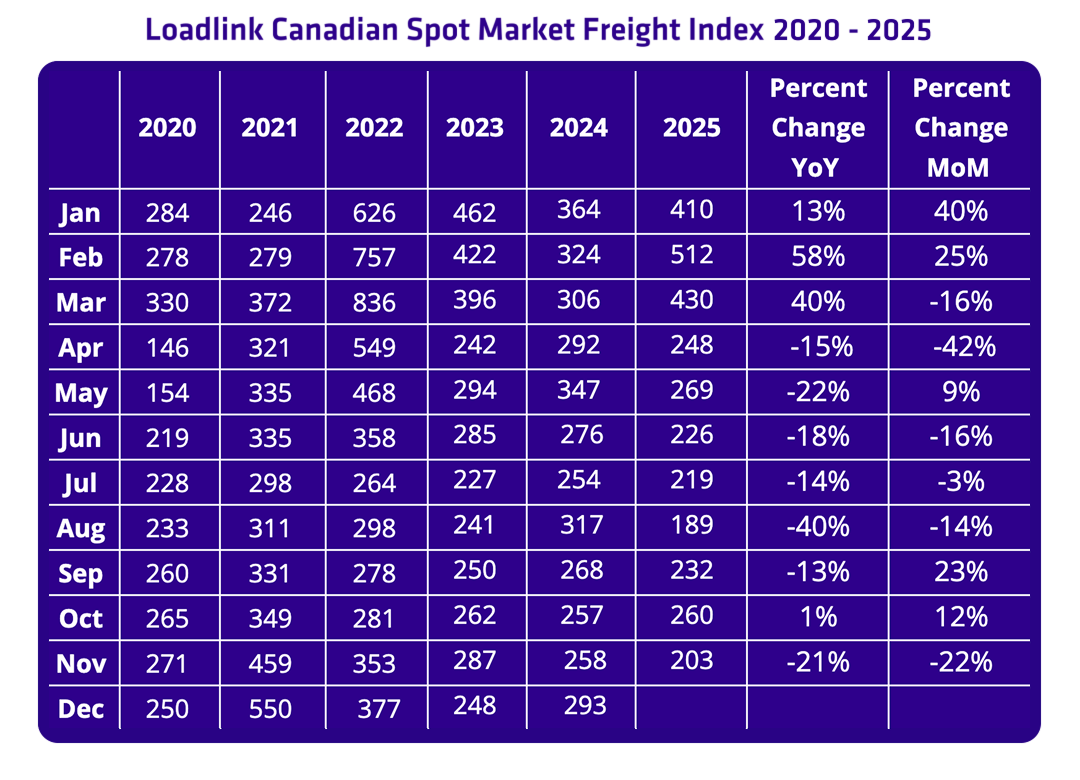

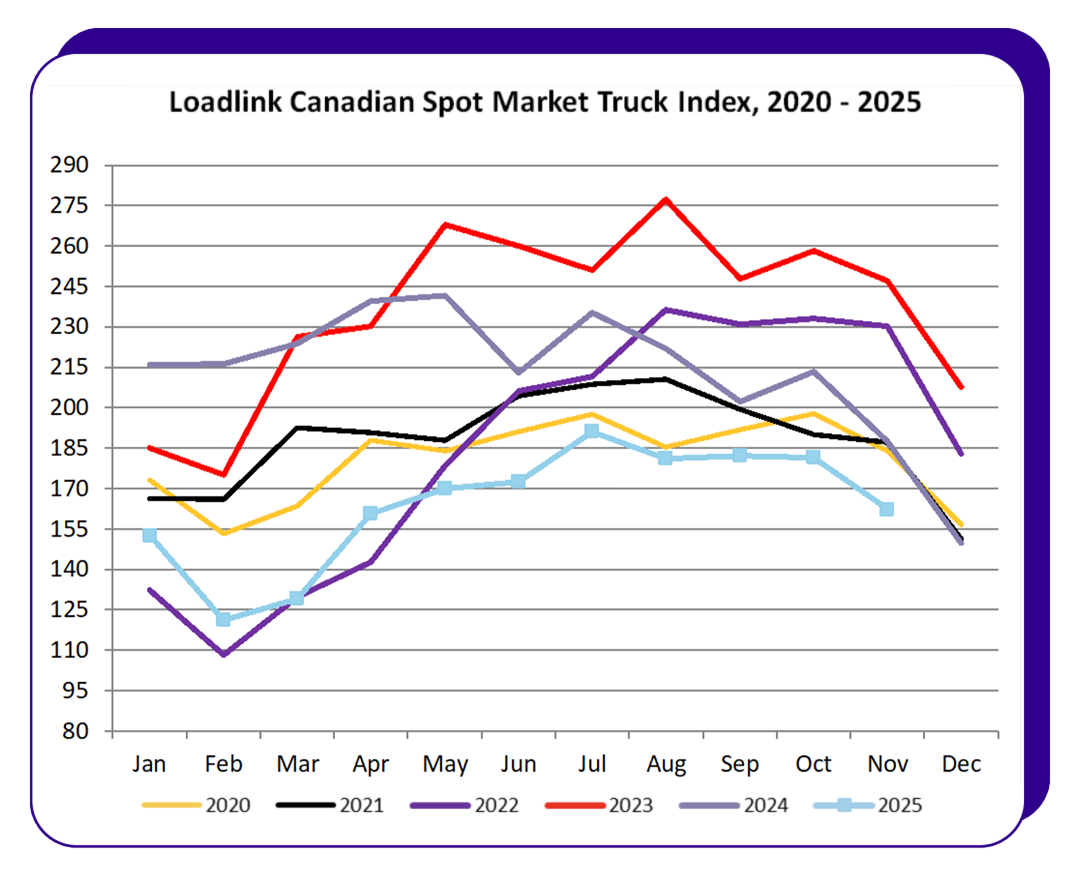

Following the solid momentum seen earlier in the fall, November brought a moderated pace to the Canadian spot market — a shift that opened a wider planning window for both brokers and carriers. Overall load postings on Loadlink declined by 22% from October and decreased by 20% year-over-year, bringing activity to a steadier, more sustainable level.

This calmer conditions created a more balanced environment and a higher truck-to-load ratio, giving teams greater flexibility to refine routing strategies, strengthen customer relationships, and prepare for the upcoming 2026 cycle. Both cross-border and domestic markets experienced softer volumes, yet this also meant increased capacity and more competitive options across major lanes.

Cross-Border Highlights

Cross-border freight remained the largest contributor to activity, making up 60% of all postings from Loadlink customers. While volumes softened, the additional truck availability allowed brokers to secure consistent coverage, and carriers continued to rely on proven U.S.–Canada corridors to maintain efficiency.

Outbound Loads (Canada → U.S.)

Month-over-month: Loads down 25%; equipment postings down 14%.

Year-over-year: Loads down 20%; equipment postings 22% lower vs. November 2024.

Inbound Loads (U.S. → Canada)

Month-over-month: Loads down 27%; equipment postings down 11%.

Year-over-year: Loads down 31%; equipment postings 20% lower vs. last year.

Despite quieter boards, expanded truck availability on cross-border routes gave brokers more choice, particularly on priority lanes. Carriers, meanwhile, used this period to focus on high-value customers and dependable turns that reinforce long-term network strength.

Intra-Canada Freight

Domestic freight accounted for 39% of total postings in November. While the market softened, truck postings held relatively steady, ensuring a positive environment for brokers while letting carriers stay aligned with their preferred regional patterns.

Month-over-month:

Loads within Canada down 14%.

Domestic equipment postings down 8%.

Year-over-year:

Volumes down 15% vs. November 2024.

