Quebec shines as top outbound market as overall monthly load postings see a small dip during a usually slower month that began with holidays.

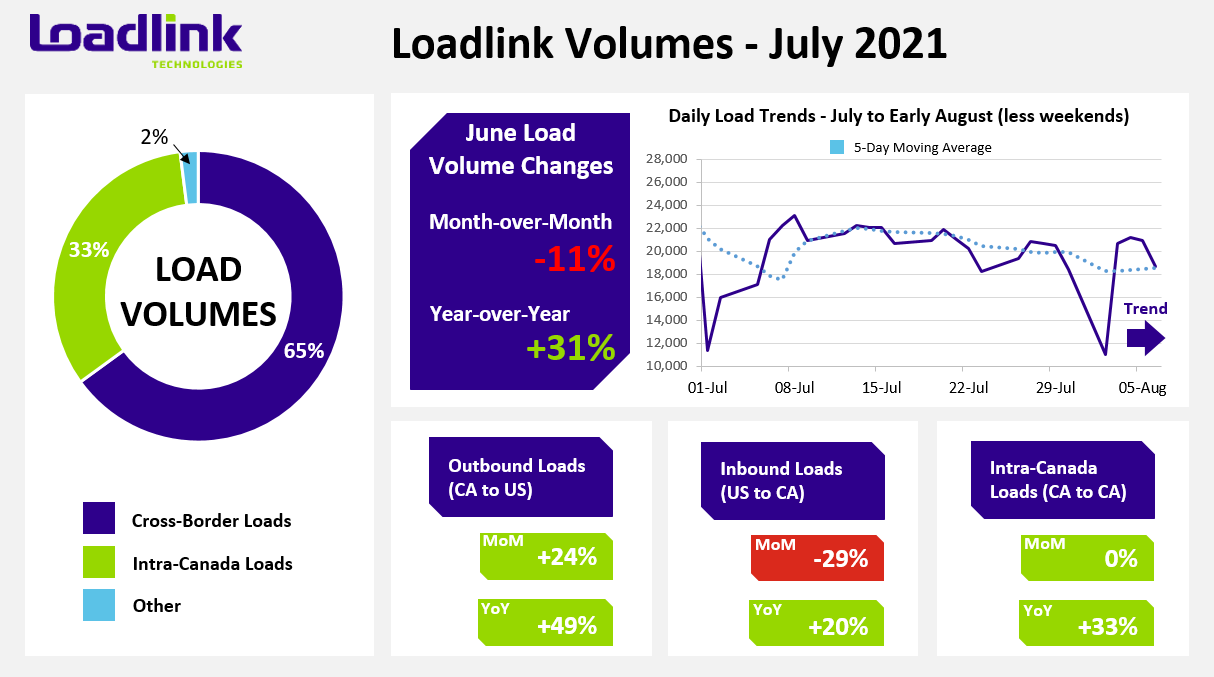

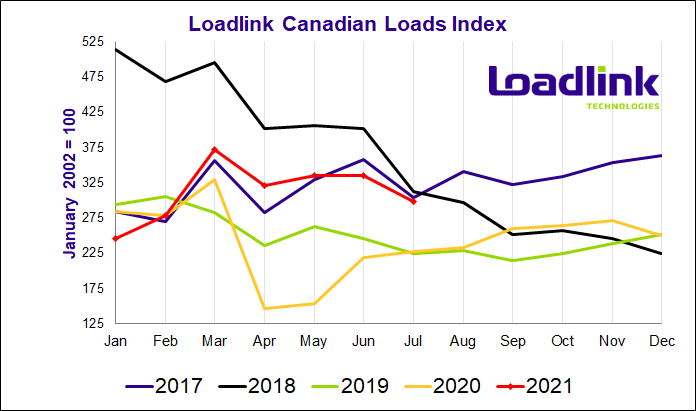

TORONTO – Loadlink Technologies reports today that the Canadian spot market saw load volumes fall 11 percent compared to June’s posting numbers. The Canada Day and American Independence Day national holidays at the start of the month likely played a role in diminished volumes as average daily postings dipped six percent per day from June. Despite lesser overall volumes, Quebec stood out with very strong outbound load volumes on both the cross-border and domestic front. On a year-over-year basis, load volumes continued to showcase 2021’s improved performance as postings were up 31 percent from July 2020.

Canada’s growing return to normalcy, following prolonged periods of lockdowns due to the COVID-19 pandemic, have helped maintain balance within the domestic trucking industry. As seen from Loadlink’s monthly performance in the past few months, fluctuations in load volumes have been mainly due to changes in the outbound versus inbound cross-border dynamic.

JULY HIGHLIGHTS

- The Canada Day and Fourth of July holidays removed roughly one full business day of loads for the month of July.

- The week immediately following the holidays had the highest average daily volumes for the month. The second week still saw strong volumes and was only half a percentage point less than the week prior.

- The third week of July saw a bit more variation in daily load postings with six percent less freight than the second week. The last week of July dropped three percent and accounted for the least load postings in the month.

