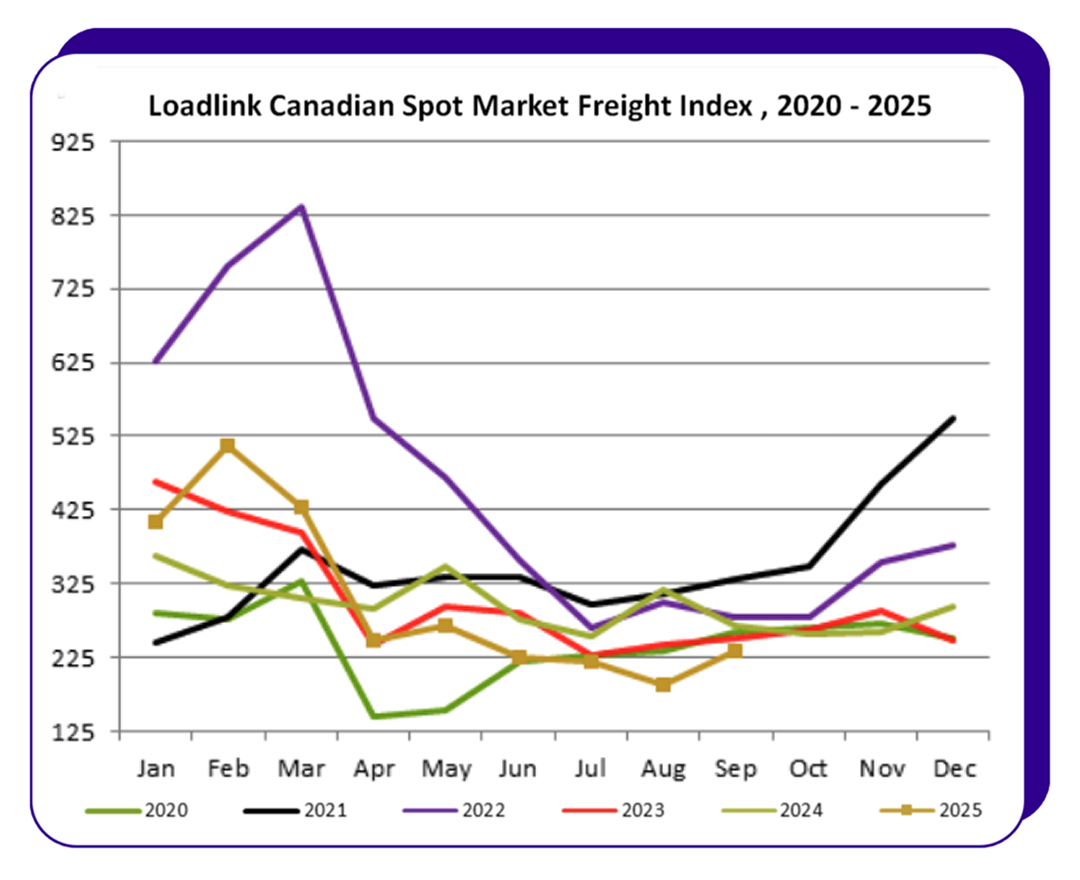

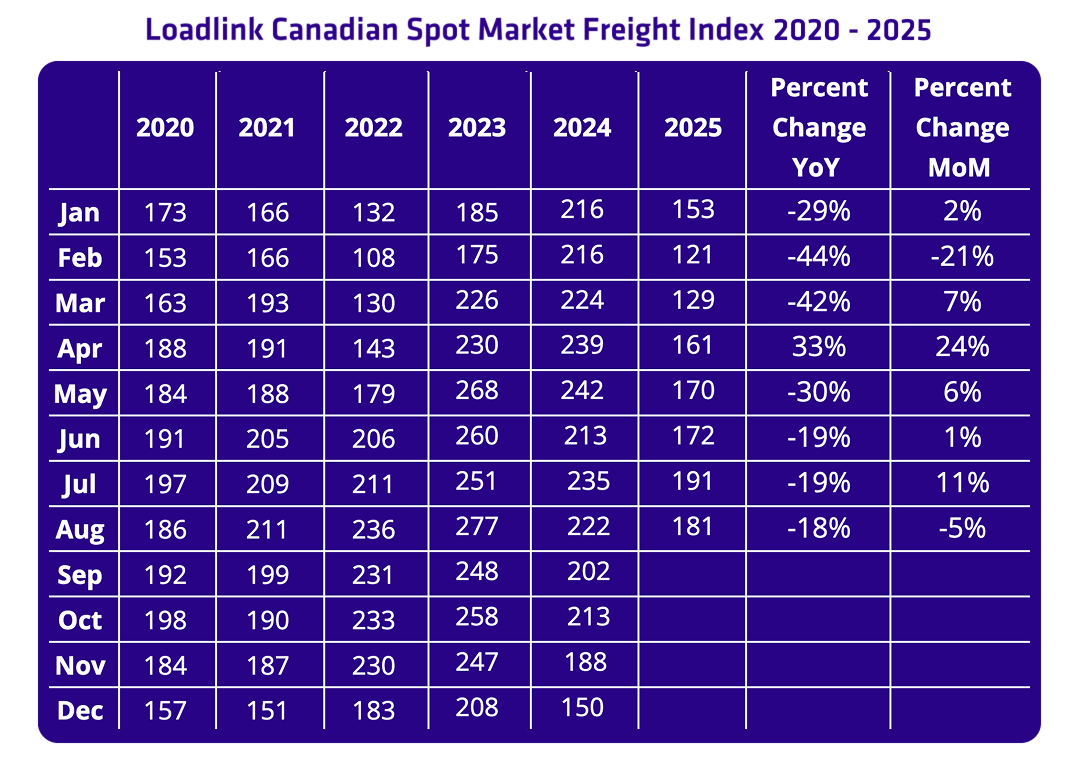

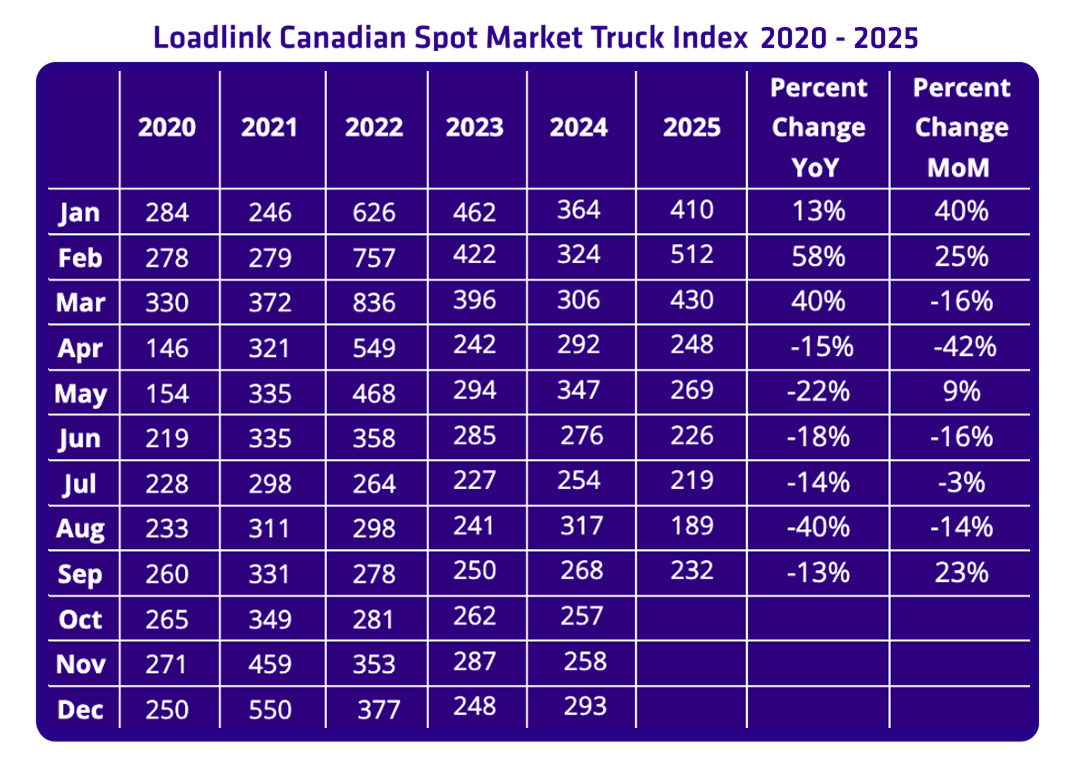

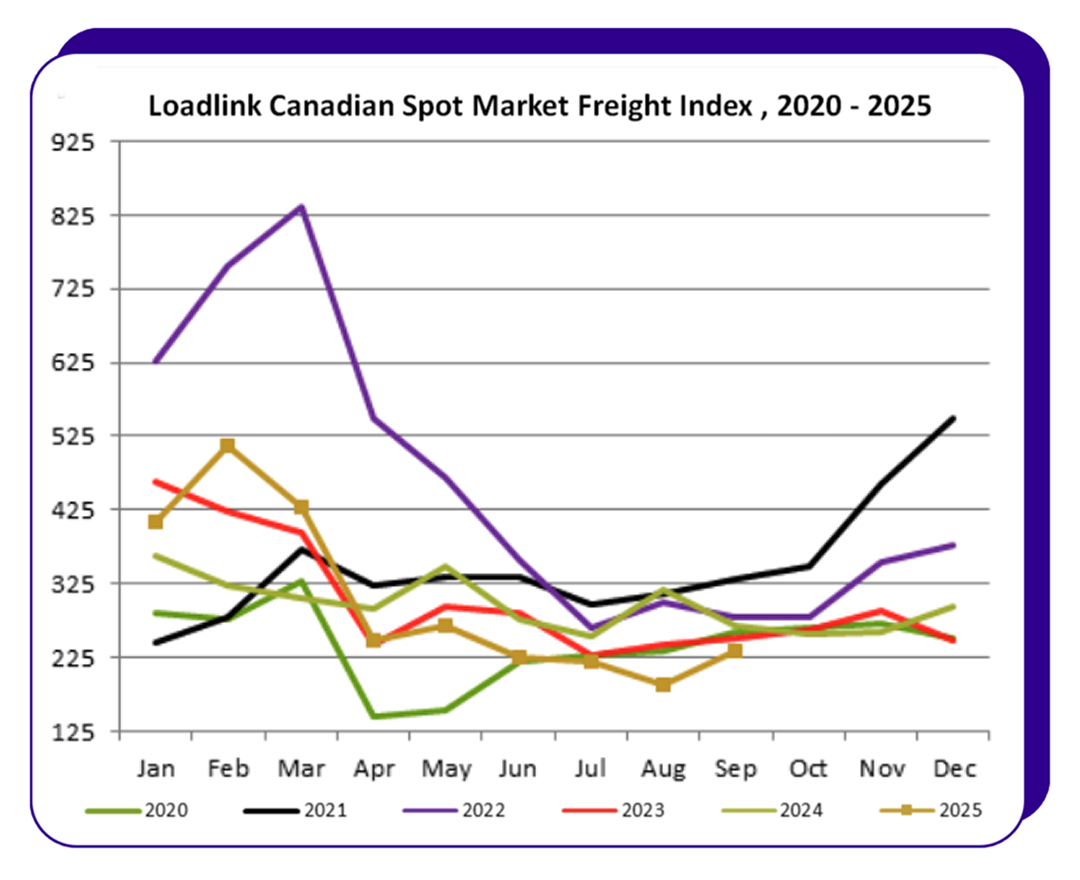

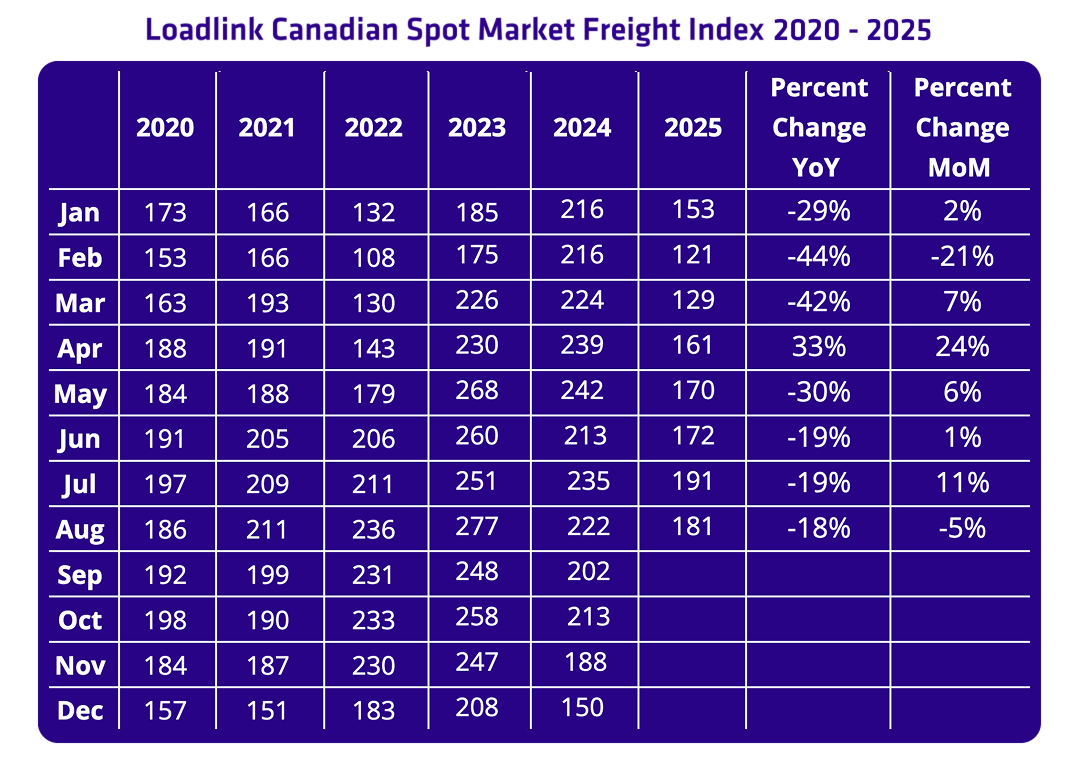

