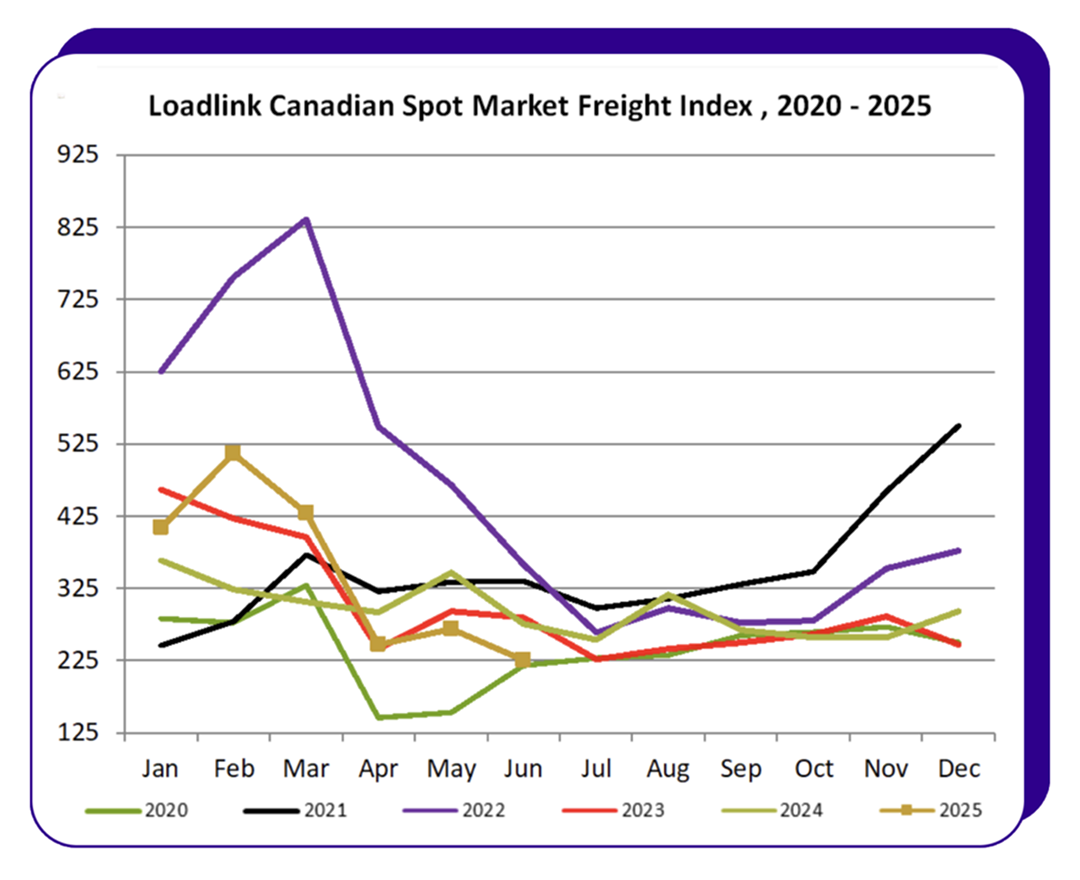

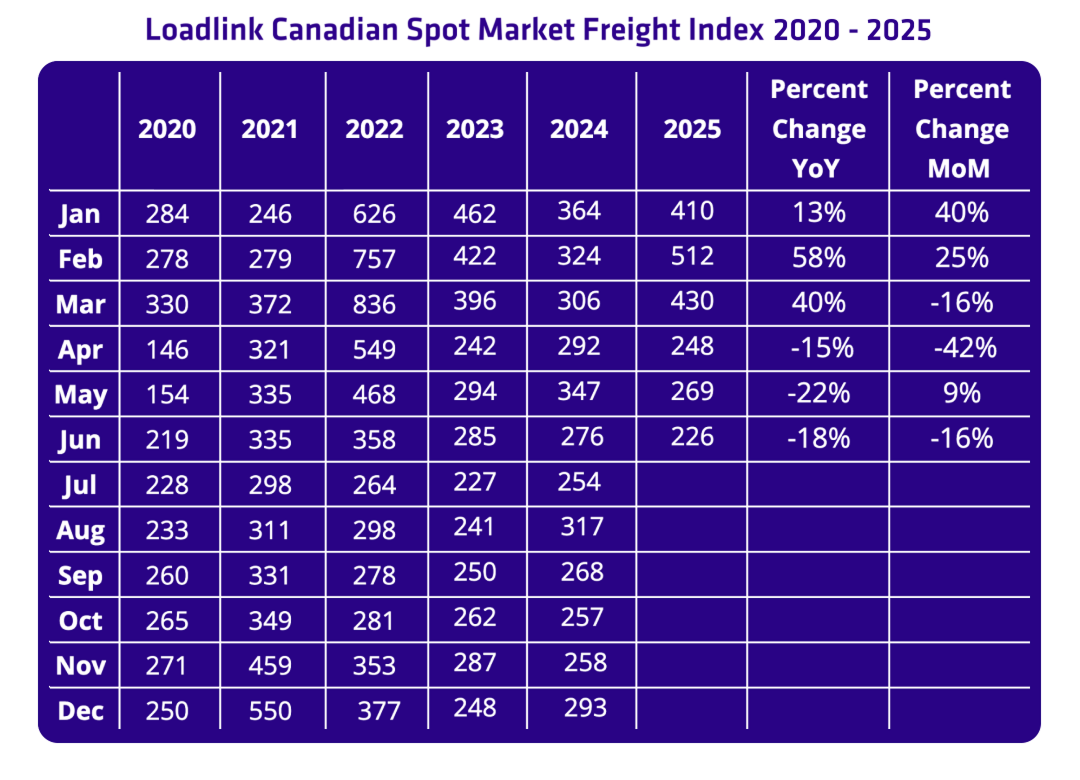

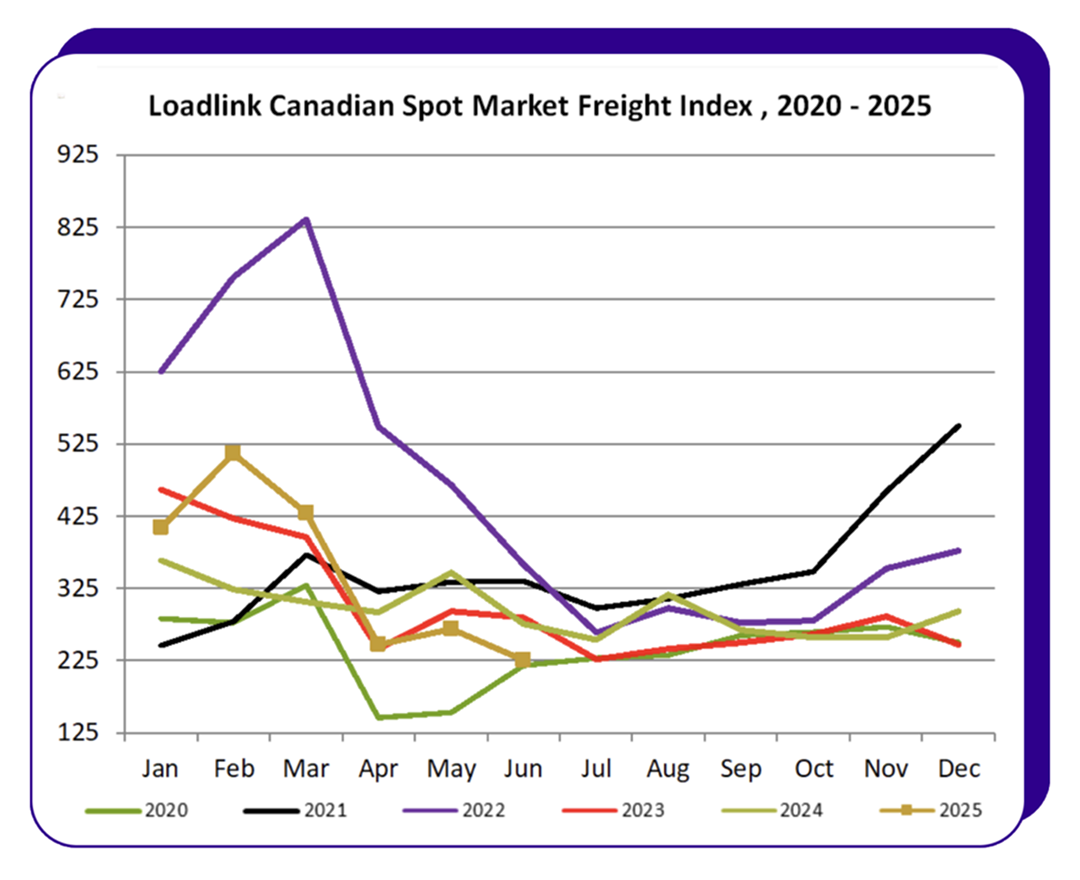

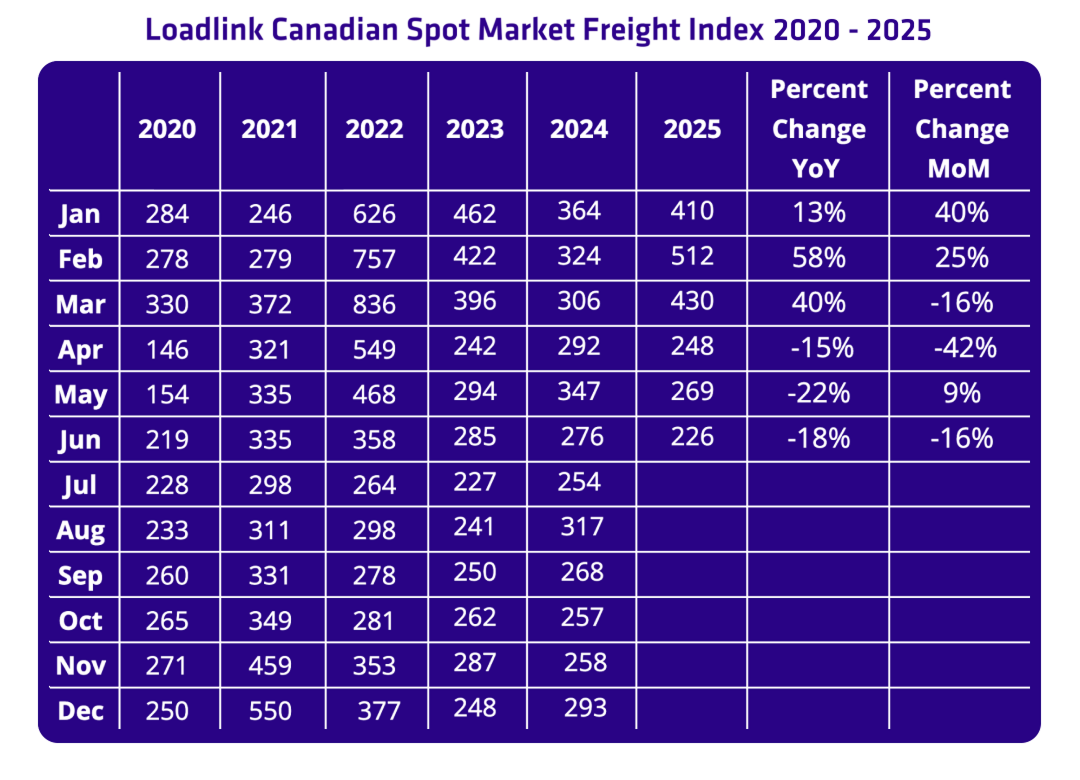

After a modest rebound in May, June brought a noticeable dip in overall freight activity across Canada. Loadlink’s data shows total load postings fell 16% from May 2025 and 18% compared to June 2024. Despite the downturn, there are signs of stability within specific market segments — particularly outbound cross-border and domestic freight, as well as continued demand for dry vans and reefers.