Outbound Cross-border Activity

Outbound cross-border lanes were the best performing on Loadlink as load posting volumes were up 24 percent from June. Year-over-year, this number was 49 percent higher than in July 2020. July’s strong outbound performance helped reduce the overall monthly decline as inbound load movement fell at a larger pace.

Continuing from last month’s standout performance, Quebec once again demonstrated significant outbound freight activity with 66 percent more cross-border loads leaving the province. This resulted in the top five outbound market lanes to be comprised of only lanes originating from Quebec. Atlantic Canada and Ontario both saw strong gains with 23 and 21 percent more outbound loads, respectively, while Western Canada fell just slightly with a minor three percent dip from June numbers.

Inbound Cross-border Activity

In contrast to the strong growth in monthly outbound cross-border freight, inbound activity suffered similar but opposite levels of decline with 29 percent lower volumes than in June. On a year-over-year basis, load postings were up 20 percent compared to July 2020.

Loads entering Canada from across the border saw declines across all regions of Canada. Western Canada was the best performing of the group with a 15 percent decline. Alberta was the best performing inbound market with three of the top five best performing inbound cross-border lanes. Ontario and Atlantic Canada shared an identical drop of 30 percent less freight, while Quebec widened its outbound-inbound performance gap with 40 percent lower volumes.

Intra-Canadian Activity

After a slight dip in June, intra-Canadian volumes stabilized once again with virtually no change in July from June’s numbers. Year-over-year, load postings were up 33 percent from July 2020.

Domestic freight destined for Western Canada was the best performing inbound region with 22 percent more loads. Ontario was the only other positive performer with four percent more inbound freight entering the region. Atlantic Canada saw a decline of 13 percent less loads from June, while Quebec’s strong outbound performance could not be replicated on the inbound-end experiencing 37 percent less freight compared to last month.

Domestic outbound freight performance was the opposite of what was seen from the inbound regions. Quebec led the way with the strongest performance of 27 more outbound freight exiting the province, similar to its fantastic cross-border activity. Atlantic Canada was the source of just five percent more domestic freight. Both Ontario and Western Canada delivered less freight out of their regions with nine and seven percent declines, respectively.

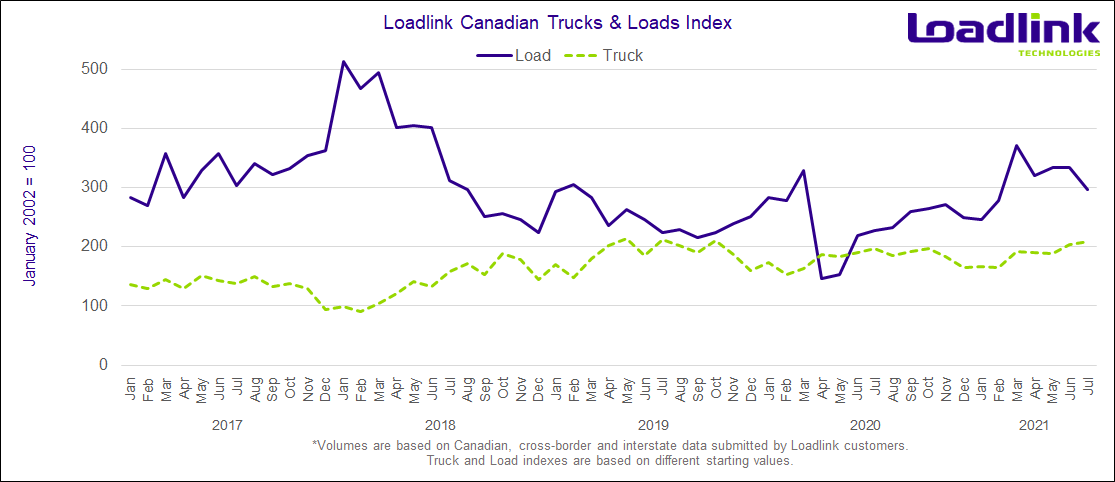

Average Truck-to-Load Ratios

In July, the truck-to-load ratio increased by 15 percent, reaching a value of 3.08 compared to 2.68 in June. Year-over-year, July’s truck-to-load ratio was 19 percent lower compared to a ratio of 3.80 in July 2020.

About Loadlink Indexes

Rate Index data is based on the average spot rates paid by freight brokers and shippers to carriers in the specific lanes where loads are hauled. This data also shows real-time and historical available capacity, and total truck-to-load ratios.

Freight Index data provides insight on Canada’s economy at large, and is a primary resource for the trucking community. The Freight Index accurately measures trends in the truckload freight spot market as its components are comprised from roughly 6,200 Canadian carriers and freight brokers. This data includes all domestic, cross-border, and interstate data submitted by Loadlink customers.

About Loadlink Technologies

Loadlink Technologies helps Canadian transportation companies facilitate the critical movement of goods by trucks through the use of its technology. With decades of propelling innovation and by way of its modernized freight matching, the company helps its members drive better business performance and competitiveness while delivering new levels of customer experiences.