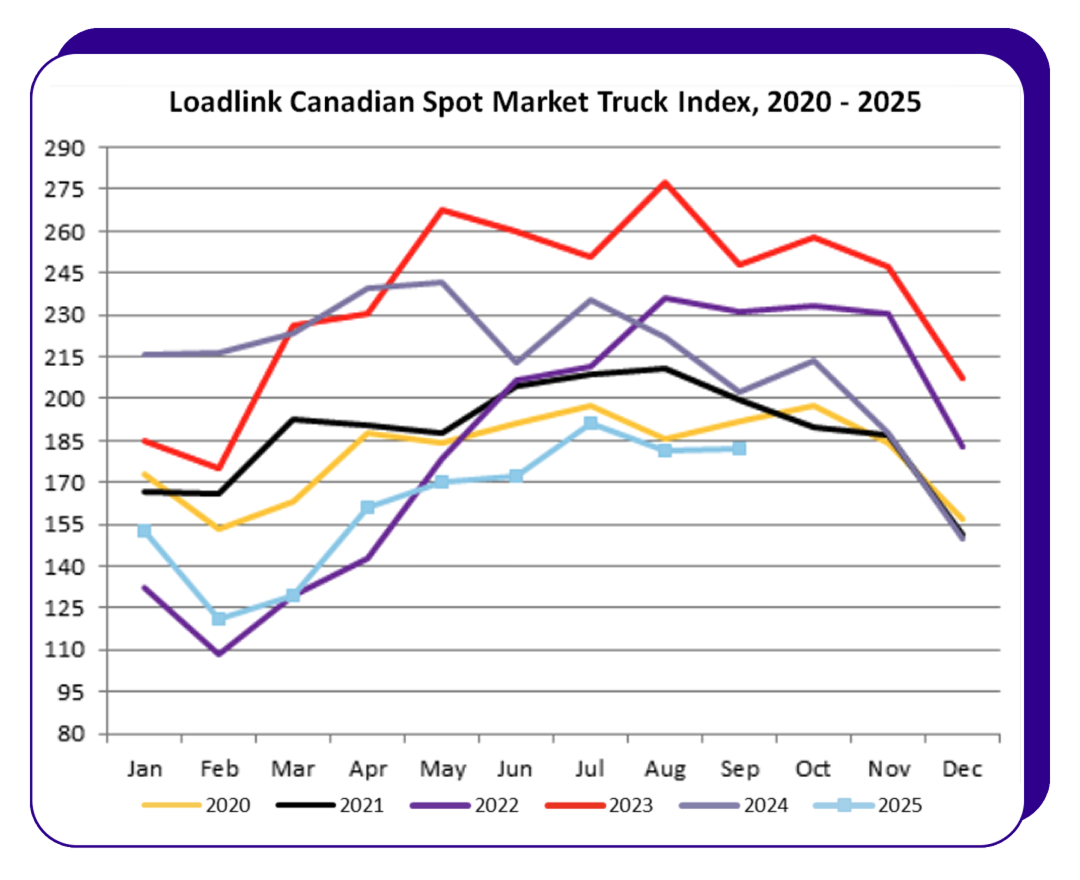

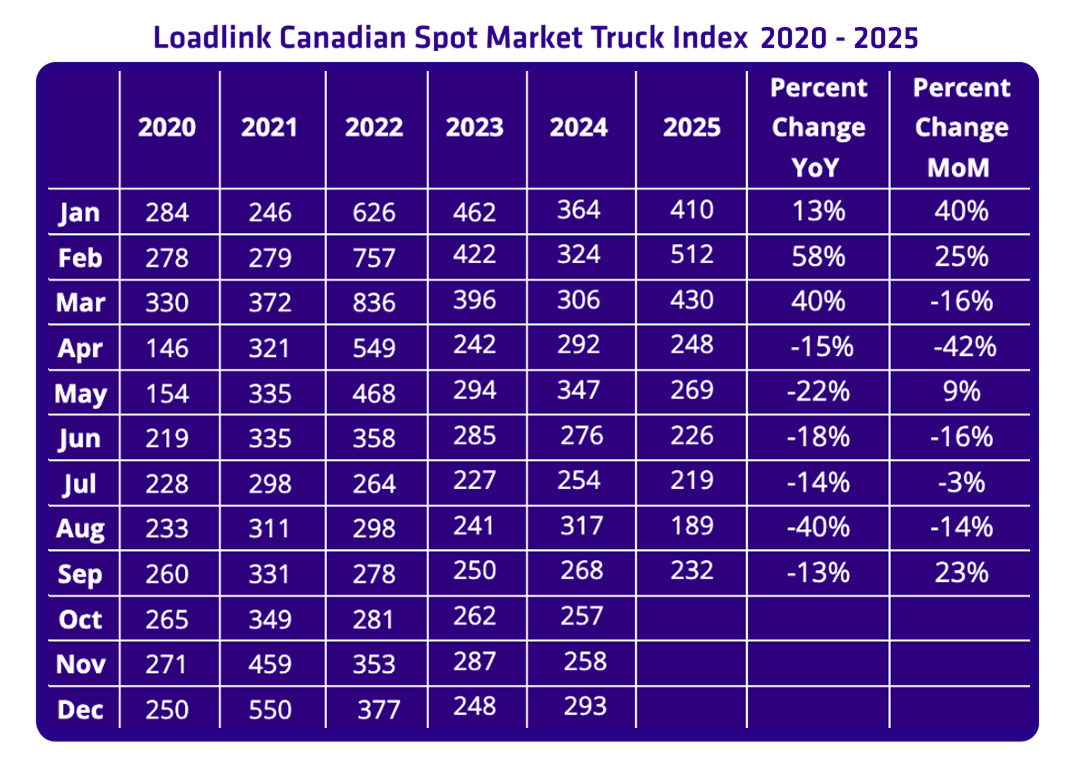

After a quieter August, September marked a positive turn for Canadian freight activity. Loadlink’s latest data shows that overall load postings increased 23% compared to August 2025, signaling a healthy rebound in market movement. While volumes remain 13% lower than September 2024, the month-over-month surge highlights renewed momentum for carriers and brokers navigating the market.

The lift was driven by both cross-border and domestic activity, with multiple lanes showing strong opportunities for freight movement. Loadlink’s data continues to provide insight into market trends, helping members adjust strategies and position themselves for success in the evolving landscape.

