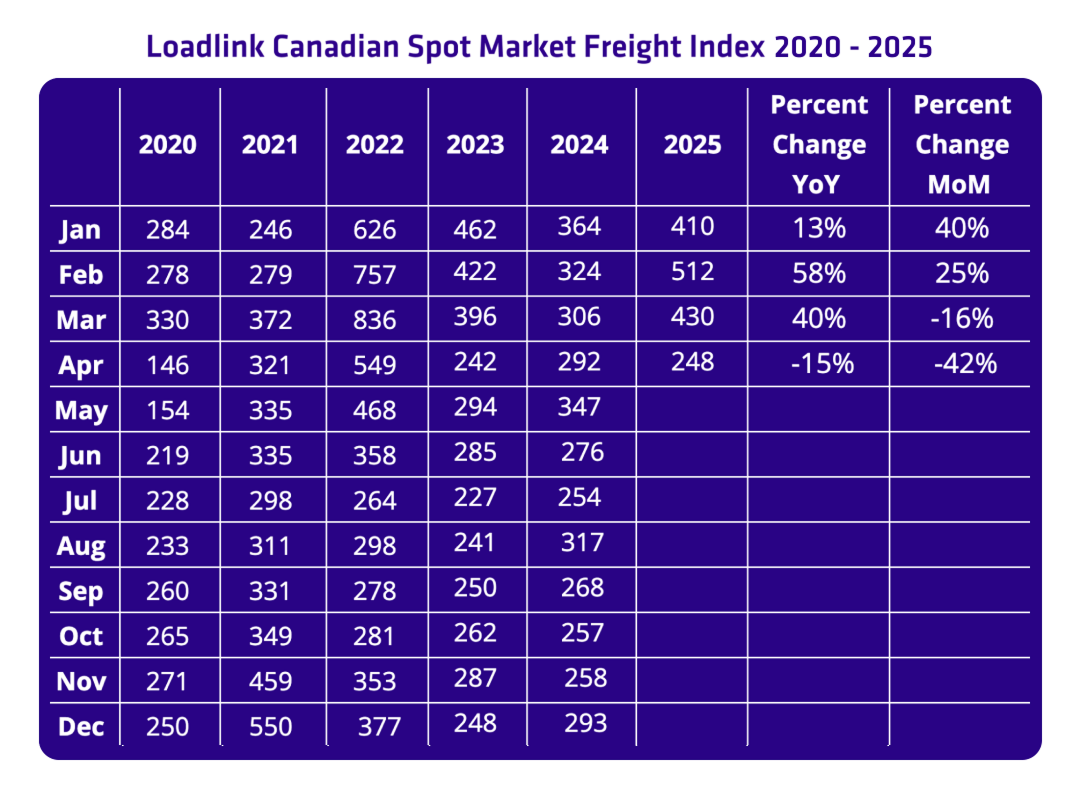

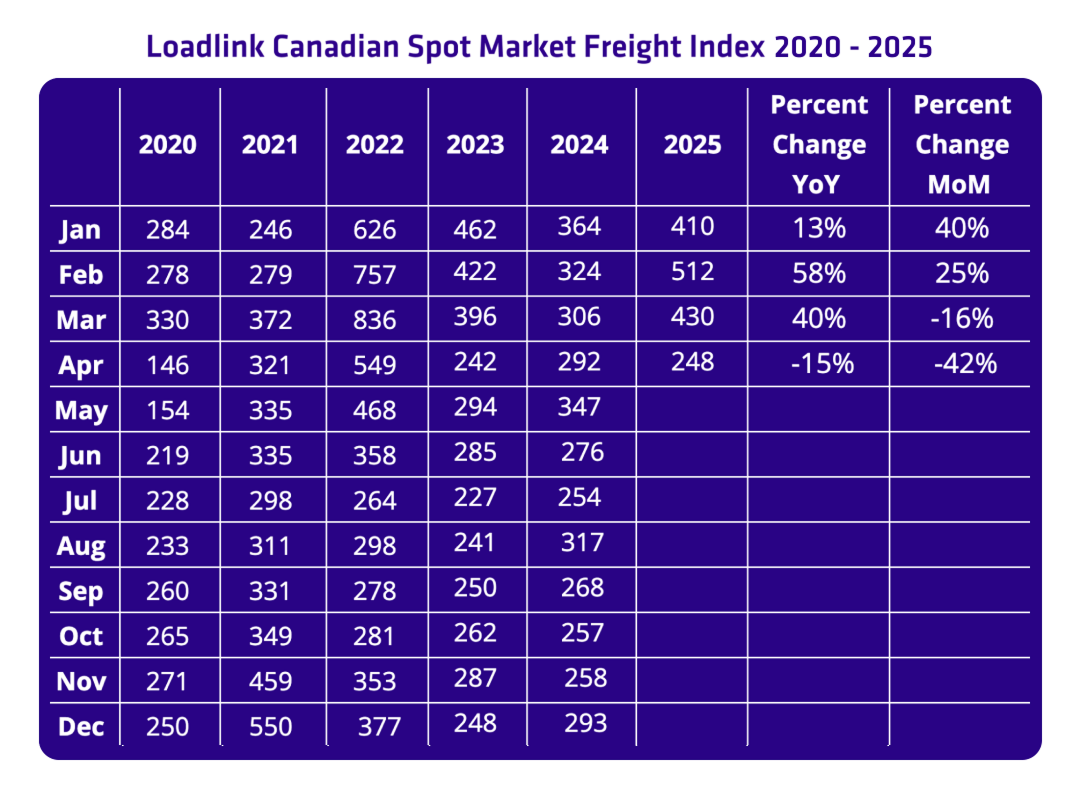

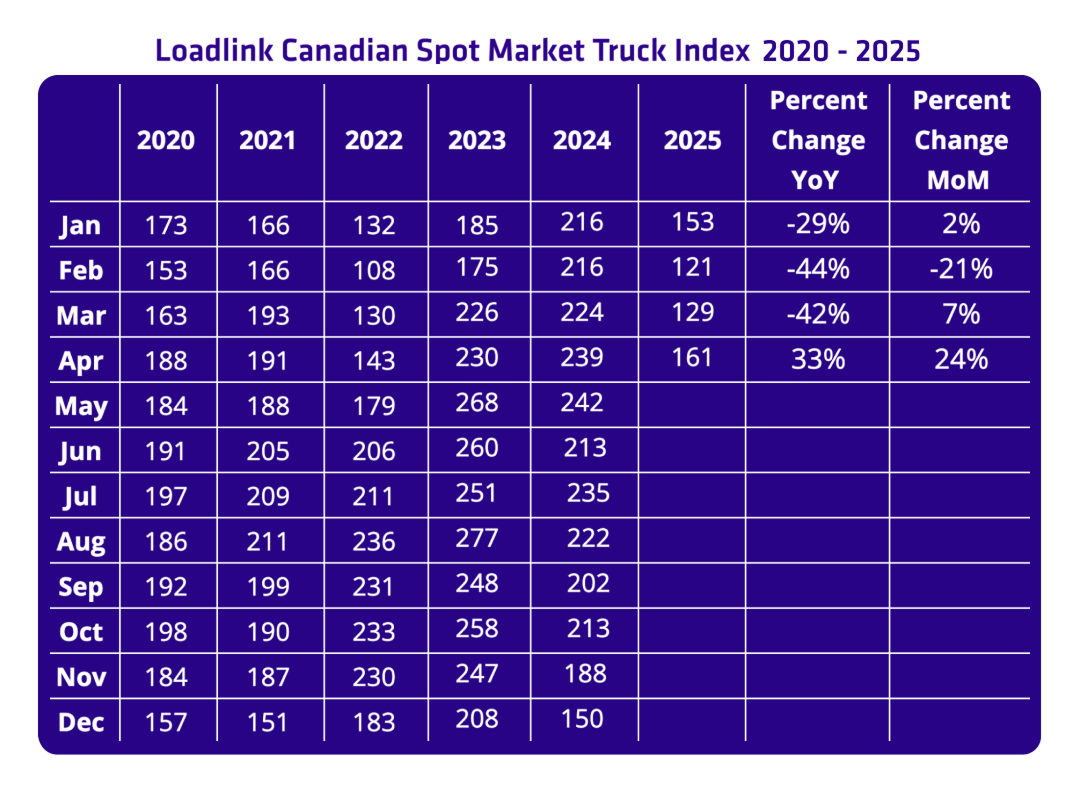

Following a strong first quarter, April brought a noticeable shift in freight volumes across North America. Loadlink’s latest data shows a 42 percent drop in postings compared to March, which was a busier month driven by accelerated freight volumes ahead of incoming tariffs. Year-over-year, April was only down 15 percent from 2024, which highlights that April’s slower volumes may be overly exaggerated due to retailers stocking inventory, which resulted in a strong March performance.

