Spring has sprung and with the new season, new opportunities. There are loads aplenty, and perhaps finally, growth in trucks available to move them.

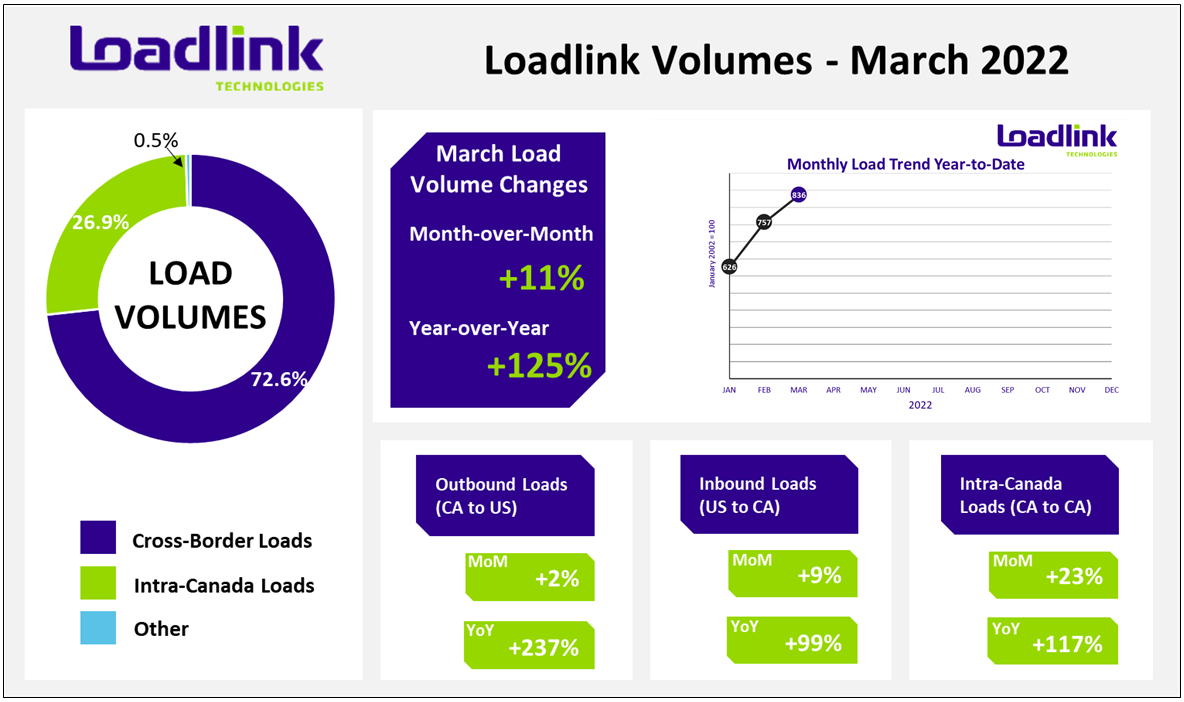

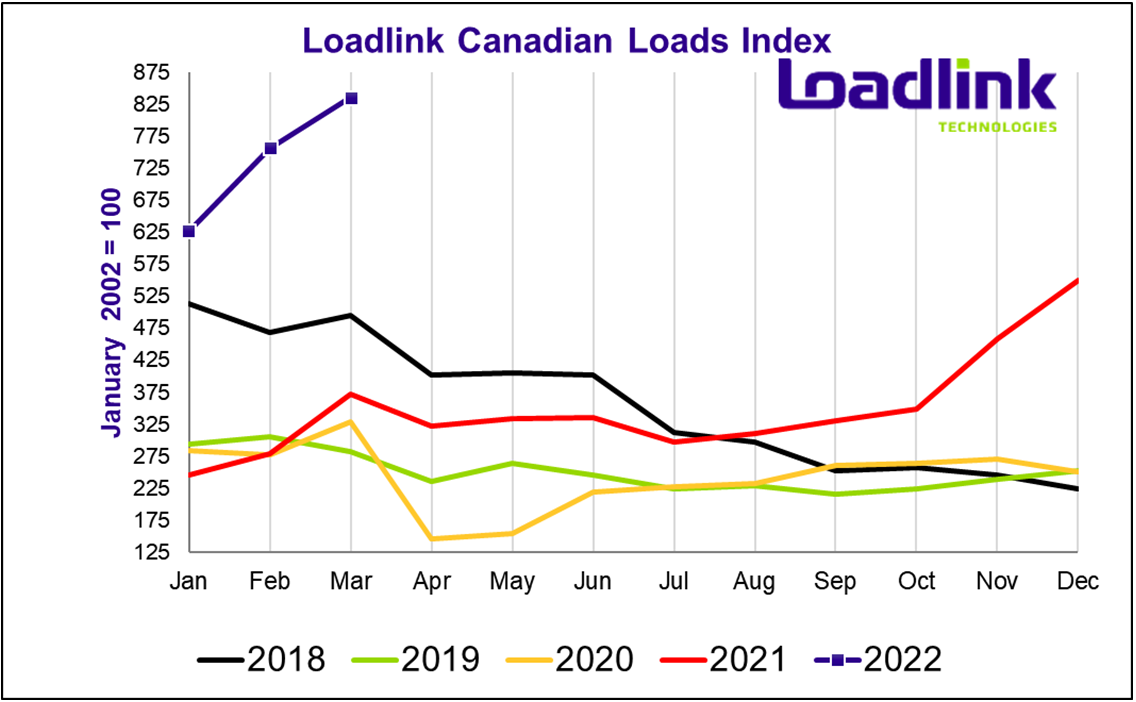

TORONTO – Loadlink Technologies’ Canadian spot market continues to grow this March, though the rapid rate of growth we have been experiencing the last few months seems to have plateaued. Compared to last March, volumes saw a prominent increase of 125 percent year-over-year and exceeded this February’s all-time record by an additional 11 percent.

