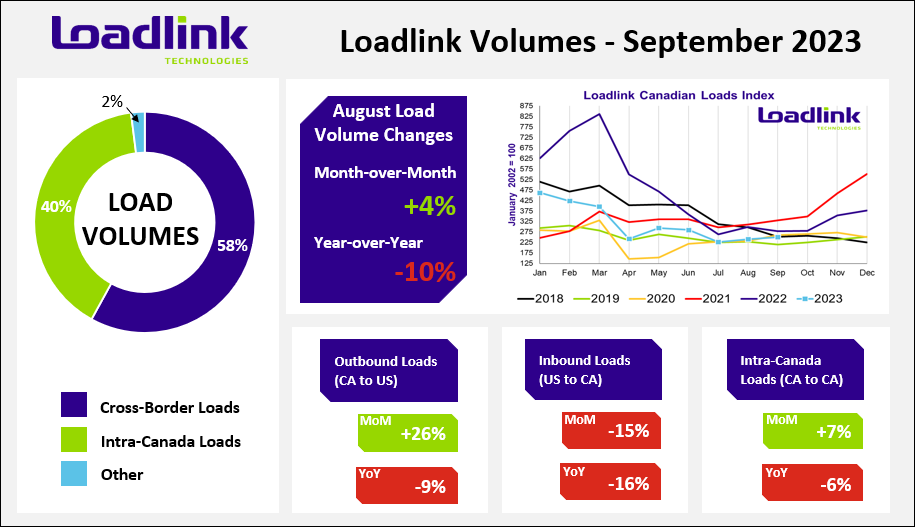

TORONTO – Loadlink Technologies’ Canadian spot market saw a positive end to the third quarter with improved freight volumes and reduced equipment postings. For the first time since December 2022 and January 2023, Loadlink’s spot market has seen two consecutive months of rising load volumes. Intra-Canadian and cross-border outbound loads improved while cross-border inbound postings fell after a flat month in August. Year-over-year comparisons continue to temper as inflated volumes from the first half of 2022 will begin to meet with more normalized volumes in the upcoming quarter.

September Spot Freight Highlights:

| Origin City | Origin State | Destination City | Destination State | Vehicle | YoY(%) | MoM(%) |

| McAllen | TX | Toronto | ON | Reefer | 27 | 224 |

| Regina | SK | Edmonton | AB | Van | 153 | 196 |

| Montreal | QC | Vancouver | BC | Van | 132 | 172 |

| Calgary | AB | Surrey | BC | Reefer | 54 | 107 |

| Brampton | ON | Calgary | AB | Van | 35 | 73 |

| Milwaukee | WI | Winnipeg | MB | Van | – | 62 |

Outbound Cross-border Activity

Outbound loads from Canada to the United States saw a sizeable improvement with 26 percent more loads compared to August, but volumes were still down nine percent from last year. Equipment postings fell by 17 percent from August but were up 13 percent year-over-year.

Inbound Cross-border Activity

After a flat month in August, inbound load volumes fell 15 percent in September. Year-over-year, load volumes fell by almost the same amount of 16 percent. Equipment postings fell by six percentage points from August and increased by just one percent compared to September 2022.

Intra-Canadian Activity

Canadian freight movement saw some improvement at the end of Q3 with seven percent more load postings, while loads fell by six percent year-over-year. Equipment postings decreased by 10 percent month-over-month but rose by 10 percent on a year-over-year basis.