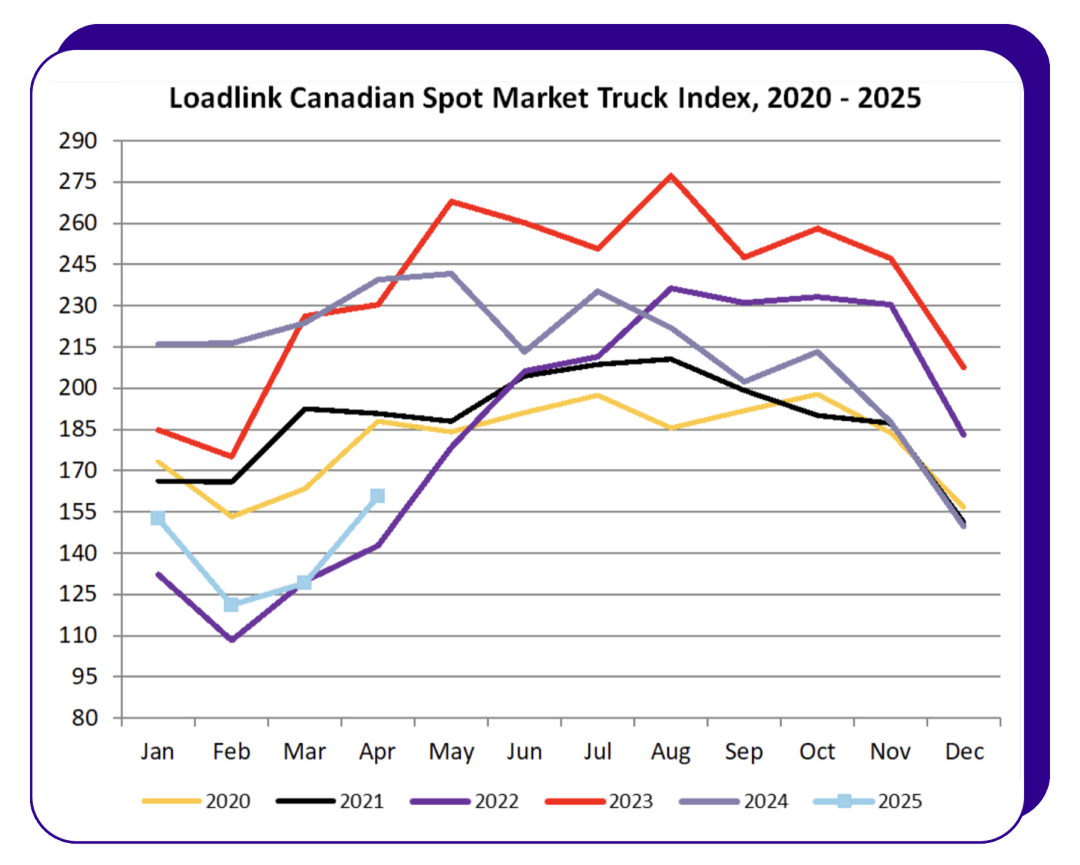

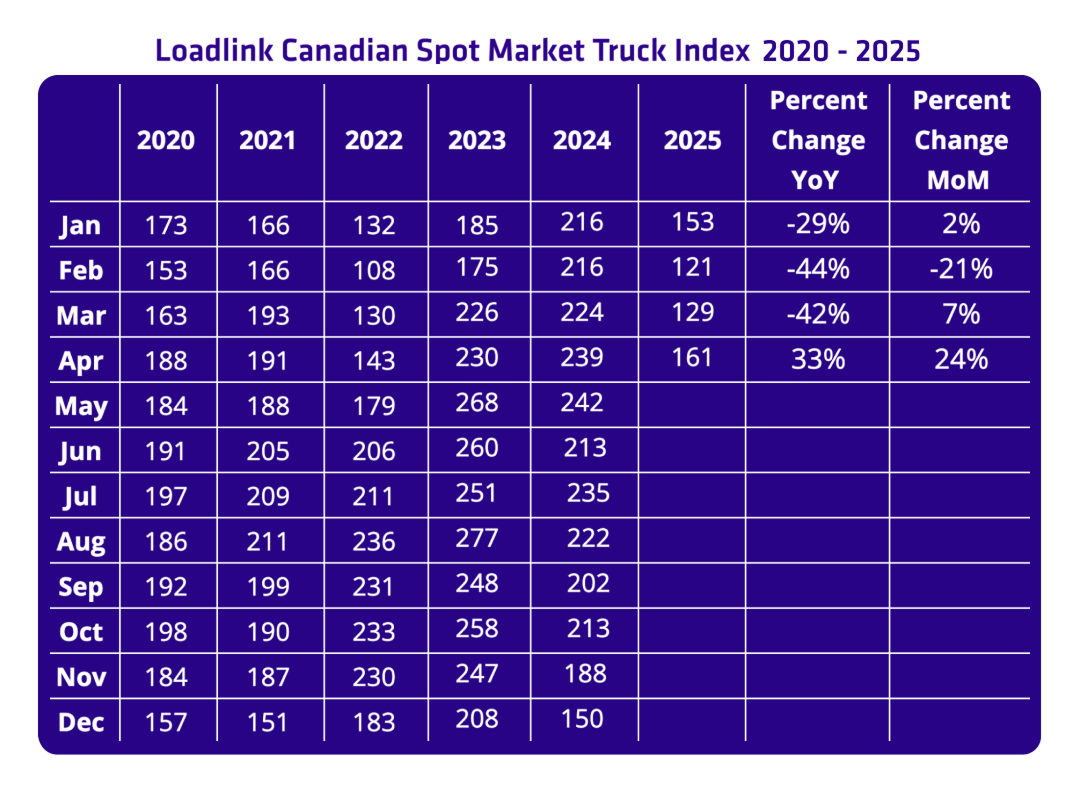

With tariff implementations severely impacting cross-border trade, it is challenging to predict how volumes may trend throughout the spring and summer seasons. In April, Loadlink’s spot market witnessed a substantial decline in outbound freight from Canada entering the U.S. Inbound volumes were also down but not to the extent of outbound. Intra-Canadian volumes saw smaller declines that were not as significant and were mostly due to seasonality. Equipment availability saw decent gains into April, but overall truck volumes into 2025 have been at the lowest seen since 2018, providing a healthier balanced truck-to-load ratio despite decreased load volumes last month.

Intra-Canadian domestic freight looks to be an area for carriers to take advantage of, as April saw a noticeable shift in freight breakup, with 38 percent of total loads being within Canada. The balance of available capacity to posted loads returned to healthier levels and may continue through the second quarter of 2025.

Cross-Border Highlights

Cross-border freight made up 61 percent of total postings from Loadlink’s Canadian customers, down from a share of 68 percent last month. Although volumes declined in April, cross-border movements continue to make up the largest share of activity and remain a key part of Loadlink’s spot freight market.

Outbound loads from Canada to the U.S. were down 64 percent from March and 21 percent compared to April 2024.

Inbound loads entering Canada from the U.S. declined 38 percent month-over-month and 19 percent year-over-year.

Despite the lower volumes, equipment availability increased, indicating that carriers currently have more available capacity and are ready to move when demand picks back up:

