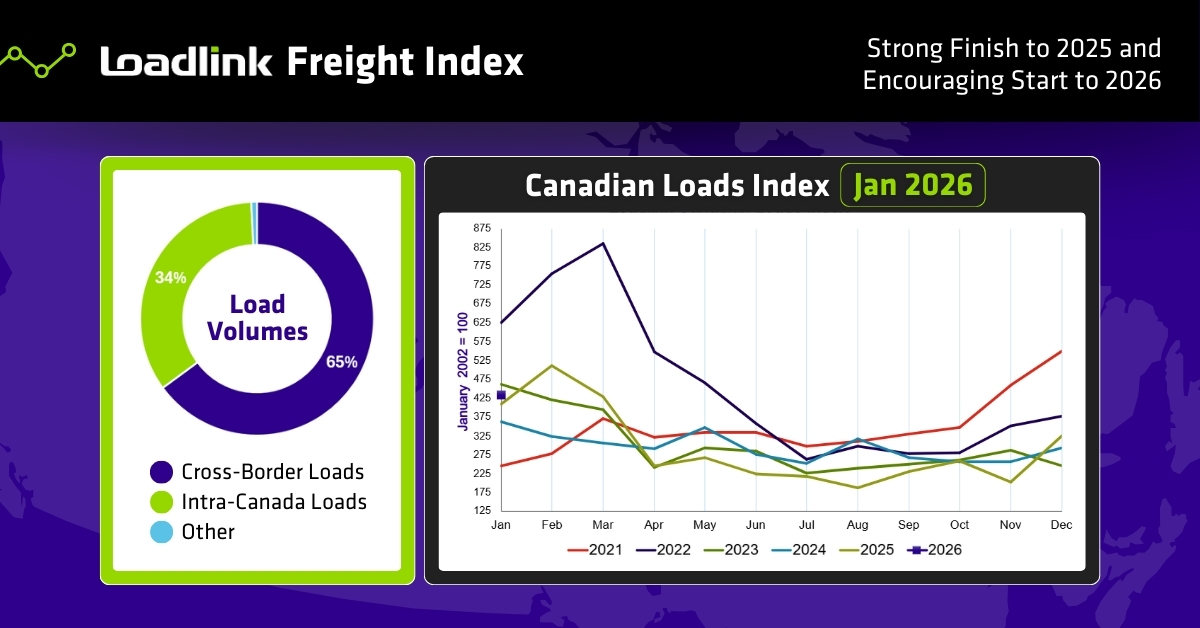

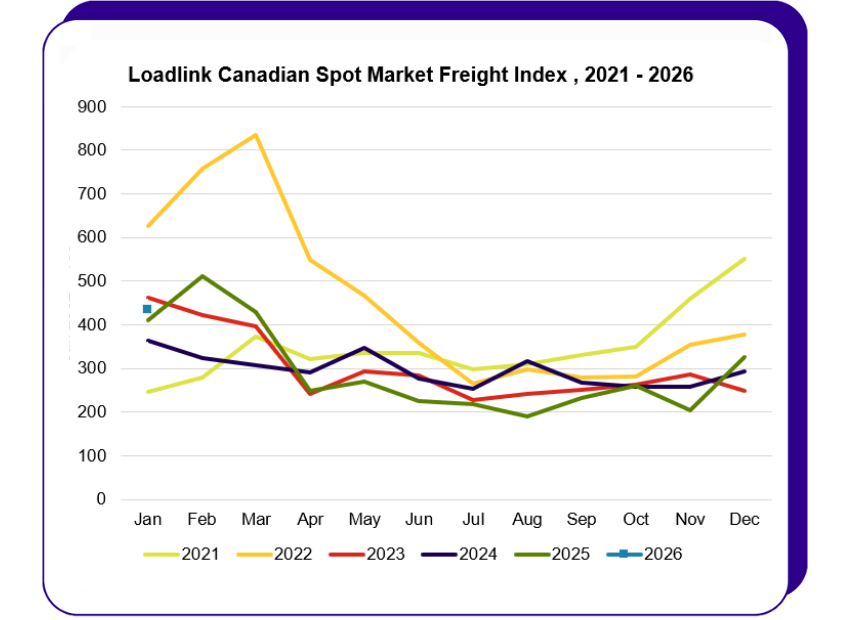

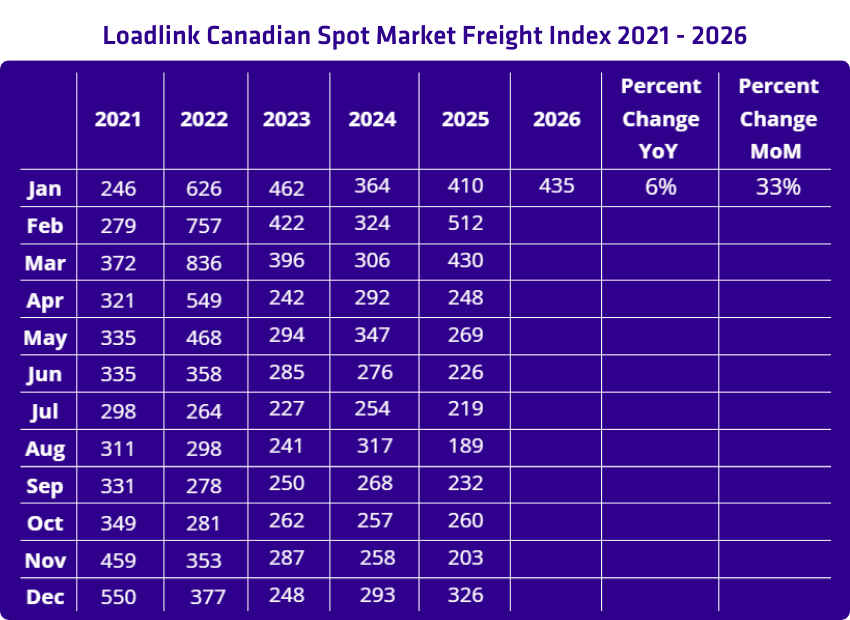

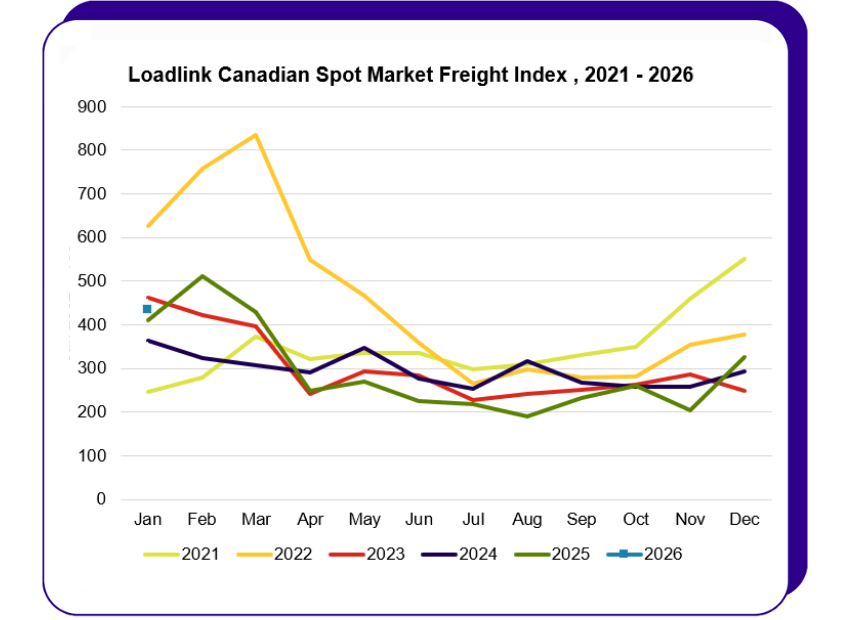

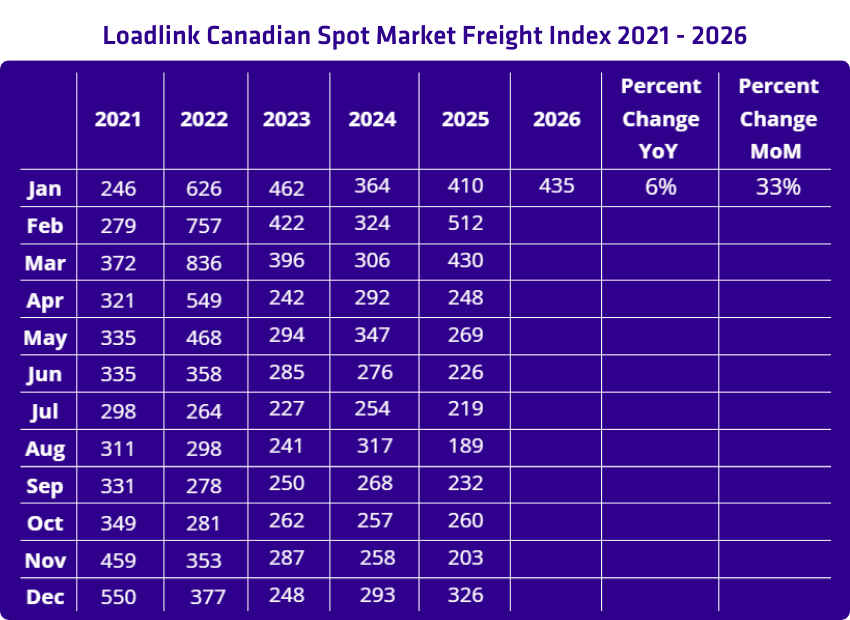

After a strong finish to 2025, Canada’s spot market opened 2026 with a clear shift in market power. Loadlink’s latest data shows January volumes increased 33% month-over-month and were 6% higher year-over-year. That momentum built on December’s surge, when volumes rose 60% from November and finished 11% higher than December 2024, with activity staying firm across both cross-border and domestic lanes.