Equipment postings down just 2% year-over-year.

With capacity remaining accessible, November offered a room for scheduling optimization, helping teams rebalance short-haul and regional freight heading into December.

Equipment Trends

Equipment posting shares remained consistent and predictable — a stability that supports operational planning even amid shifting volumes:

Dry Vans: 53%

Reefers: 24%

Flatbeds: 19%

Other: 4%

Dry vans and reefers continued to dominate both cross-border and domestic markets, underscoring steady demand for general and temperature-controlled freight.

Truck-to-Load Ratio

November’s average truck-to-load ratio rose to 3.51 trucks per posted load up 14% from October’s 3.06. Up 10% year-over-year compared to November 2024.

November as a Strategic Reset

November’s softer conditions arrived at an ideal time, giving teams across the industry a welcome moment to regroup after a busy fall. With more capacity available and volumes pacing at a manageable level, carriers and brokers were able to reassess lane profitability fine-tune routing strategies strengthen core customer relationships prepare proactively for early-2026 demand shifts.

“November brought a quieter period in the spot market, giving both carriers and brokers an opportunity to reassess and realign,” said James Reyes, General Manager at Loadlink Technologies. “With more trucks competing for each load, timely data becomes critical to staying focused on the right lanes and strengthening key relationships.”

As the market transitions toward 2026, Loadlink will continue delivering real-time visibility and insights to help members navigate these shifts with confidence — supporting smarter decisions in calmer periods and readiness for the next upswing in freight activity.

About Loadlink Technologies

Loadlink Technologies is Canada’s leading freight matching platform. By connecting brokers and carriers, Loadlink helps businesses move freight efficiently and cost-effectively. Through innovative solutions, Loadlink supports the logistics sector by simplifying workflows and enhancing the capacity for freight movement across North America through our software.