This environment is creating new opportunities across the supply chain, as carriers may benefit from reduced competition on outbound lanes, while brokers can take advantage of more flexible coverage options in a softer market.

Cross-Border Highlights

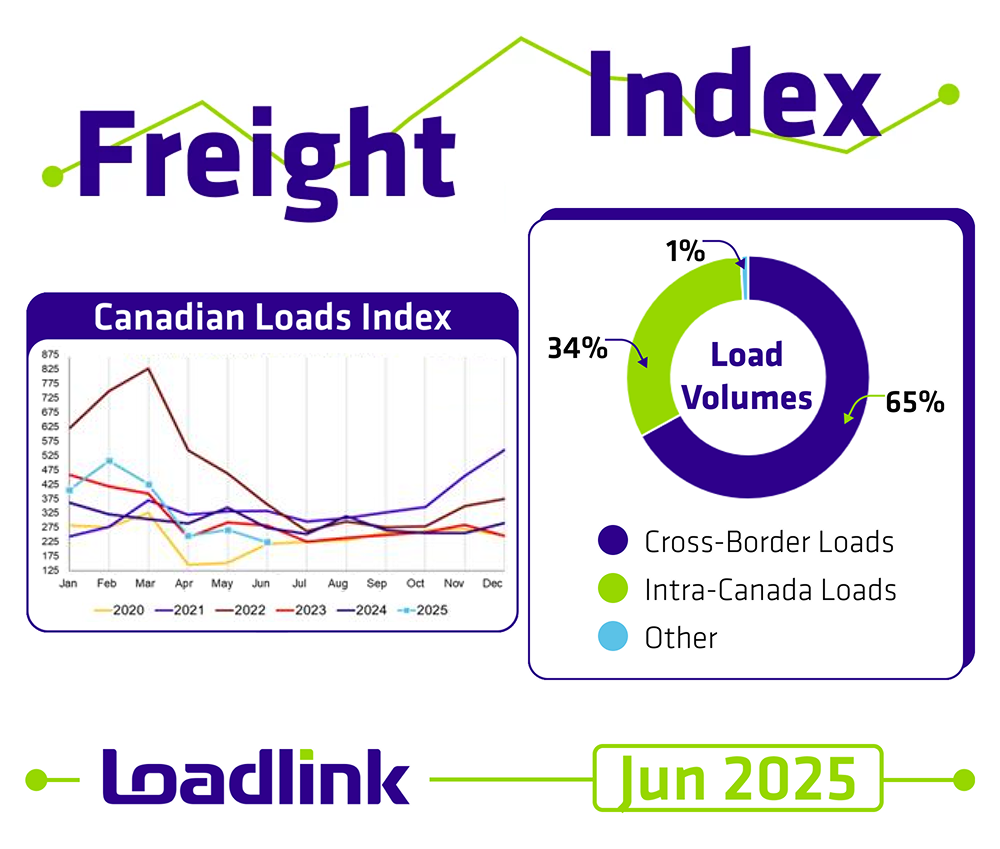

Cross-border freight remained dominant in June, accounting for 65% of all postings from Loadlink’s Canadian-based customers — unchanged from May.

● Outbound loads from Canada to the U.S. rose 4% compared to May, standing out as a positive signal in an otherwise softer month. Although volumes were down 12% year-over-year, outbound activity remains one of the more stable segments in the current market.

● Inbound loads into Canada from the U.S. experienced a 25% drop month-over-month and a 27% decline year-over-year, reflecting ongoing softness in northbound trade.

● Cross-border equipment availability tightened compared to June 2024. Outbound postings dropped 25%, and inbound equipment fell 15%, pointing to fewer trucks available for cross-border hauls.

While inbound activity remains under pressure, outbound freight is showing early signs of resilience. With capacity tightening, carriers may find stronger rates on outbound lanes.

Intra-Canada Freight

Domestic freight made up 34% of June postings, consistent with May. While intra-Canada loads dropped 10% month-over-month, the annual decrease was just 6%, signalling a relatively stable long-term trend.

