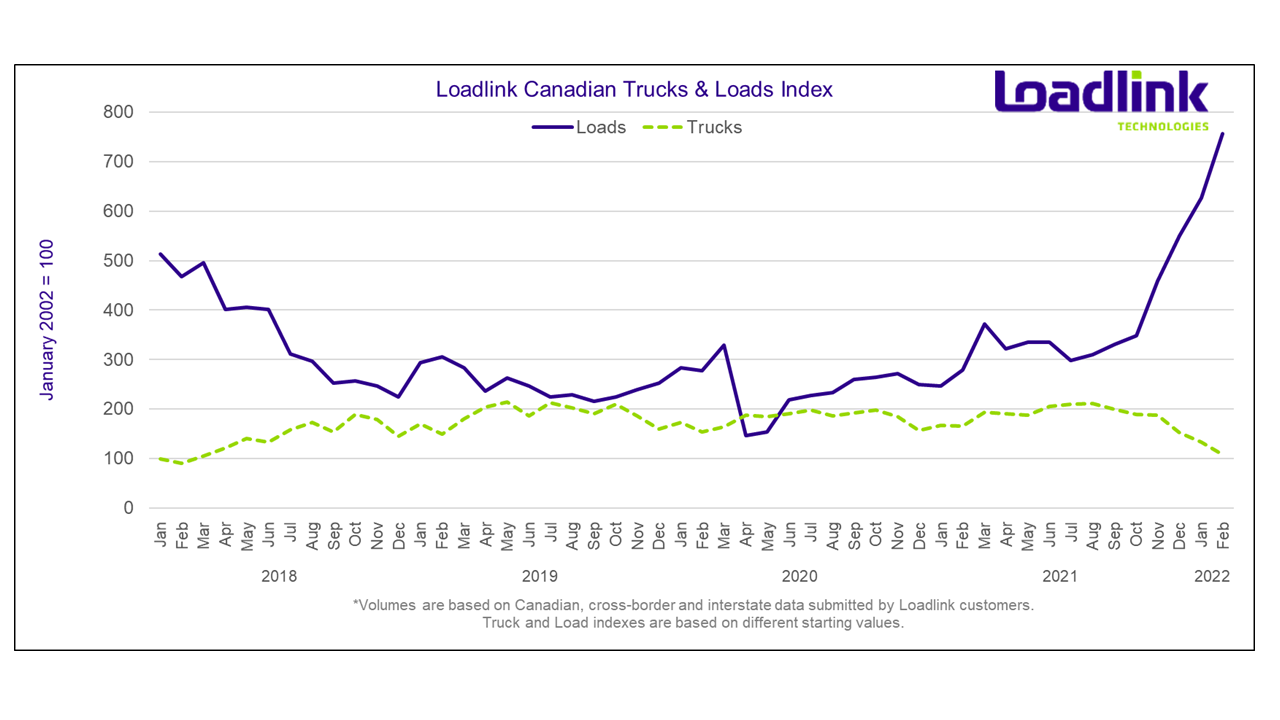

- Year-over-year, February’s truck-to-load ratio was 0.63, 76 percent lower compared to the ratio of 2.61 in February 2021.

- Notably, single-day load volumes reached an all-time high in February, over 2.5x more than even 5 years ago, during the record low capacity crunch that temporarily ensued following the Electronic Logging Device (ELD) mandate in the United States.

- Due to the increased demand for trucks, there’s a strong strain on capacity, particularly inbound.

- Loads continue to surpass historic trends – volumes climbed 171% since February 2021.

“While available capacity shrank across the board, the decline in cross-border equipment this month was much sharper than the typical drop usually experienced in February. We have never seen a decline of over 40% year-over-year. The various border blockades had a significant impact on truck postings across the country, creating ripple effects across the market,” says Claudia Milicevic, president of Loadlink Technologies.

February’s Canadian spot market saw recent events further intensify long-term trends in the movement of freight both within Canada and cross-border.

Outbound Cross-border Activity

Truckloads shipping across the border from Canada to the United States, soared 271 percent from this time last year. Equipment postings were down 45 percent year-over-year.

Inbound Cross-border Activity

Inbound loads rose 21 percent compared to last month and 158 percent compared to February of last year. Equipment postings were down 40 percent year-over-year and 19 percent from January.

Intra-Canadian Activity

Freight activity within Canada continues to grow. Since February of last year loads within Canada grew 140 percent. Equipment postings were down year-over-year by 22 percent.

Average Truck-to-Load Ratios

The truck-to-load ratio fell even further below one truck for every one load posted on Loadlink, following the downward trajectory we’ve seen over the past few months. The ratio for February was 0.63 available trucks for every load posted, down 32 percent from 0.93 in January. Year-over-year, February’s truck-to-load ratio was 76 percent lower compared to a ratio of 2.61 in February 2021.

About Loadlink Indexes

Freight Index data provides insight into Canada’s economy at large and is a primary resource for the trucking community. The Freight Index accurately measures trends in the truckload freight spot market as its components are comprised from roughly 7,000 Canadian carriers and freight brokers. This data includes all domestic and cross-border data submitted by Loadlink customers and thus is considered a real-time pulse of what’s happening in the North American freight industry.

Rate Index data is based on the average spot rates paid by freight brokers and shippers to carriers in the specific lanes where loads are hauled. This data also shows real-time and historically available capacity as well as total truck-to-load ratios.

About Loadlink Technologies

Loadlink Technologies moves Canada’s freight by matching trucks with loads. With 30 years of freight matching experience, Loadlink delivers a reliable ecosystem of technology, data, and analytics to keep Canadian freight moving. Loadlink is trusted by transportation companies and brokers of all shapes and sizes and is proudly the industry’s largest and most efficient digital freight network.