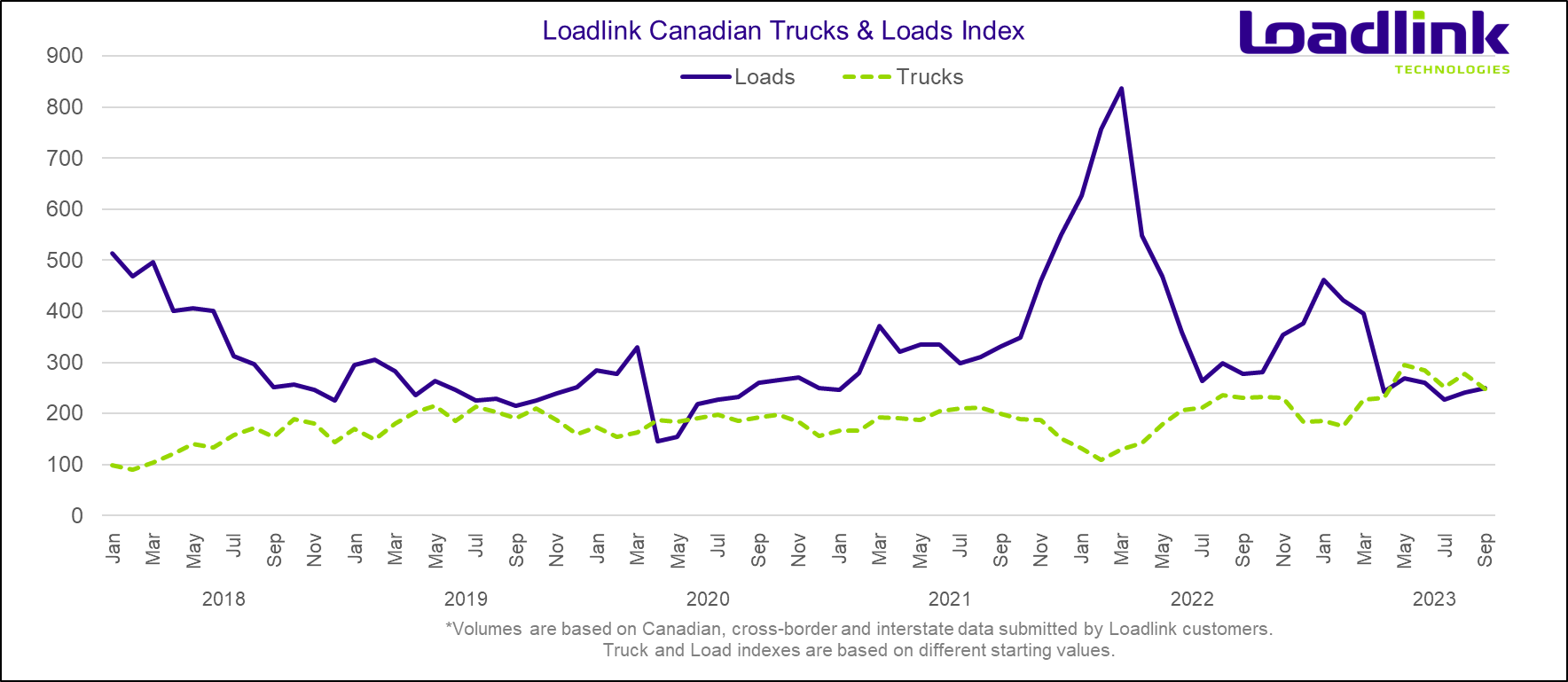

Average Truck-to-Load Ratios

The truck-to-load ratio in September was 4.34 trucks for every one load posted on Loadlink. The ratio for last month was 5.05 available trucks for every load posted, which meant September’s ratio decreased by 14 percent. Year-over-year, truck-to-load ratio increased by 19 percent compared to a ratio of 3.64 in September 2022.

About Loadlink Indexes

Freight Index data provides insight into Canada’s economy at large and is a primary resource for the trucking community. The Freight Index accurately measures trends in the truckload freight spot market as its components are comprised of roughly 7,750 Canadian carriers and freight brokers. This data includes all domestic and cross-border data submitted by Loadlink customers and thus is considered a real-time pulse of what’s happening in the North American freight industry.

Rate Index data is based on the average spot rates paid by freight brokers and shippers to carriers in the specific lanes where loads are hauled. This data also shows real-time and historically available capacity as well as total truck-to-load ratios.

About Loadlink Technologies

Loadlink Technologies moves Canada’s freight by matching trucks with loads. With 30 years of freight matching experience, Loadlink delivers a reliable technology, data, and analytics ecosystem to keep Canadian freight moving. Loadlink is trusted by transportation companies and brokers of all shapes and sizes and is proudly the industry’s largest and most efficient digital freight network.