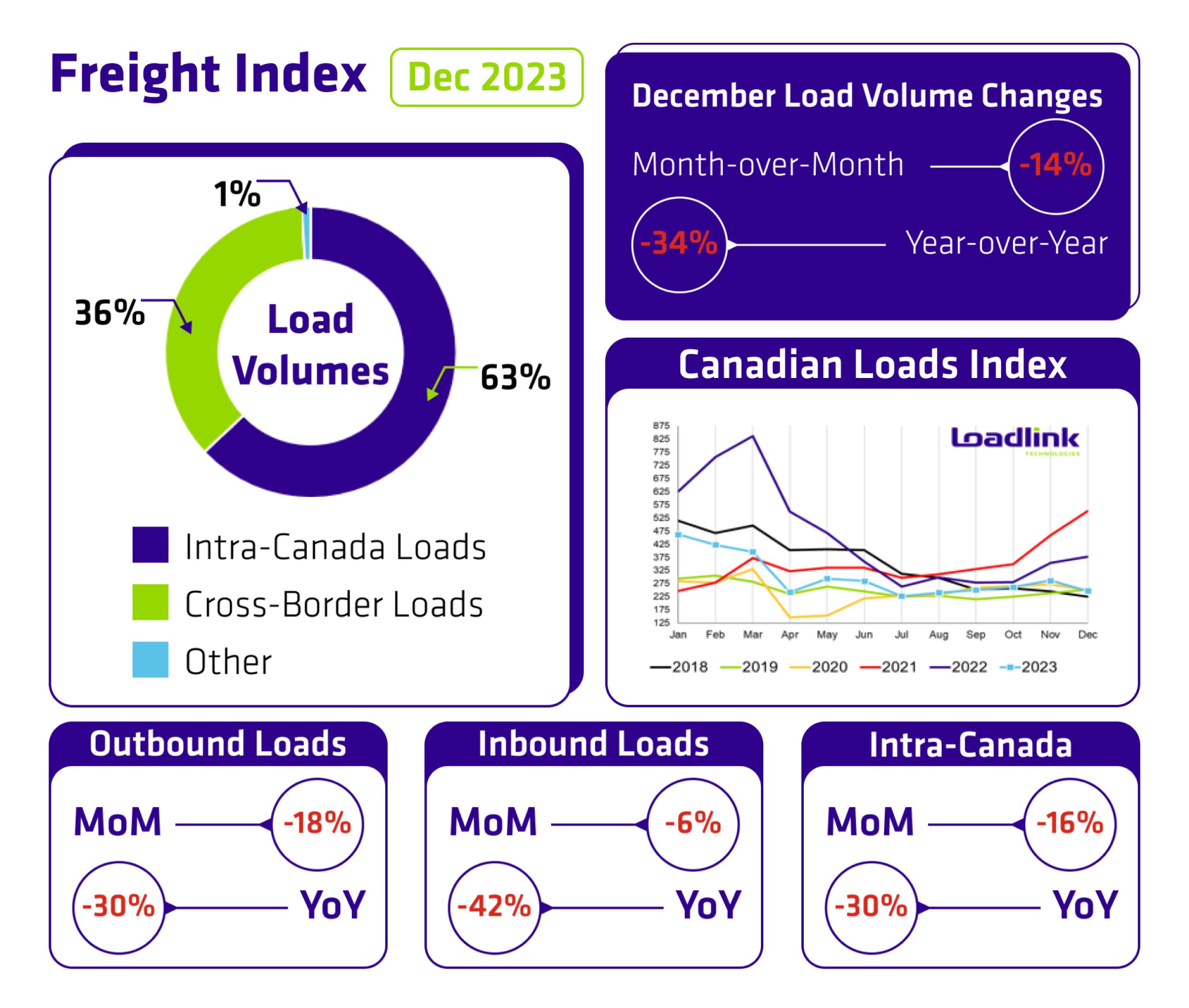

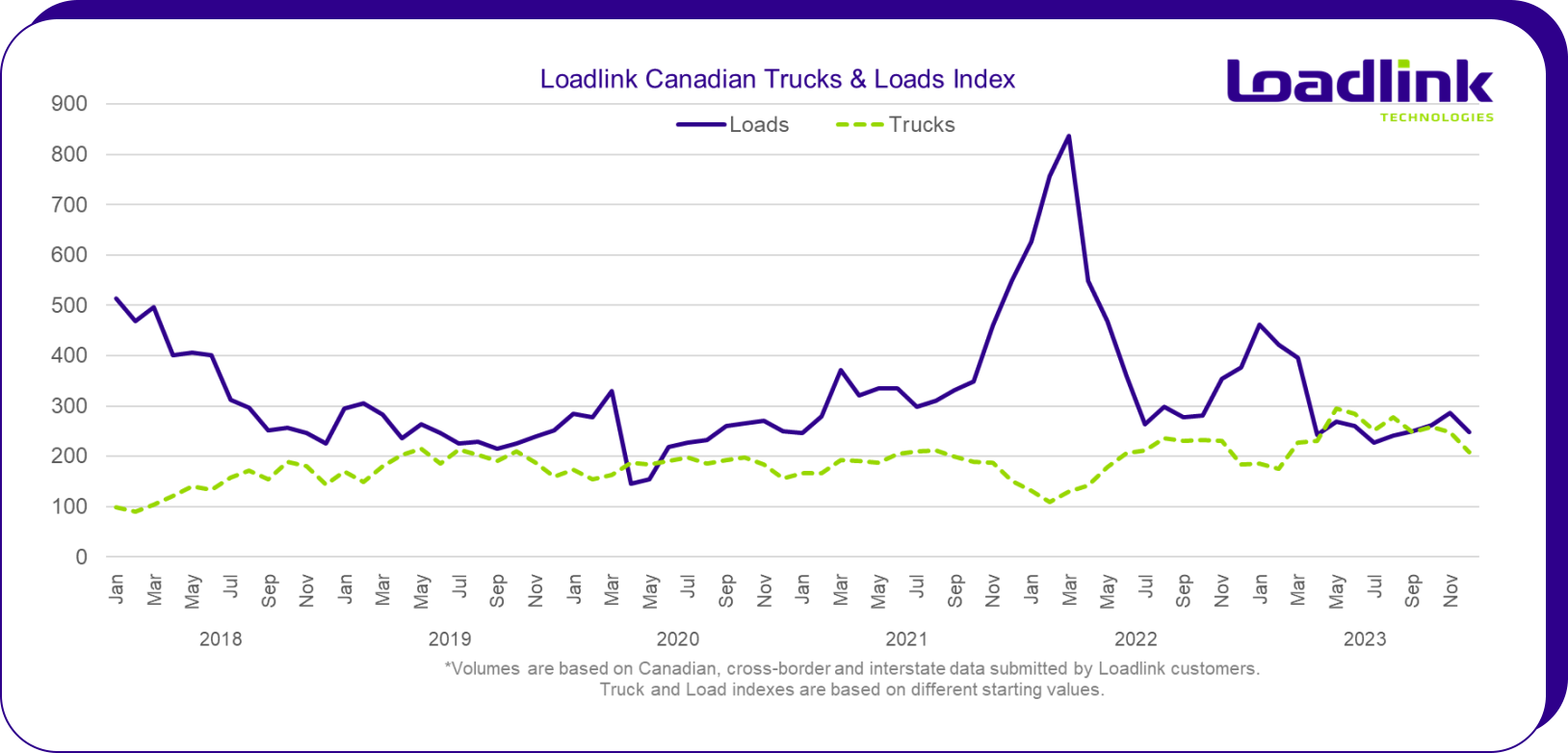

TORONTO – Loadlink Technologies’ Canadian spot market ended its hot run of monthly improvements in Q4 with all-around declines in freight activity due to the holiday season. To put it into perspective, December began the month with strong daily load volumes that have not been seen since March of this year, but by the end of week three, average daily volumes fell by 54 percent due to an extremely strong period of seasonal declines during the holiday period surrounding Christmas. As a result, overall monthly load volumes fell 14 percent from November, but the truck-to-load ratio improved by three percent to a value of 3.68 in December, showing that despite the drop in posting volumes, spot market balance improved and the equivalent decreases in truck postings helped tighten the truck-to-load ratio.

