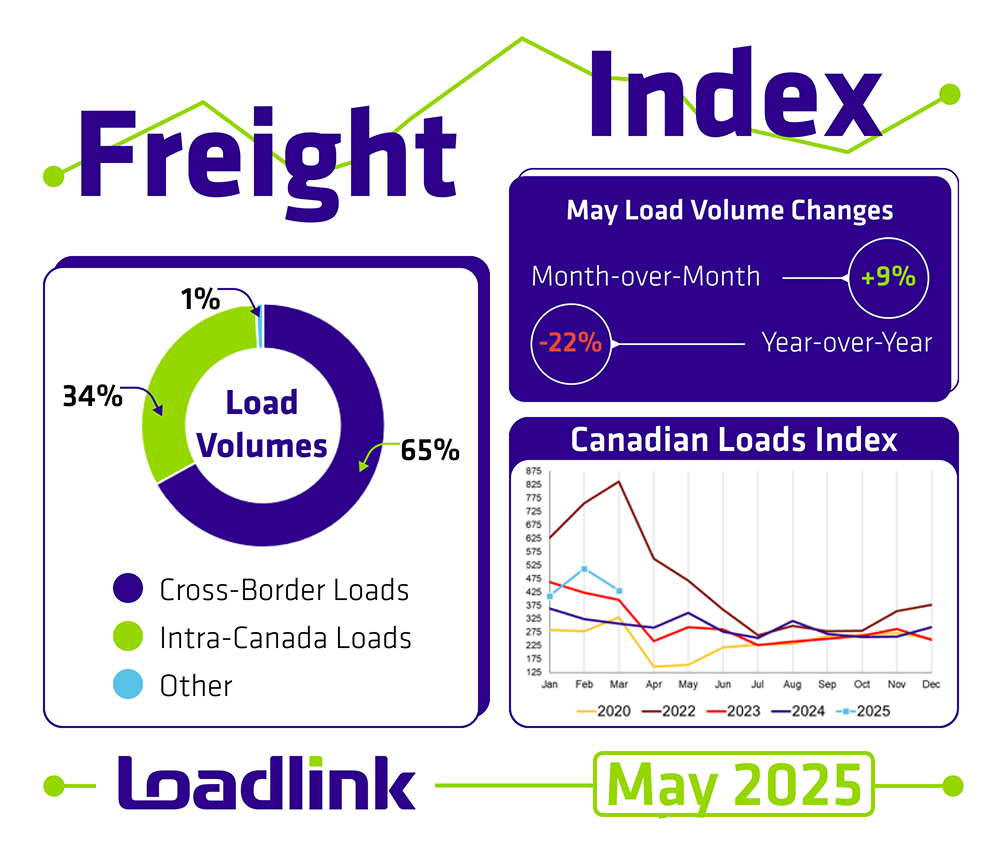

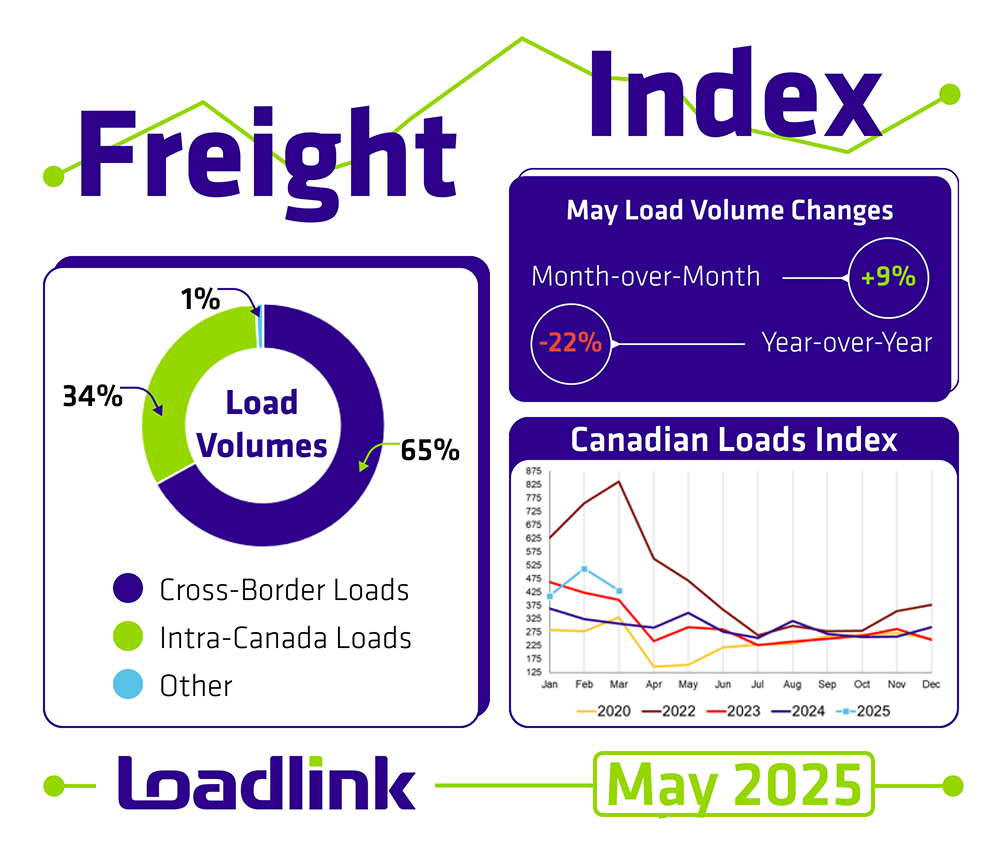

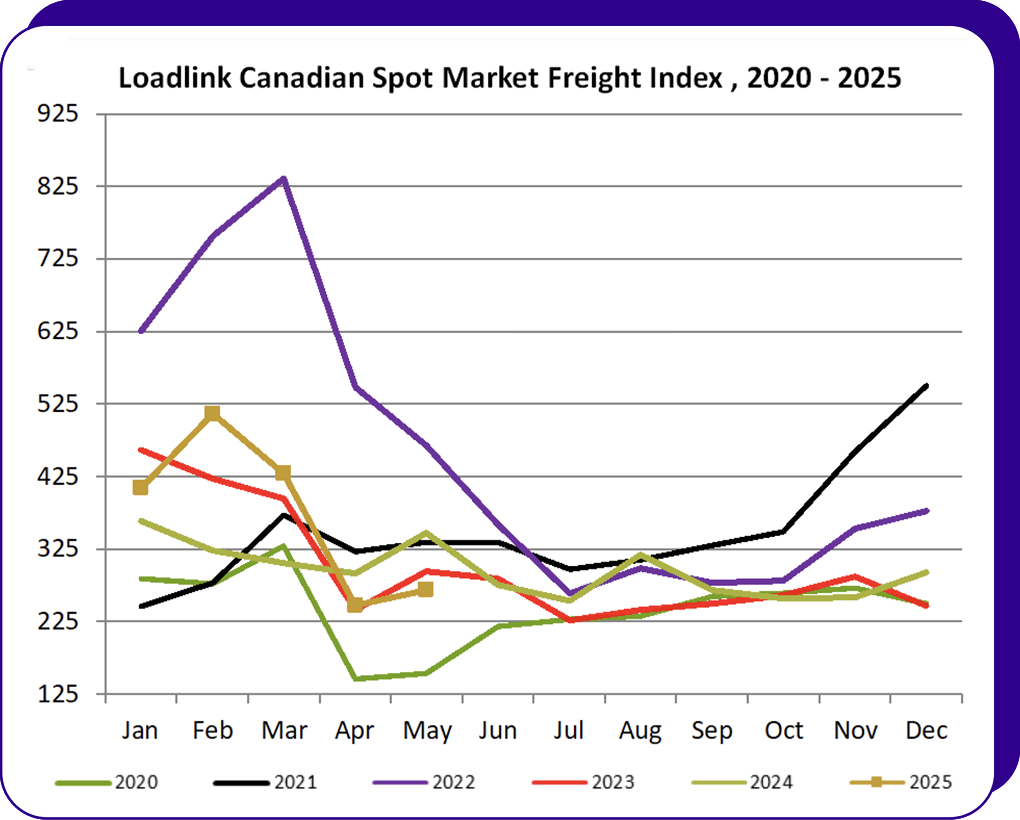

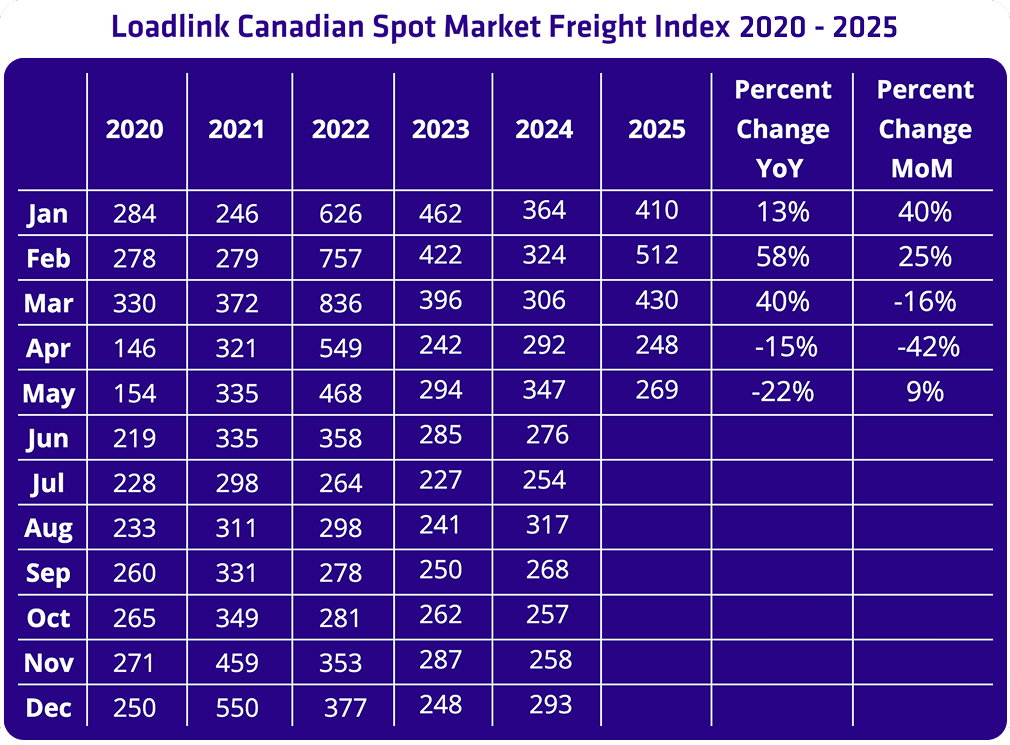

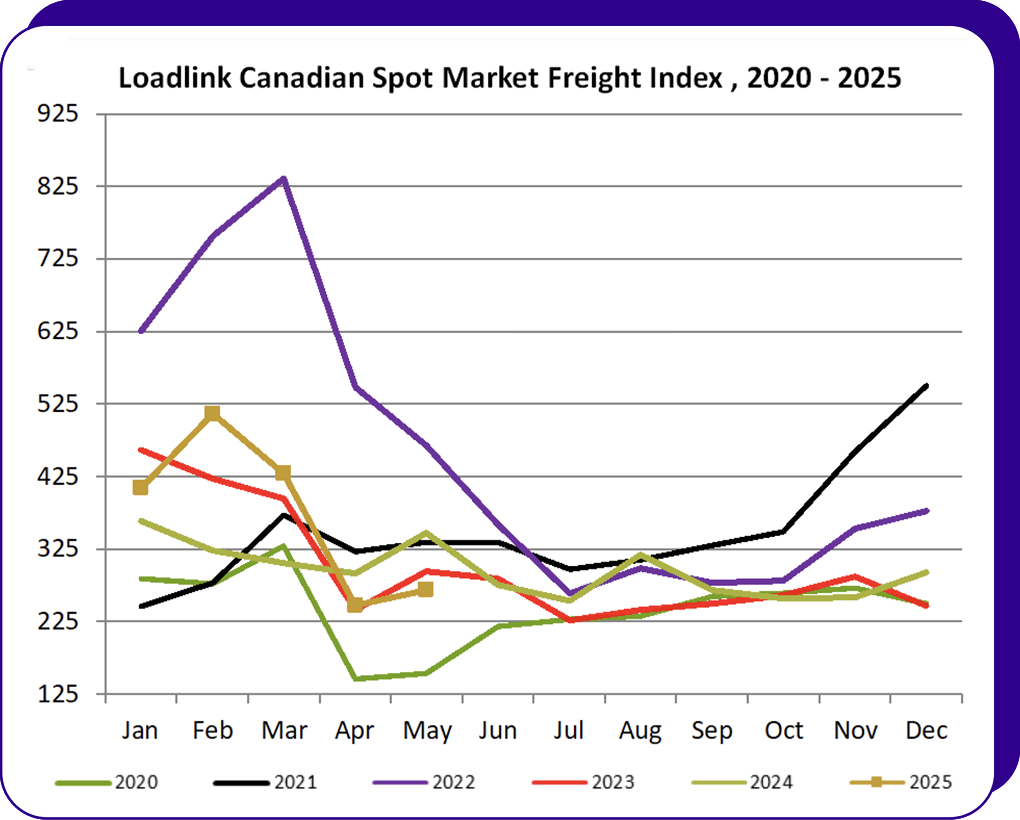