Outbound equipment rose 39 percent from March but was down 34 percent from last year.

Inbound equipment grew 17 percent from last month but was 32 percent lower than last year.

Intra-Canada Freight

Domestic freight activity made up 38 percent of all postings, up from the usual range of around 30 to 32 percent. Loads within Canada dipped 30 percent from March but saw a small year-over-year decline of just 6 percent, indicating similar domestic activity compared to last year despite the ongoing disruptions in the freight industry due to tariffs. Equipment availability for intra-Canada freight rose 22 percent from March but fell 32 percent from April of last year.

Equipment Trends

Dry vans continued to lead the way, making up 55 percent of equipment postings. Reefers followed at 23 percent, flatbeds at 18 percent, and other types at 4 percent.

Truck-to-Load Ratio

In April, there were 2.85 trucks available for every load posted on Loadlink—more than double March’s ratio of 1.32. While this reflects a slower freight market, brokers have greater access to available trucks, giving them more options when moving freight. As demand picks up again, carriers who stay informed and prepared will be well-positioned to handle the next surge in load volumes. Compared to April 2024, this year’s ratio improved by 21 percent.

About Loadlink Technologies

Loadlink Technologies is Canada’s leading freight matching platform. By connecting brokers and carriers, Loadlink helps businesses move freight efficiently and cost-effectively. Through innovative solutions, Loadlink supports the logistics sector by simplifying workflows and enhancing the capacity for freight movement across North America through our software.