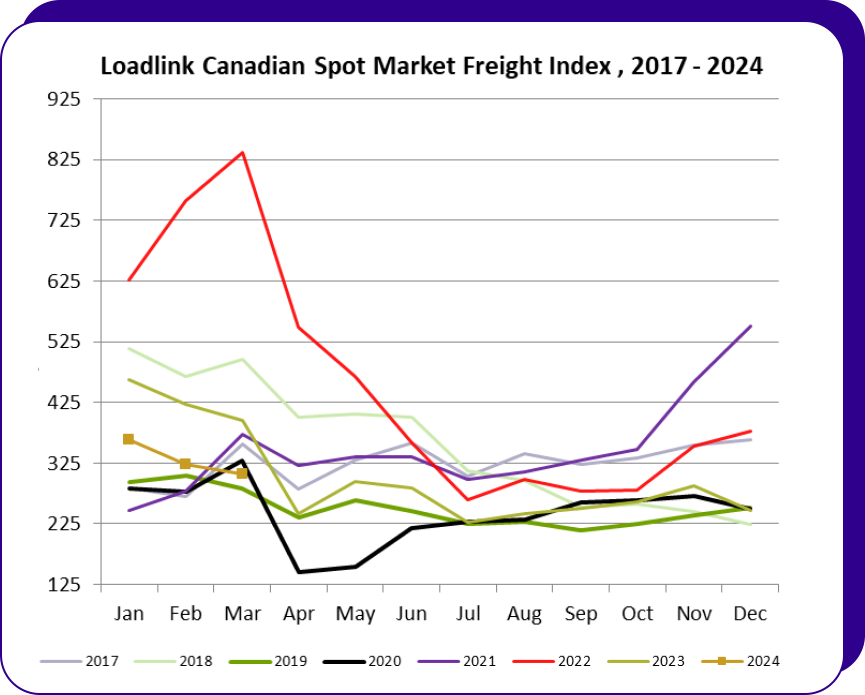

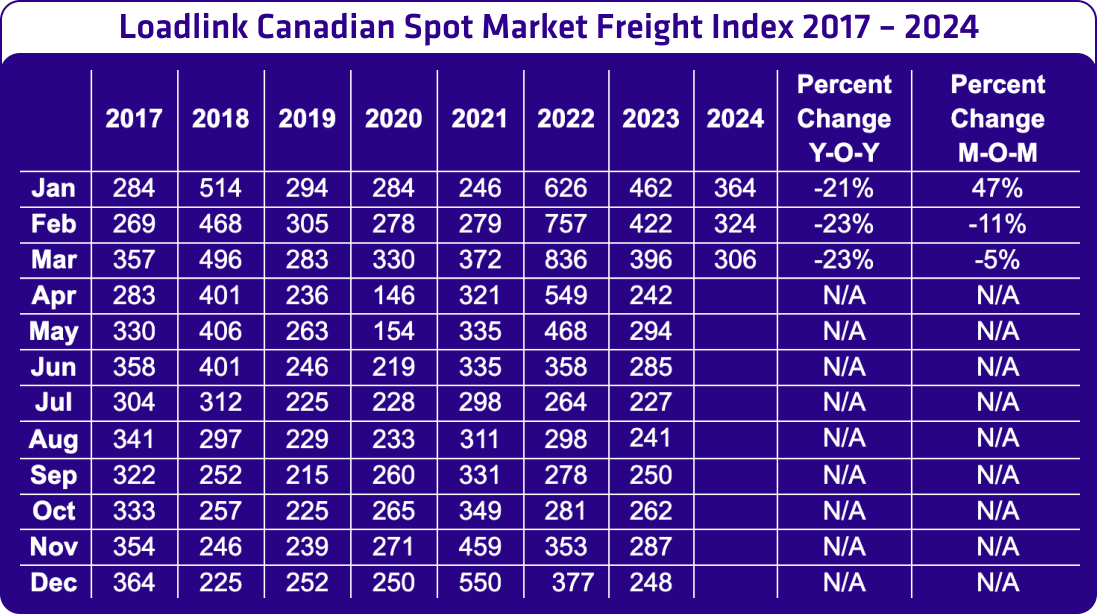

The Canadian freight market in Q1 2024 exhibited a dynamic performance, characterized by a record-breaking January followed by standard volumes in February and a slight decline in March

January: A Month of Exceptional Demand

January 2024 kicked off the year on a high note. Loadlink’s Canadian spot market experienced a record month, with total load postings surging by an impressive 47 percent compared to December 2023. This significant upswing was driven in large part by inbound cross-border activity, which saw a remarkable 110 percent month-over-month increase. This surge surpassed even typical seasonal trends, suggesting exceptionally strong demand for freight movement into Canada at the beginning of the year.