Outbound Cross-border Activity

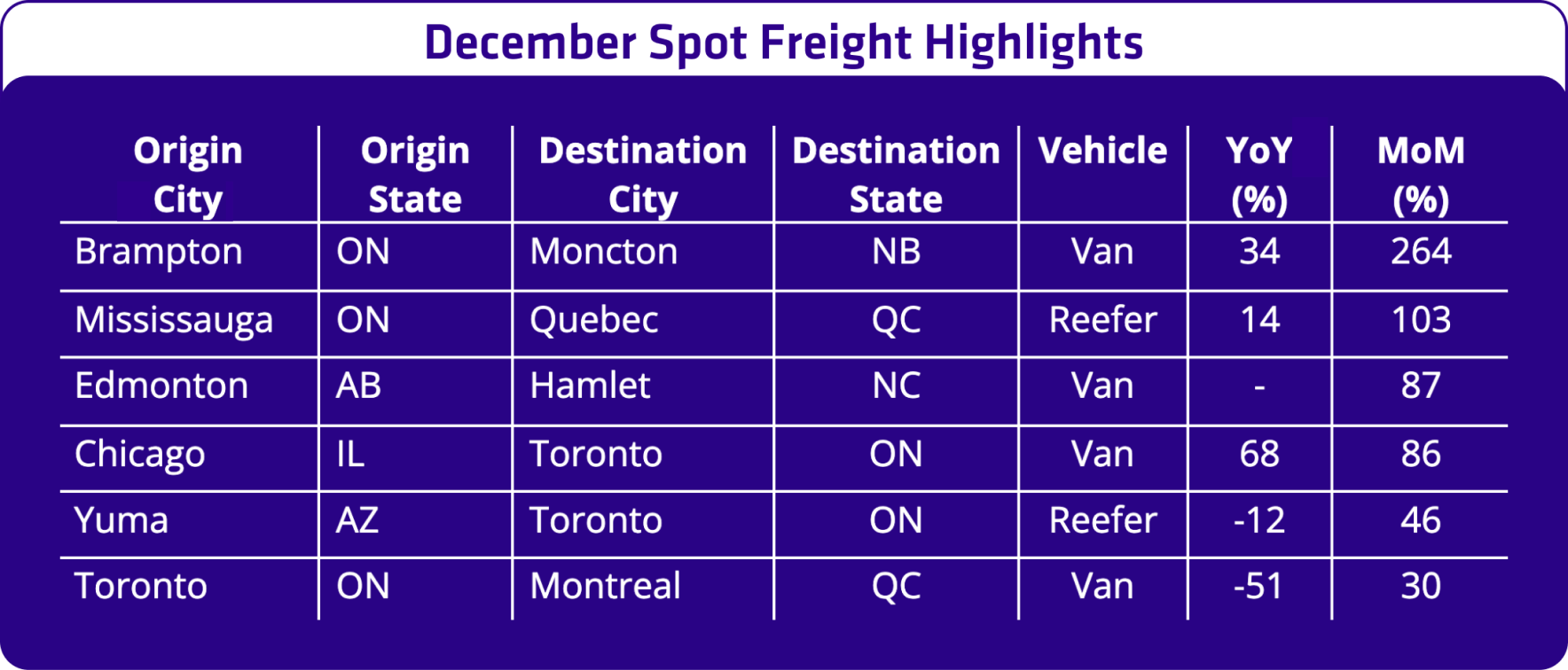

The strong outbound load performance for the first two months of Q4 ended as December’s cross-border activity weakened due to the holiday season as there were 18 percent fewer cross-border loads entering the United States from Canada. Year-over-year, load volumes were down 30 percent from December 2022. Equipment postings once again saw more decline coinciding with declining driver availability in the latter half of the month with 15 percent fewer trucks than in November but was up eight percent from the same period last year.

Inbound Cross-border Activity

Inbound loads entering Canada did not witness as large of a decline as outbound volumes with just a six percent month-over-month decrease from November’s volumes. On an annual basis, 2022’s strong end-of-year volumes helped exaggerate year-over-year comparisons with a 42 percent decrease in December 2023 inbound loads versus the same period last year. Equipment postings fell at a larger scale with 15 percent fewer trucks than in November but were up 11 percent from December 2022.

Intra-Canadian Activity

Freight activity within Canada saw stable declines of 16 percent fewer loads and 17 percent fewer trucks from November, which further signalled the impact of the seasonal holiday decline on the Canadian spot market. Compared to last year, load volumes were down 30 percent, but truck volumes were up 19 percent.

Average Truck-to-Load Ratios

The truck-to-load ratio in December was 3.68 trucks for every load posted on Loadlink. The ratio for last month was 3.78 available trucks for every load posted, which meant December’s ratio decreased three percent from November’s value. Year-over-year, the truck-to-load ratio increased by 73 percent compared to a ratio of 2.13 in December 2022.

About Loadlink Indexes

Freight Index data provides insight into Canada’s economy at large and is a primary resource for the trucking community. The Freight Index accurately measures trends in the truckload freight spot market as its components are comprised of over 7,000 Canadian carriers and freight brokers. This data includes all domestic and cross-border data submitted by Loadlink customers and thus is considered a real-time pulse of what’s happening in the North American freight industry.

Rate Index data is based on the average spot rates paid by freight brokers and shippers to carriers in the specific lanes where loads are hauled. This data also shows real-time and historically available capacity as well as total truck-to-load ratios.

About Loadlink Technologies

Loadlink Technologies moves Canada’s freight by matching trucks with loads. With 30 years of freight matching experience, Loadlink delivers a reliable technology, data, and analytics ecosystem to keep Canadian freight moving. Loadlink is trusted by transportation companies and brokers of all shapes and sizes and is proudly the industry’s largest and most efficient digital freight network.

Follow us on Facebook, LinkedIn, Twitter, Tiktok, and Instagram.

Loadlink Technologies, with over 30 years of experience, continues to play a pivotal role in Canada’s freight movement by efficiently matching trucks with loads. Their reliable technology, data, and analytics ecosystem contribute to the industry’s largest and most efficient digital freight network.