Equipment availability for domestic lanes grew 2% month-over-month, although it remained 15% below June 2024 levels. This environment presents areas of opportunities for carriers focused on shorter hauls or intra-provincial lanes to secure consistent freight.

Equipment Trends

The breakdown of equipment postings in June remains the same:

● Dry Vans: 55%

● Reefers: 23%

● Flatbeds: 18%

● Other: 4%

Dry vans and reefers continue to dominate Loadlink’s equipment mix, offering steady demand across both cross-border and domestic lanes.

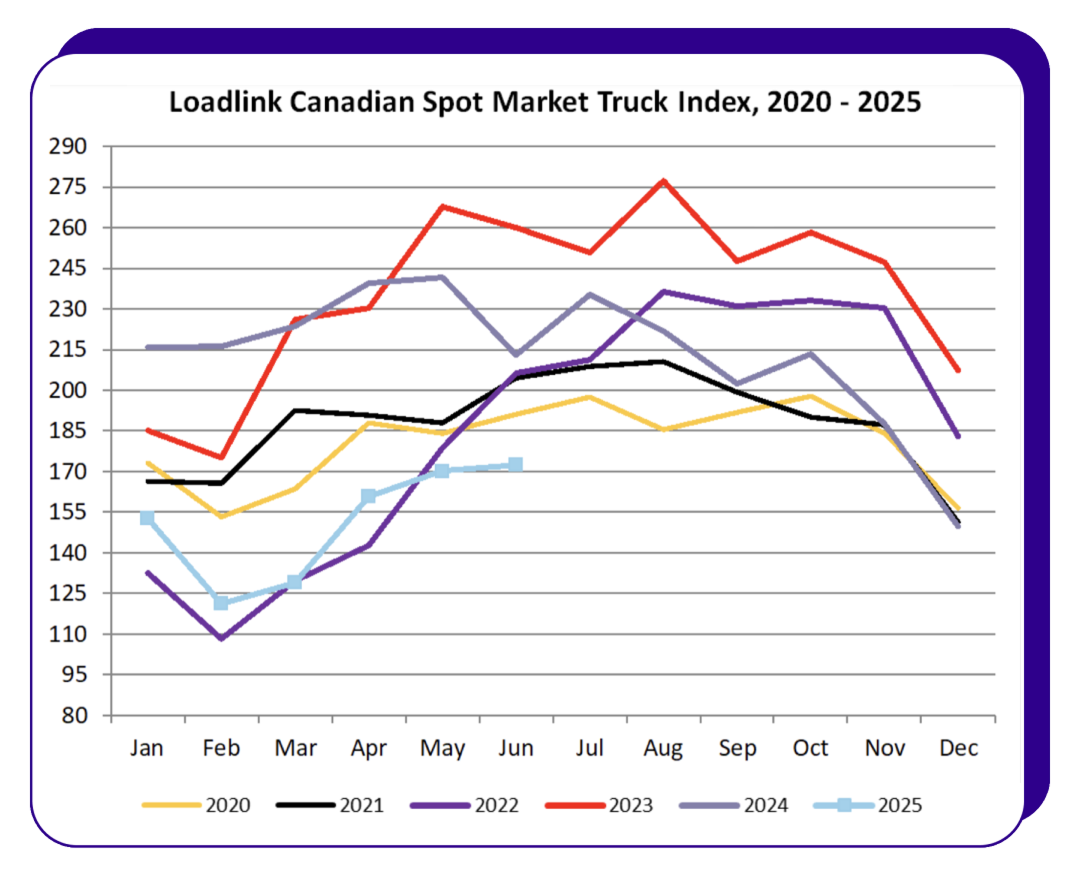

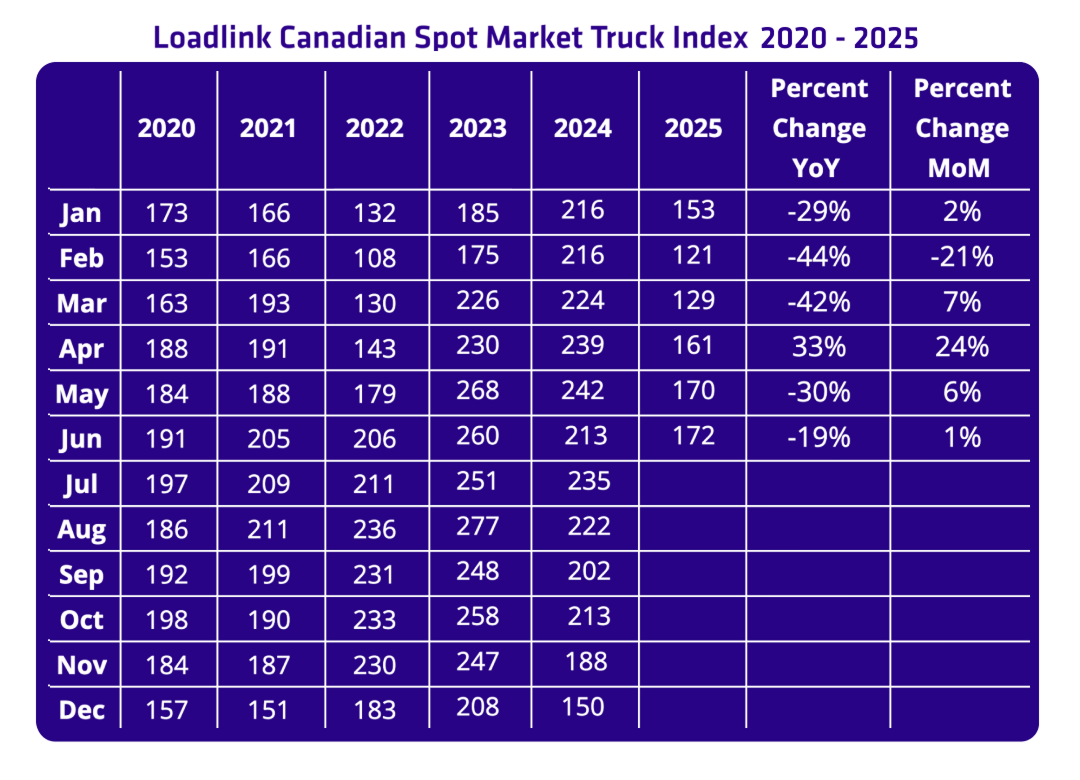

Truck-to-Load Ratio

June saw the truck-to-load ratio rise to 3.35, up 21% from May’s 2.7, indicating more trucks available per load. This is nearly identical to June 2024’s ratio of 3.39, showing a consistent balance of supply and demand year-over-year.

While the increase suggests heightened competition for carriers, it gives brokers access to a larger market of available trucks, making it easier to secure coverage and move loads efficiently.

Finding Key Opportunities in a Shifting Market

Despite an overall drop in volumes, June’s data shows that outbound cross-border and intra-Canada freight held steady from last month. Combined with tightening capacity on outbound lanes and ongoing demand for dry van and reefer equipment, the market offers a clear advantage to those who adapt quickly and act on timely insights.

“While outbound postings held steady in June, the overall volume decline and tightening capacity will continue to put pressure on the market. While the turnaround isn’t happening as fast as we would like, there are still opportunities for brokers and carriers to explore certain lanes that can lead to sustainable profitability,” said James Reyes, General Manager at Loadlink Technologies.

Whether you’re a carrier focused on keeping trucks moving or a broker looking for reliable coverage, Loadlink gives you access to Canada’s most active and largest freight network, helping you stay ahead as conditions shift.

About Loadlink Technologies

Loadlink Technologies is Canada’s leading freight matching platform. By connecting brokers and carriers, Loadlink helps businesses move freight efficiently and cost-effectively. Through innovative solutions, Loadlink supports the logistics sector by simplifying workflows and enhancing the capacity for freight movement across North America through our software.