February: Finding Equilibrium After a Record Start

Following January’s record-breaking performance, February returned to normal levels. This can be attributed to factors such as the shorter month and holidays like Family Day. Despite this adjustment, load volumes remained well above averages seen in the second and third quarters of 2023. This suggests a return to a more balanced pattern after January’s exceptional activity.

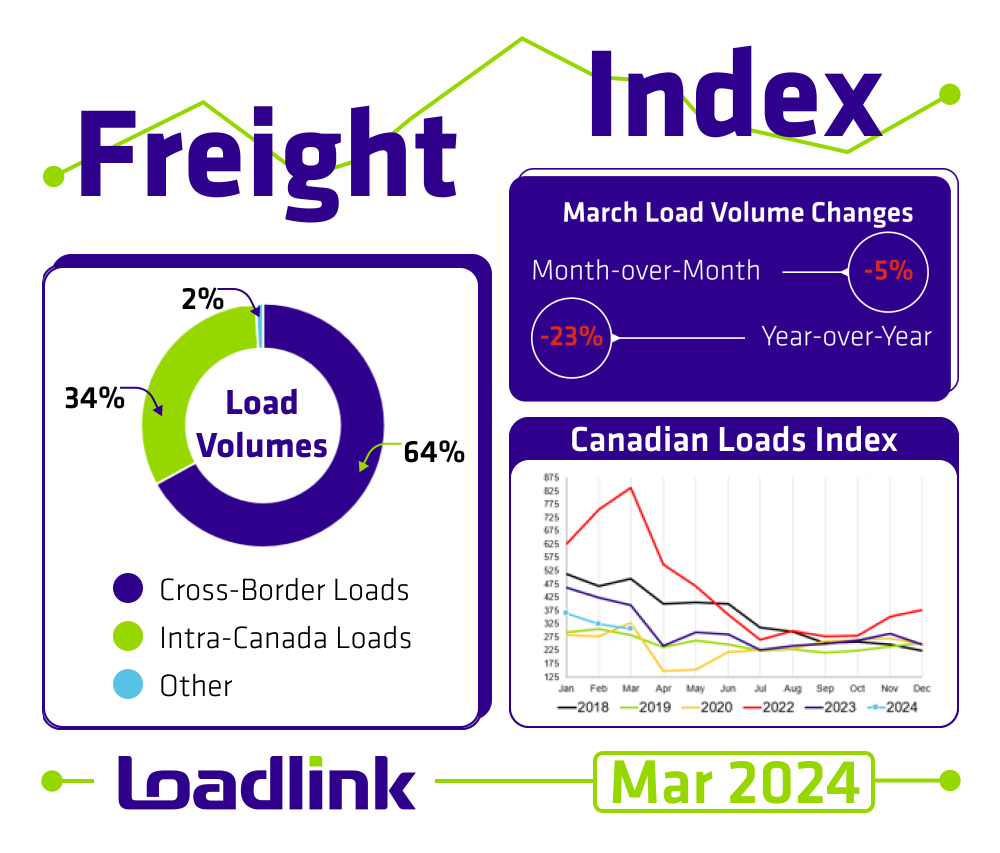

March: A Shift Towards Increased Truck Availability

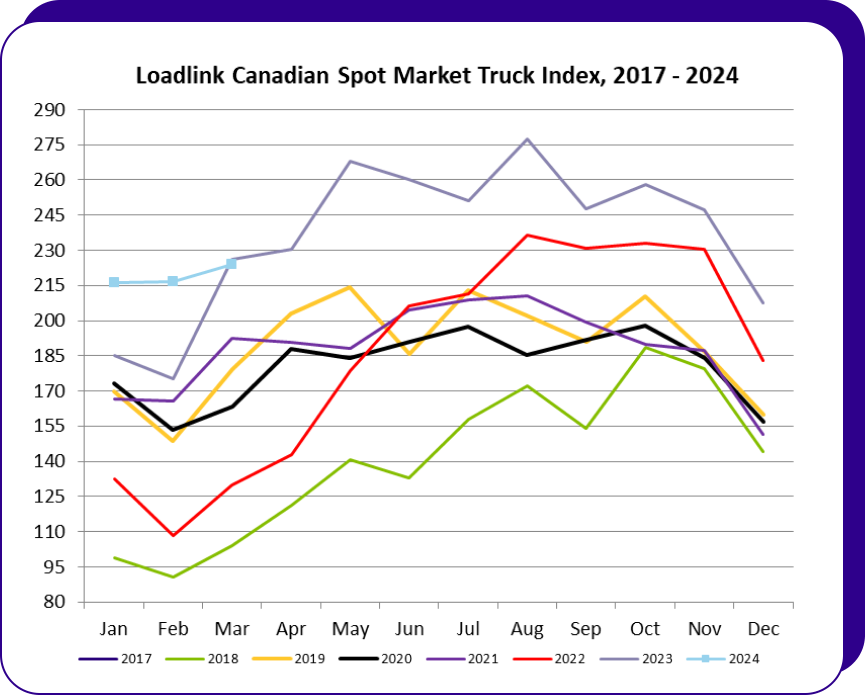

March saw a further moderation in freight volumes compared to February. Overall volumes dipped by 5 percent. However, it’s crucial to consider this within the context of historical trends. After a strong showing in March 2023 from increased consumer spending and businesses stocking up on inventory, freight volumes started a downward trend in April, reflecting the softening market in 2023. It is likely that part of this year’s decline can be attributed to a four-day dip in activity as many companies slowed or closed for the early Easter long weekend.