Cross-Border Highlights

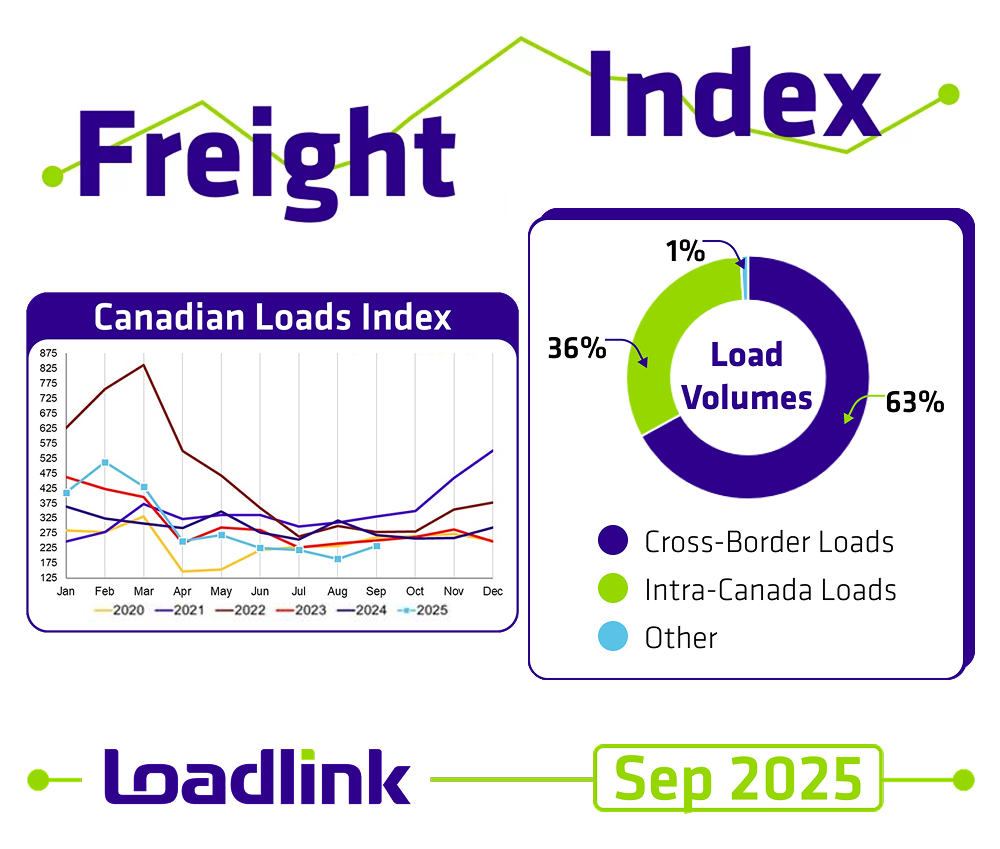

Cross-border freight remained the largest portion of activity, making up 63% of postings from Canadian-based customers.

· Outbound loads (Canada to U.S.) saw a strong month-over-month increase of 39%, though volumes were down 21% year-over-year. Equipment postings dipped slightly by 2% from last month but were 16% lower compared to September 2024.

· Inbound loads (U.S. to Canada) also experienced a notable rebound, climbing 28% from August. Equipment availability remained stable, with only a 1% decrease month-over-month and 16% lower than last year.

This rebound on both inbound and outbound lanes presents opportunities for carriers to secure freight more efficiently and for brokers to better match capacity with demand.

Intra-Canada Freight

Domestic freight accounted for 36% of total postings in September.

· Month-over-month, load postings within Canada increased 8%, while year-over-year volumes remained mostly steady, rising just 1%.

· Equipment postings saw a slight pullback, falling 9% from last month and 33% year-over-year.

Shorter-haul and regional lanes continue to offer consistent freight options, especially as carriers adjust to shifting equipment availability.

Equipment Trends

The mix of equipment postings remained stable:

· Dry Vans: 55%

· Reefers: 24%

· Flatbeds: 17%

· Other: 4%

Dry vans and reefers continue to dominate, reflecting steady demand across both domestic and cross-border markets.