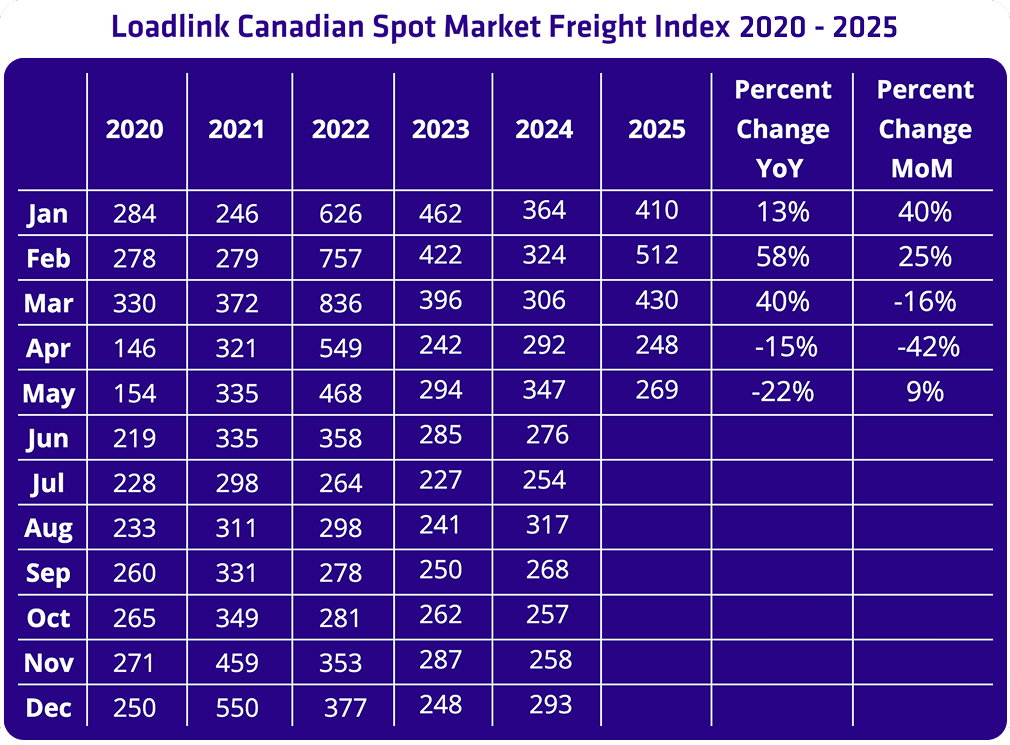

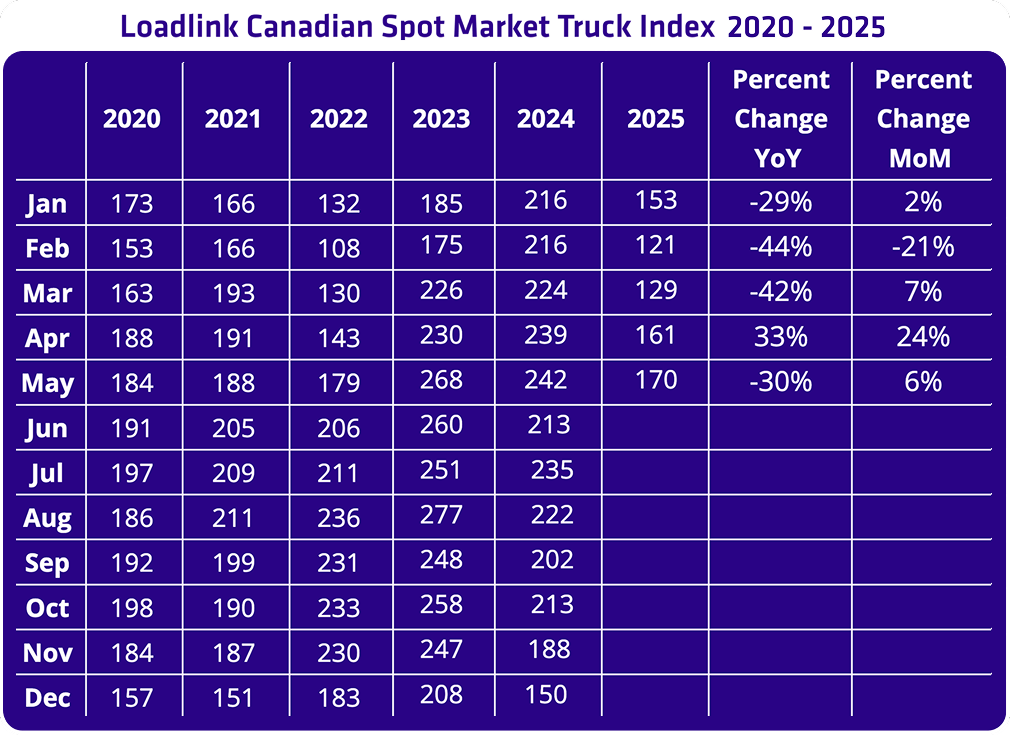

Loadlink’s latest data for May showed signs of freight activity picking back up across Canada. The spot market saw a 9% increase in total load postings compared to April. While year-over-year volumes were still down 22% from May 2024, the slight month-over-month recovery suggests a more stable start to summer.

Cross-border freight remained the dominant segment of activity, accounting for 65% of all postings from Loadlink’s Canadian-based customers. Inbound volumes into Canada from the U.S. saw a strong increase in May, while outbound freight continued to decline. On the domestic side, intra-Canada freight held relatively steady month-over-month and continues to offer opportunities for carriers adjusting to slower cross-border demand.