March Stats

- Month-over-month: Volumes decreased 5 percent compared to February 2024.

- Year-over-year: Volumes decreased 23 percent compared to March 2023.

Load and Equipment Trends:

Cross-Border: Cross-border load postings accounted for 64 percent of the data submitted by Loadlink’s Canadian-based customers.

- Inbound cross-border loads (from the United States to Canada) decreased 25 percent, and outbound loads (from Canada to the U.S.) decreased 13 percent year-over-year.

- Inbound cross-border equipment increased 1 percent and outbound equipment decreased 8 percent year-over-year.

Intra-Canada: Postings accounted for 34 percent of the data submitted by Loadlink’s Canadian-based customers.

Equipment Breakdown: The top equipment postings were Dry Vans 53 percent, Reefers 26 percent, Flatbeds 17 percent, and Other 4 percent.

Additional Data:

Outbound Cross-border Activity

Month-over-month loads from Canada to the United States decreased by 16 percent compared to last month. Equipment postings rose by 8 percent from last month.

Inbound Cross-border Activity

Inbound loads entering Canada from the United States decreased by 6 percent from last month. Equipment postings rose by 2 percent from last month.

Intra-Canadian Activity

Month-over-month loads within Canada rose by three percent, while year-over-year, volumes fell 26 percent. Equipment postings rose by 2 percent month-over-month and 2 percent year-over-year.

Average Truck-to-Load Ratios

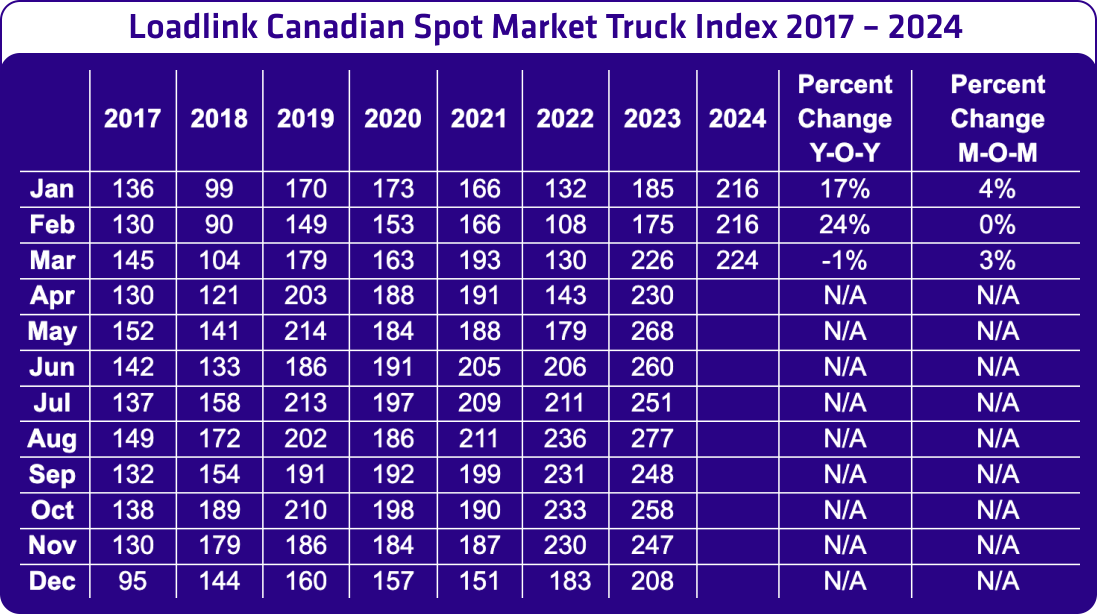

The truck-to-load ratio in March was 3.21 trucks for every one load posted on Loadlink. The ratio for February 2024 was 2.93 available trucks for every load posted, which meant March’s ratio rose by 10 percent from February’s value.

Looking Ahead: A Promising Future for Canadian Freight

The Canadian freight market navigated Q1 2024 with dynamism, showcasing a strong start followed by a period of adjustment. While volumes softened in March, the increased truck availability observed throughout the quarter remains a positive sign. This abundance of capacity, coupled with the robust performance earlier in the year, positions the industry for continued success in Q2 and beyond.