Truck-to-Load Ratio

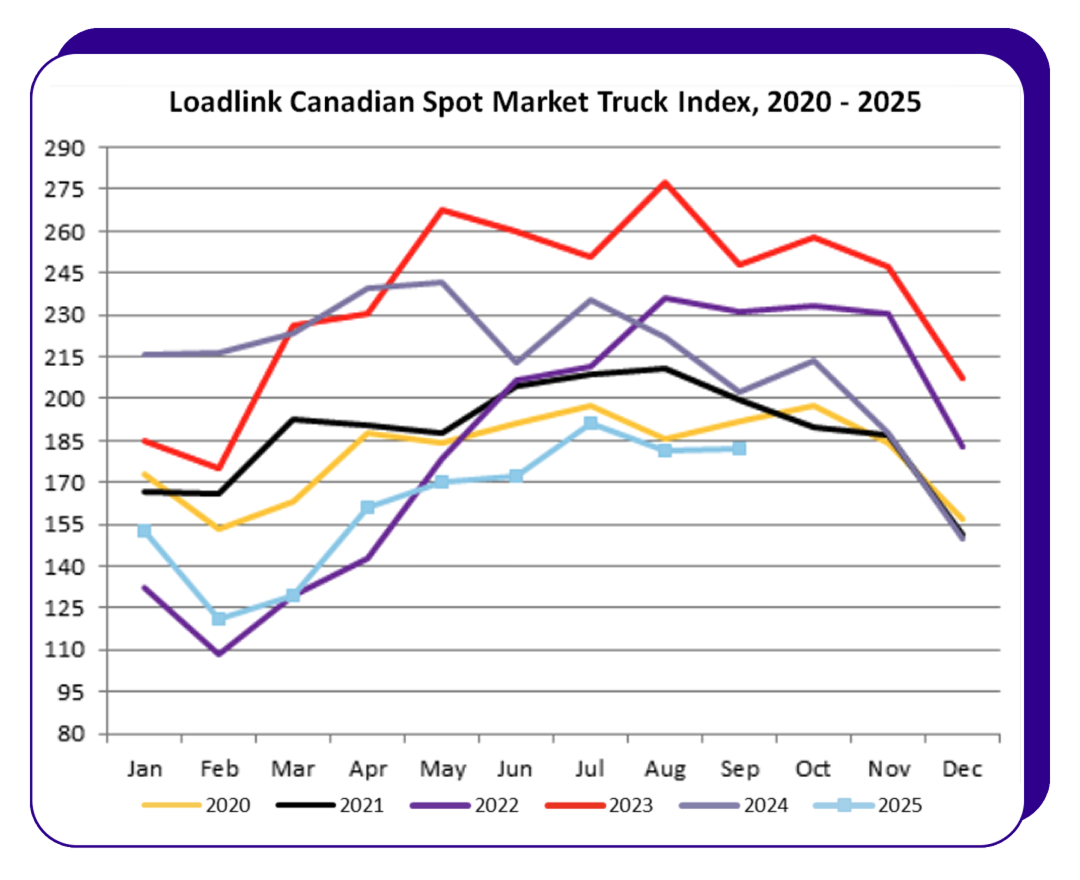

The average truck-to-load ratio for September was 3.44 trucks per posted load, down 18% from August’s 4.20. Compared to September 2024, the ratio was 4% higher. The drop from August indicates stronger demand relative to available trucks, offering carriers a favourable environment for securing loads.

Turning September Momentum into Action

September brought a strong bounce in Canadian freight activity, with cross-border lanes showing the highest gains and domestic volumes also increasing. Outbound loads from Canada to the U.S. rose 39% month-over-month, inbound loads into Canada increased 28%, and intra-Canada volumes grew 8%. These trends point to clear opportunities for carriers to keep trucks moving and for brokers to secure coverage efficiently.

“Cross-border lanes are moving faster than we’ve seen all year, and the lower truck-to-load ratio shows demand is rising quickly. Carriers and brokers who act now can take advantage of these active lanes and maintain steady freight through the end of the year,” said James Reyes, General Manager at Loadlink Technologies.

Loadlink continues to provide the insights and visibility needed to track market activity, enabling members to respond quickly to changes and capitalize on current opportunities as 2025 enters its final quarter.

About Loadlink Technologies

Loadlink Technologies is Canada’s leading freight matching platform. By connecting brokers and carriers, Loadlink helps businesses move freight efficiently and cost-effectively. Through innovative solutions, Loadlink supports the logistics sector by simplifying workflows and enhancing the capacity for freight movement across North America through our software.