Equipment availability rose in some areas, particularly outbound and domestic postings. May’s tighter truck-to-load ratio indicates growing demand for freight on the spot market, highlighting more chances for carriers to secure top-paying loads in the months ahead.

Cross-Border Highlights

Cross-border freight made up 65% of total postings from Loadlink’s Canadian customers.

Outbound loads from Canada to the U.S. were down 17% from April and down 29% compared to May 2024.

Inbound loads entering Canada from the U.S. were up 28% from April but down 22% compared to May 2024.

Outbound equipment heading to the U.S. was up 16% from April but down 29% compared to May 2024.

Inbound equipment coming from the U.S. was down 3% from April and down 31% compared to May 2024.

Intra-Canada Freight

Domestic freight activity accounted for 34% of all postings in May. Loads within Canada were down 2% compared to April and down 20% year-over-year.

Equipment availability rose 6% month-over-month but was still down 29% compared to May 2024. With cross-border volumes shifting, domestic freight remains a consistent option for carriers adjusting to the demand.

Equipment Trends

Dry vans continued to dominate postings, accounting for 55% of all equipment. Reefers followed at 23%, flatbeds at 18%, and other types made up the remaining 4%.

Truck-to-Load Ratio

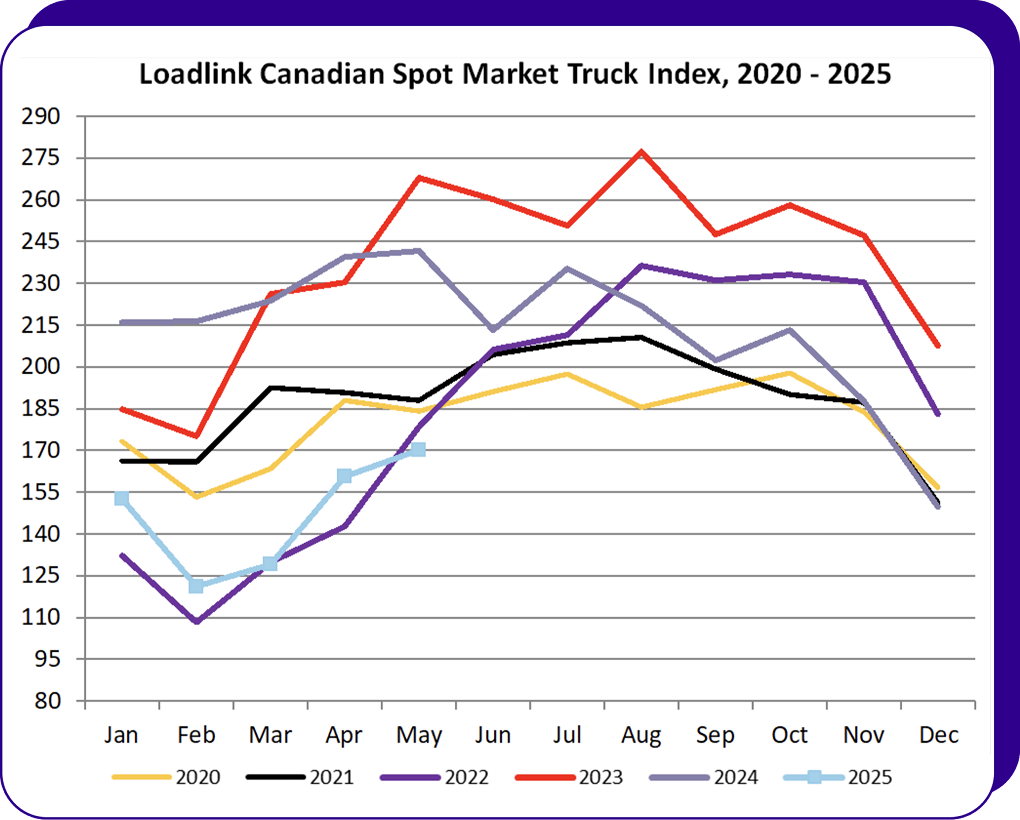