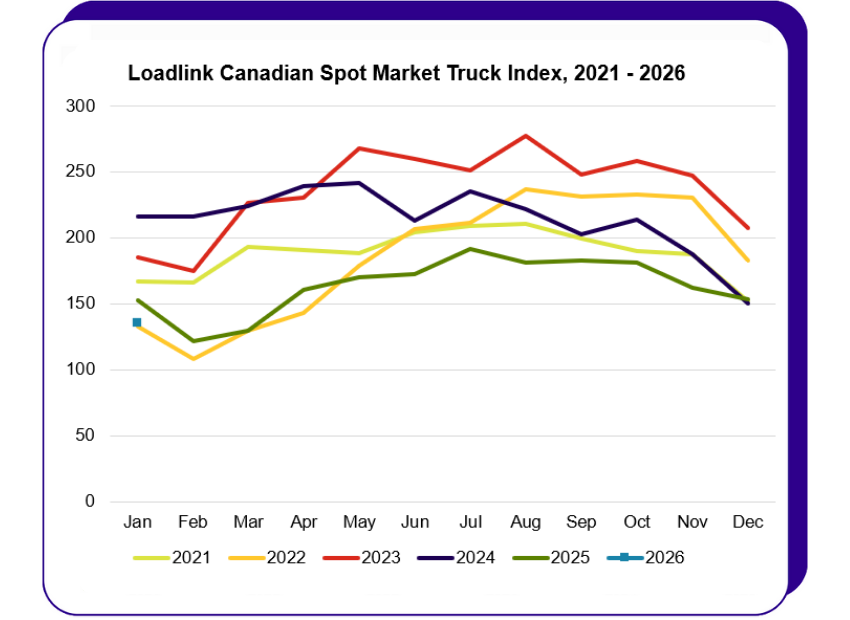

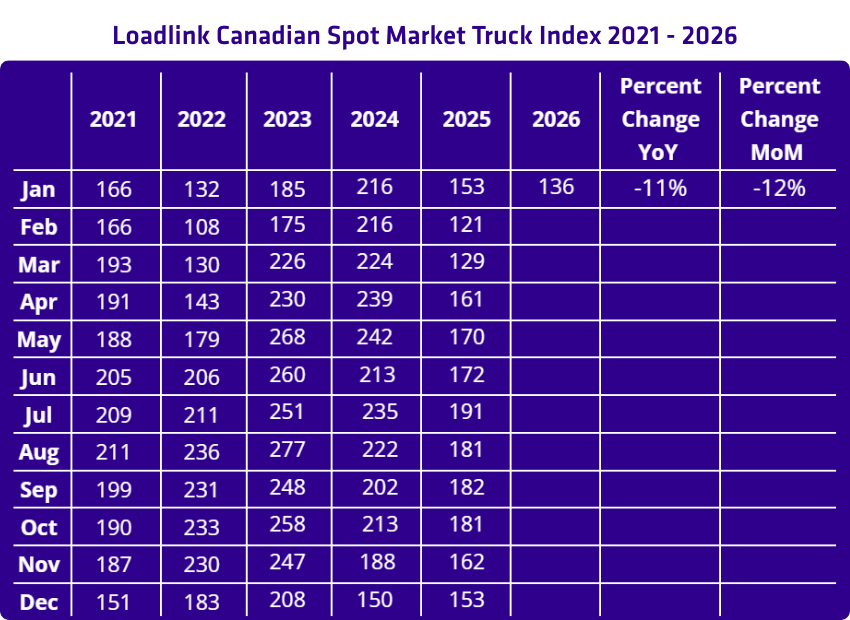

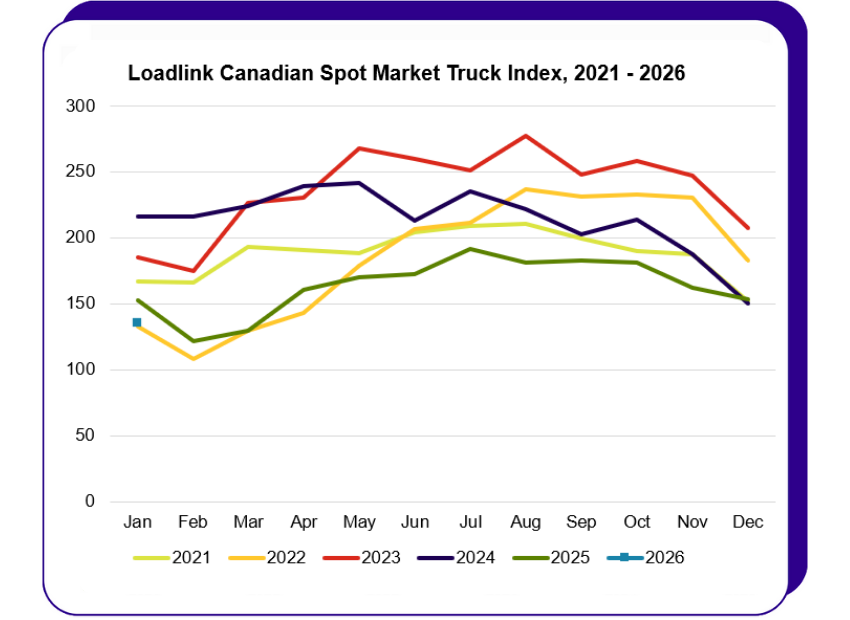

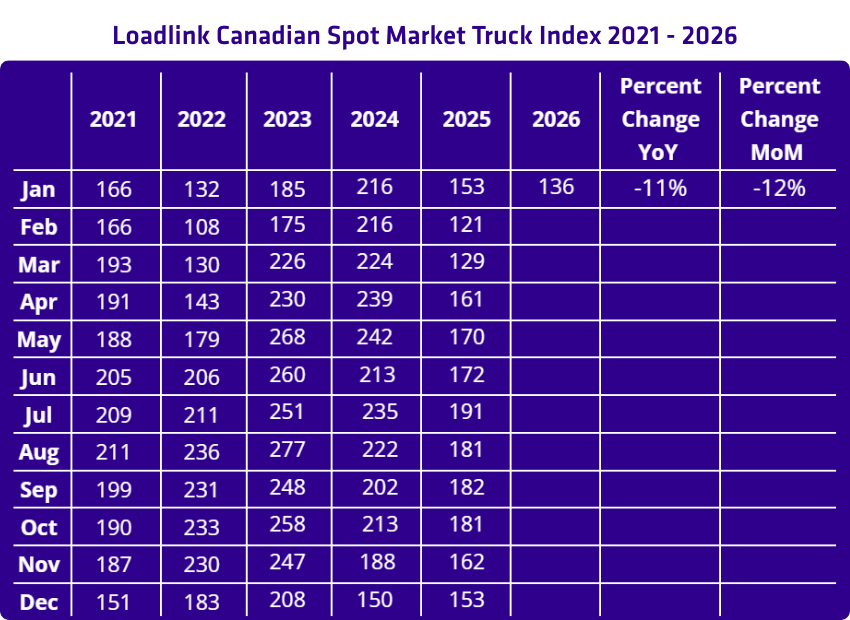

Capacity tightened again as the truck-to-load ratio dropped to 1.37 in January from 2.07 in December (34% lower) and sat 16% below January 2025 (1.61). The tightening conditions signal improving leverage for carriers heading into Q1, as demand continues to outpace available equipment.