MARCH SPOT FREIGHT HIGHLIGHTS

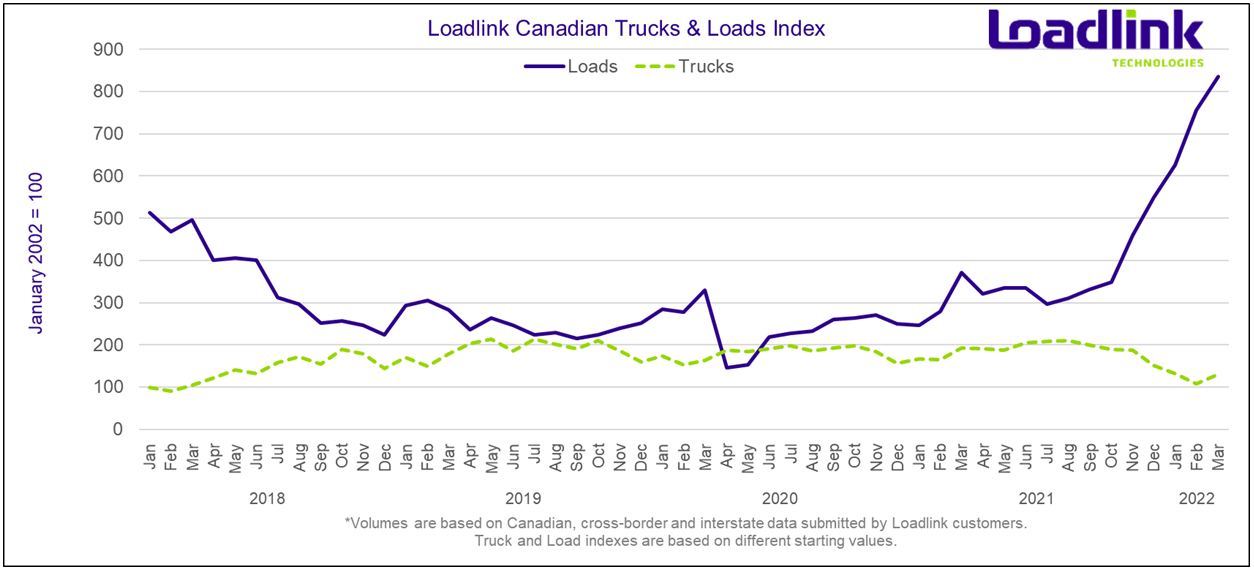

- March’s truck-to-load ratio was 0.68, 53 percent lower compared to the ratio of 1.44 in March 2021.

- The strains on capacity are still very apparent, though this is the first in many months that we have seen capacity grow at all.

- Loads continue to surpass historic trends – volumes climbed 125% since March 2021.

“As a result of backlogs from border blockades and vaccine mandates, late February and early March load volumes spiked by 20%. While still high, load volumes shrank by nearly the same amount towards the end of the quarter, while available trucks increased slightly.” says Claudia Milicevic, president of Loadlink Technologies.

March’s Canadian spot market still has us feeling the effects of long-term trends in the movement of freight both within Canada and cross-border, though there are early indicators of change for the near future.

Outbound Cross-border Activity

Truckloads shipping across the border from Canada to the United States, soared 237 percent from this time last year. Equipment postings were down 44 percent year-over-year.

Inbound Cross-border Activity

Inbound loads rose 9 percent compared to last month and 99 percent compared to last March. Equipment postings were down 33 percent year-over-year and 23 percent from February.

Intra-Canadian Activity

Freight activity within Canada continues to grow. Since March of last year loads within Canada grew 117 percent. Equipment postings climbed slightly, up 17 percent from February, though are still down year-over-year by 22 percent.

Average Truck-to-Load Ratios

The truck-to-load ratio rose in March, finally putting an end to the downward trend we’ve seen over the past few months, though is still below one truck for every one load posted on Loadlink. The ratio for March was 0.68 available trucks for every load posted, up 8 percent from 0.63 in February. Year-over-year, March’s truck-to-load ratio was 53 percent lower compared to a ratio of 1.44 in March 2021.

About Loadlink Indexes

Freight Index data provides insight into Canada’s economy at large and is a primary resource for the trucking community. The Freight Index accurately measures trends in the truckload freight spot market as its components are comprised from roughly 7,000 Canadian carriers and freight brokers. This data includes all domestic and cross-border data submitted by Loadlink customers and thus is considered a real-time pulse of what’s happening in the North American freight industry.

Rate Index data is based on the average spot rates paid by freight brokers and shippers to carriers in the specific lanes where loads are hauled. This data also shows real-time and historically available capacity as well as total truck-to-load ratios.

About Loadlink Technologies

Loadlink Technologies moves Canada’s freight by matching trucks with loads. With 30 years of freight matching experience, Loadlink delivers a reliable ecosystem of technology, data, and analytics to keep Canadian freight moving. Loadlink is trusted by transportation companies and brokers of all shapes and sizes and is proudly the industry’s largest and most efficient digital freight network.