TransCore Link Logistics’ Canadian spot market saw a seven percent decline in June load volumes, a month which normally offers improved performance over the rest of the year. The minor dip was matched by a greater drop in truck postings, causing truckload capacity to contract seven percent. Despite the slight contraction, average intra-Canadian flatbed and reefer rates both increased five percent, while average van rates fell by three percent.

Historically, June offers the strongest spot-market freight performance, but the market cooled slightly in the second quarter following an unusually hot start to 2019. Thus far, 2019 load volumes have performed irregularly setting a new historic trend of volumes in each passing month.

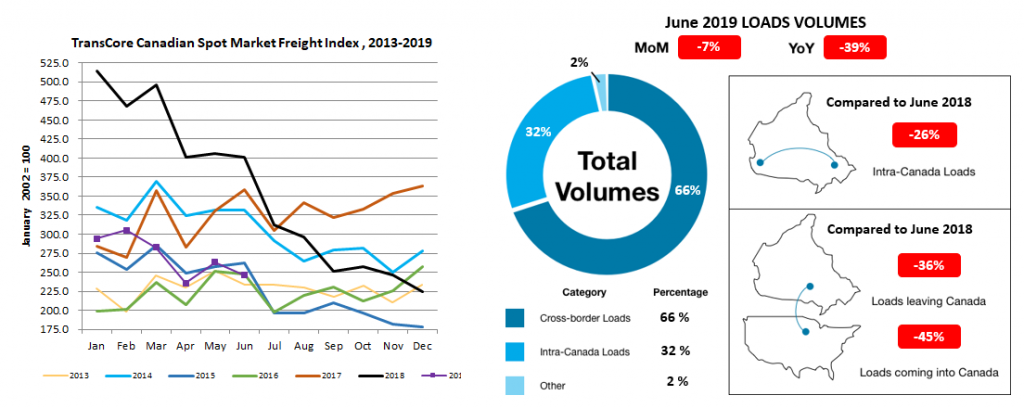

Month-over-month, June’s load volumes finished seven percent lower than May, while these numbers were down 39 percent year-over-year.

Second Quarter Load and Truck Performance

Second quarter load volumes were down 15 percent compared to the first quarter of 2019 and were down 38 percent from the historic numbers noted in the second quarter of 2018. Second quarter freight volumes usually outperform the quarter preceding it; however, 2019 to date proved to be outside the norm. Other years where Q2 load volumes exceeded Q1 include: 2014, 2015 and 2018.

Second quarter equipment postings were the strongest quarterly postings in Loadlink’s history. Overall, the second quarter of 2019 surpassed the first quarter’s volumes by 21 percent, which saw record volumes in May decline as it entered June. Compared to the second quarter of 2018, equipment volumes were up a significant 53 percent year-over-year.

Intra-Canada loads accounted for 32 percent of the total volumes. Load postings within Canada decreased 10 percent compared to May and were down 26 percent year-over-year.

|

By Region of Origin |

|

|

By Region of Destination |

|

|

|

Western: |

34 percent |

– 10% |

Western: |

30 percent |

– 11% |

|

Ontario: |

34 percent |

– 11% |

Ontario: |

43 percent |

– 6% |

|

Quebec: |

26 percent |

– 8% |

Quebec: |

24 percent |

– 12% |

|

Atlantic: |

6 percent |

– 14% |

Atlantic: |

3 percent |

– 25% |

Cross-border load postings represented 66 percent of the data submitted by Loadlink users.

An overall monthly decline of five percent in cross-border load postings was observed in June, mainly due to a decrease in loads entering major markets in Ontario and Quebec.

Cross Border Loads into Canada by Region of Destination (with M-O-M volume change):

|

Ontario: |

56 percent |

– 9% |

|

Western: |

19 percent |

+ 5% |

|

Quebec: |

23 percent |

– 6% |

|

Atlantic: |

2 percent |

– 16% |

Equipment Performance

Overall June equipment numbers decreased 13 percent while the daily average number of truck postings decreased by five percent. Compared to June 2018, capacity was up 40 percent year-over-year. Capacity for the month was the highest for any June ever recorded in Loadlink’s database.

Truck-to-Load Ratio

The truck-to-load ratio in June was 3.31. This seven percent decrease from May (3.57) was driven by a larger decrease in capacity despite a minor slip in load availability. Compared to the first quarter of 2019, the second quarter ratio increased 43 percent to 3.55 from 2.49. Year-over-year, the average ratio for June increased 128 percent from 1.45 in June 2018.

About TransCore Indexes

Truckload spot rates in specific areas can be accessed from TransCore’s Rate Index truckload rating tool, and real-time and historical data on total truck and load volumes, as well as ratios in specific areas can be accessed from TransCore’s Posting Index.

TransCore’s Canadian Freight Index accurately measures trends in the truckload freight spot market. The components of the Freight Index are comprised from roughly 6,400 of Canada’s trucking companies and freight brokers; this data includes all domestic, cross-border and interstate data submitted by Loadlink customers.

About TransCore Link Logistics

Looking for a better way to match available freight loads with trucks, TransCore Link Logistics in 1990 developed Loadlink, a load board connecting brokers, carriers, owner operators and private fleets in Canada to a real-time database of 18 million loads, shipments and trucks – the largest in the industry. The monthly Canadian Freight Index now defines the freight movement spot market. The company also provides its customers with dispatch solutions, ACE/ACI eManifest, Posting Index, Rate Index, credit solutions, factoring, an online transportation job board, mileage software and more.

More information on TransCore Link Logistics can be found at www.transcore.ca, @loadlink on Twitter, on YouTube, on Facebook and on LinkedIn.

Select a Year

Recent Posts

- January 2026 Freight Index: Strong Finish to 2025 and Encouraging Start to 2026

- November 2025 Freight Index: Market Pauses After Fall, Planning Window Widens

- October 2025 Freight Index: Demand Lifts as Capacity Tightens Across the Board

- LinkMixer is back: Loadlink brings the freight community together

- September Freight Index: Freight Volumes Bounce Back with Strong Month-Over-Month Gains