Canadian spot market shows continued freight recovery as September on pace for growth based on the month’s first week of loads.

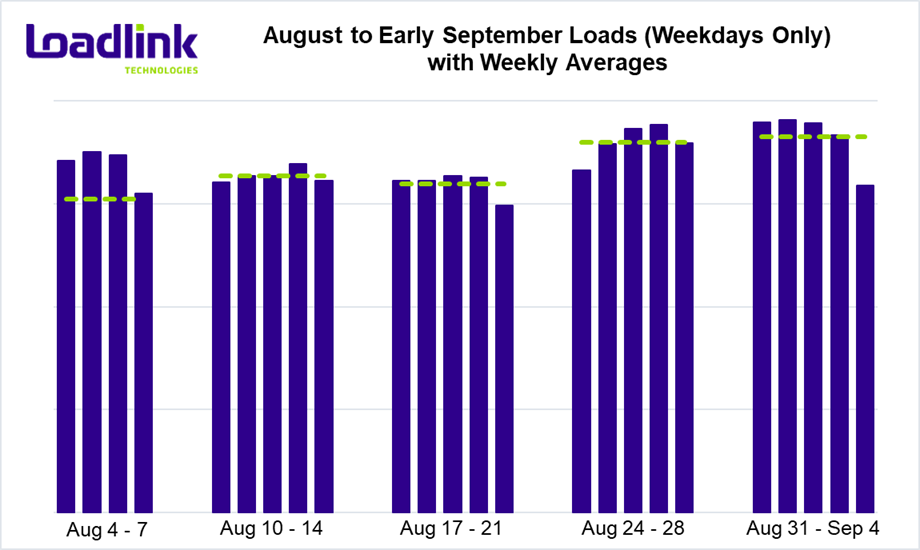

TORONTO – At the end of August, load volumes rose as the month transitioned into September. The first week of September had the highest load volumes seen since March prior to the onset of the pandemic. A possible reason for improved numbers in the first week may be due to preparations for back-to-school activity. Following a strong start to the month, volumes lessened in the second week as a result of the Labour Day holiday observed in the United States and Canada.

At the time of writing, average daily load numbers in September are up five percent compared to the average value across all of August. If this pace of growth can be sustained through the remainder of the month, overall freight volumes at the month’s end may exceed August by 10 to 12 percent.

Notable Market Activity – Cross-Border

According to Loadlink’s first week of volumes in September, higher load volumes were a result of more postings across various markets and lanes, rather than a few popular lanes contributing to majority of the boost in freight. This is evident as 57 percent of lanes with sufficient postings (minimum 150) in the first week saw declines in volumes from the last week of August, but total volumes were greater. Despite a greater number of these busy lanes falling in load numbers, a few cross-border lanes saw substantially higher posting quantities.

The Manitoba to Illinois lane was the big winner as load volumes rose 610 percent from the last week of August. The Quebec outbound lane to Tennessee came in next with a 154 percent increase in load postings. Ontario to South Carolina was third in line with a 122 percent rise in loads. The Massachusetts inbound market also saw notable gains as freight entering the market from Ontario and Quebec both increased 43 and 33 percent, respectively.

Notable Market Activity – Within Canada

Intra-Canadian lanes that saw better performance in the first week of September against the last week of August heavily involved the Saskatchewan market. The Saskatchewan to Manitoba lane performed the best out of all domestic lanes as load volumes rose 89 percent. Other lanes involving Saskatchewan that improved in the first week of September included the Manitoba outbound lane (+20%), the Ontario inbound (+13%), Ontario outbound (+11%) and the Alberta inbound (+9%).

Other domestic lanes that saw the largest gains were the markets of Quebec to New Brunswick (+25%), Nova Scotia to Ontario (+24%), and the popular Quebec to Ontario lane (+16%). In terms of absolute volume changes, the Quebec to Ontario lane was the obvious winner as it is the busiest corridor on Loadlink’s spot market. The backhaul lane of Ontario to Quebec saw loads fall 13 percent. Other popular domestic lanes that saw declines in freight volumes included Alberta to British Columbia (-2%), the local Ontario market (-2%) and Ontario to Alberta (-31%).

Average Truck-to-Load Ratios

At the time of writing, September’s early truck-to-load ratio sits at 3.43 and is two percent lower than August’s value. This was a result of peak daily load volumes witnessed in the first week of the month as Loadlink’s spot market saw the highest number of daily load postings since the pandemic.

About Loadlink Indexes

Rate Index data is based on the average spot rates paid by freight brokers and shippers to carriers in the specific lanes where loads are hauled. This data also shows real-time and historical available capacity, and total truck-to-load ratios.

Freight Index data provides insight on Canada’s economy at large, and is a primary resource for the trucking community. The Freight Index accurately measures trends in the truckload freight spot market as its components are comprised from roughly 6,000 Canadian carriers and freight brokers. This data includes all domestic, cross-border, and interstate data submitted by Loadlink customers.

About Loadlink Technologies

Loadlink Technologies helps Canadian transportation companies facilitate the critical movement of goods by trucks through the use of its technology. With decades of propelling innovation and by way of its modernized freight matching, the company helps its members drive better business performance and competitiveness while delivering new levels of customer experiences.