Cross-Border Highlights

Cross-border freight remained the largest portion of activity and increased its share into the new year, marking 60% of postings in December and 65% in January from Canadian-based customers.

December 2025

· Outbound loads (Canada → U.S.) increased 38% month-over-month and decreased 1% year-over-year. Equipment postings fell 6% from November and were 3% lower year-over-year.

· Inbound loads (U.S. → Canada) surged 90% month-over-month and rose 9% year-over-year. Equipment availability declined 7% from November and was 11% lower year-over-year.

January 2026

· Outbound loads (Canada → U.S.) increased 14% month-over-month and decreased 12% year-over-year. Equipment postings fell 2% from December and were 14% lower year-over-year.

· Inbound loads (U.S. → Canada) increased 72% month-over-month and saw no change year-over-year. Equipment postings fell 20% from December and were 25% lower year-over-year.

Inbound freight into Canada surged across December and January, pulling the market’s focus northbound and tightening the window for securing trucks on those lanes. That northbound push became the defining trend as 2026 got underway.

Intra-Canada Freight

Domestic freight accounted for 39% of postings in December and 34% in January.

December 2025

· Month-over-month, loads within Canada increased 61%, while year-over-year volumes were 24% higher than 2024.

· Equipment postings were 4% lower than in November and 20% higher year-over-year.

January 2026

· Month-over-month, loads within Canada increased 17%, while year-over-year volumes were 35% higher than January 2025.

· Equipment postings were 9% lower month-over-month and 3% higher year-over-year.

Domestic activity remained firm through January, and winter freight patterns continued to keep capacity conditions tight. Loads were still rising, while available equipment dipped month-over-month, which kept the domestic market competitive for coverage to start the year.

Equipment Trends

The mix of equipment postings remained stable:

December 2025

• Dry Vans: 53%

• Reefers: 23%

• Flatbeds: 20%

• Other: 4%

January 2026

• Dry Vans: 54%

• Reefers: 22%

• Flatbeds: 19%

• Other: 5%

Truck-to-Load Ratio

December 2025

The truck-to-load ratio in December was 2.07 trucks for every one load posted on Loadlink.

· Month-over-month: Down from 3.51 in November 2025 (41% lower)

· Year-over-year: Down from 2.24 in December 2024 (8% lower)

January 2026

The truck-to-load ratio in January was 1.37 trucks for every one load posted on Loadlink.

· Month-over-month: Down from 2.07 in December 2025 (34% lower)

· Year-over-year: Down from 1.61 in January 2025 (16% lower)

For carriers, the consecutive tightening means more flexibility in route selection. For brokers, it signals the need for earlier outreach on time-sensitive freight.

A Firm Start to 2026 Keeps Conditions Favourable for Carriers

December’s surge carried straight into January, setting a strong tone for the start of 2026. Cross-border activity expanded its share into the new year, and inbound freight into Canada was the clearest driver of that shift. With load activity rising again in January and capacity tightening further, conditions remained favourable for carriers, while brokers faced a faster-moving market on the lanes that tightened first.

“January’s momentum didn’t reset after the holidays; it built on December’s,” said James Reyes, General Manager at Loadlink. “Inbound freight into Canada sets the pace, and when capacity tightens, the market moves faster, and teams have to move with more intent. Carriers gain more control over what fits their network, and brokers who commit earlier on priority lanes stay ahead of the curve.”

Loadlink continues to provide the visibility and insights members need to track market shifts in real time, respond quickly to changes, and make confident decisions as 2026 kicks off.

About Loadlink Technologies

Loadlink Technologies is Canada’s leading freight matching platform. By connecting brokers and carriers, Loadlink helps businesses move freight efficiently and cost-effectively. Through innovative solutions, Loadlink supports the logistics sector by simplifying workflows and enhancing the capacity for freight movement across North America through our software.