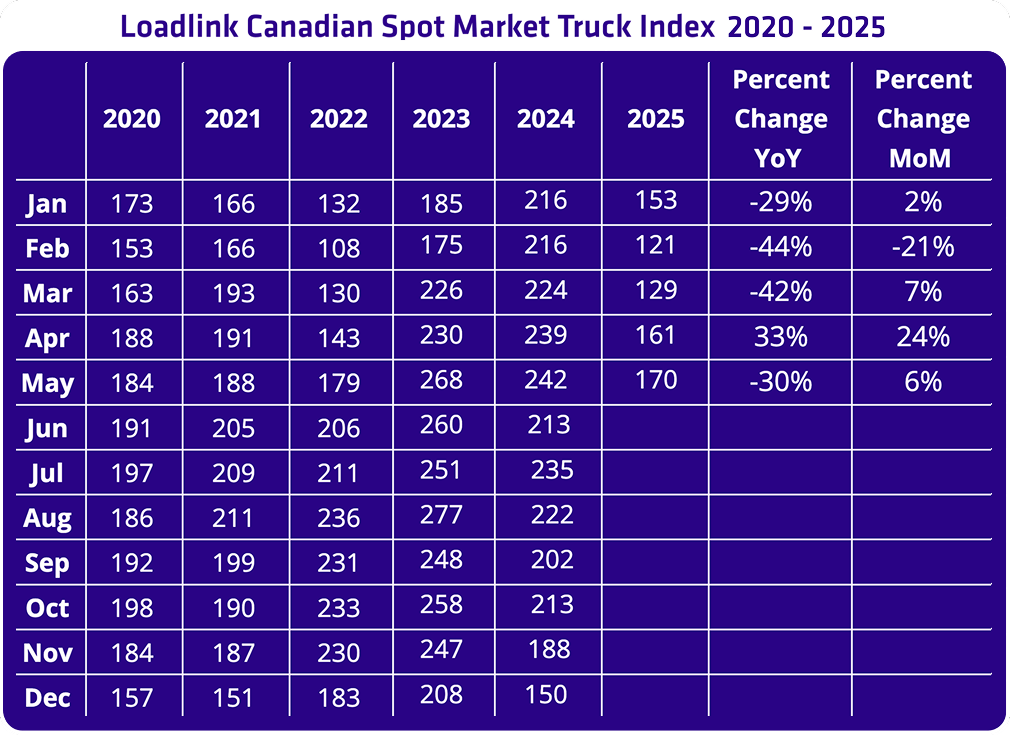

In May, there were 2.77 trucks available for every load posted on Loadlink. This marked a small improvement from April’s ratio of 2.85, representing a 3% tightening month-over-month. Compared to May 2024, the ratio was down 10% from 3.06, pointing to slightly improved conditions for carriers, with fewer trucks competing for each load.

Momentum Builds as Summer Nears

May’s data shows early signs of the freight market stabilizing. A small month-over-month rise in load volumes and a tighter truck-to-load ratio are creating better conditions for carriers. Inbound cross-border activity picked up, while domestic freight remained steady, offering dependable work within Canada. With panic around the tariffs cooling and uncertainty still lingering, Canada’s freight market remains resilient and continues to show steady growth. With these changes taking shape, now is an ideal time to enter the market and secure consistent, high-paying loads before we kick off the summer.

About Loadlink Technologies

Loadlink Technologies is Canada’s leading freight matching platform. By connecting brokers and carriers, Loadlink helps businesses move freight efficiently and cost-effectively. Through innovative solutions, Loadlink supports the logistics sector by simplifying workflows and enhancing the capacity for freight movement across North America through our software.