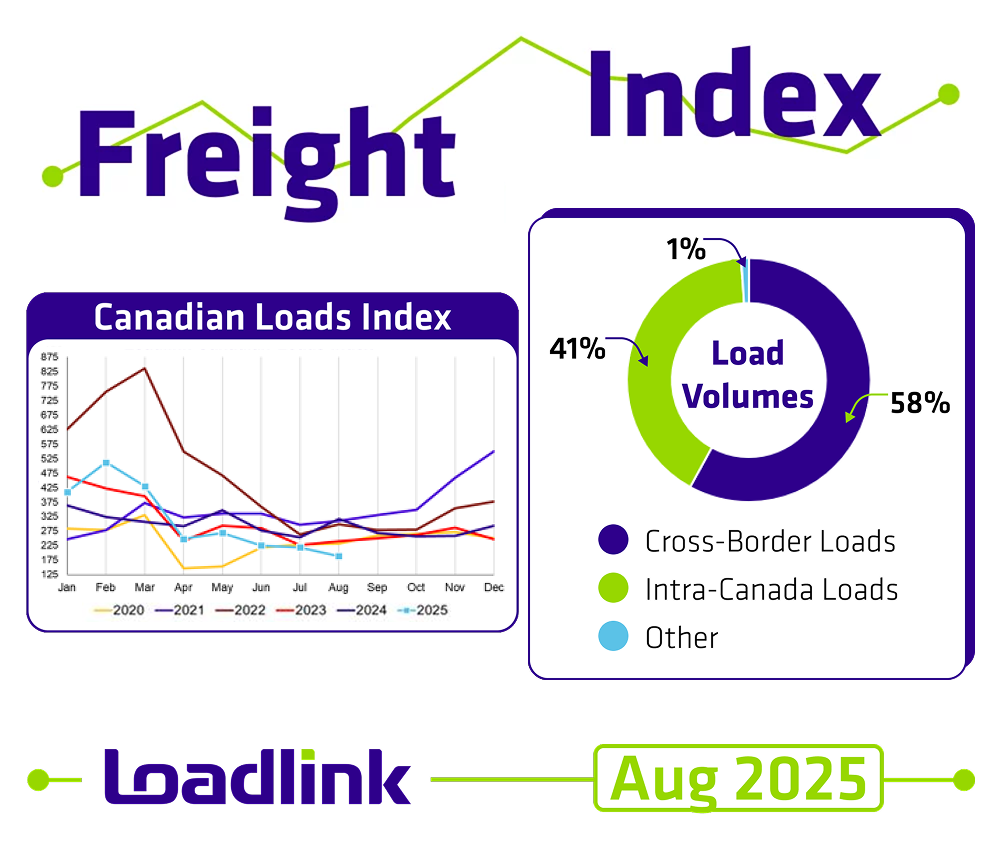

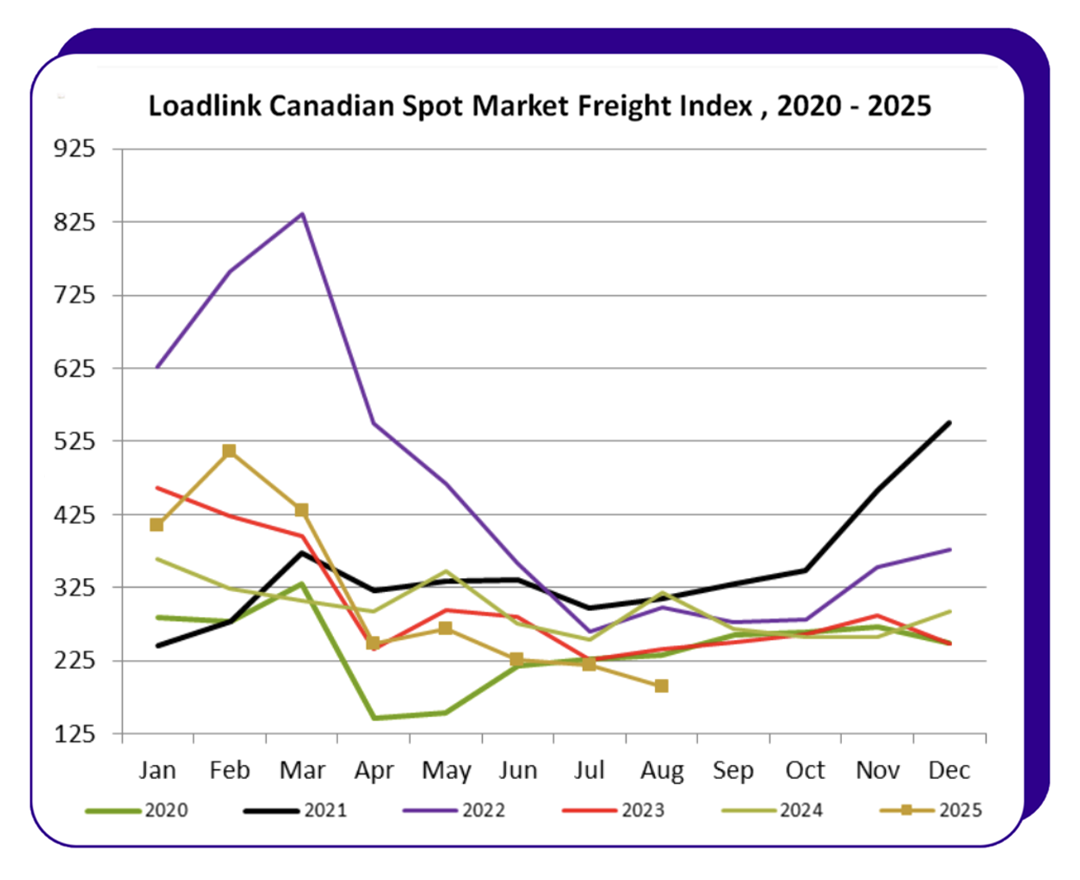

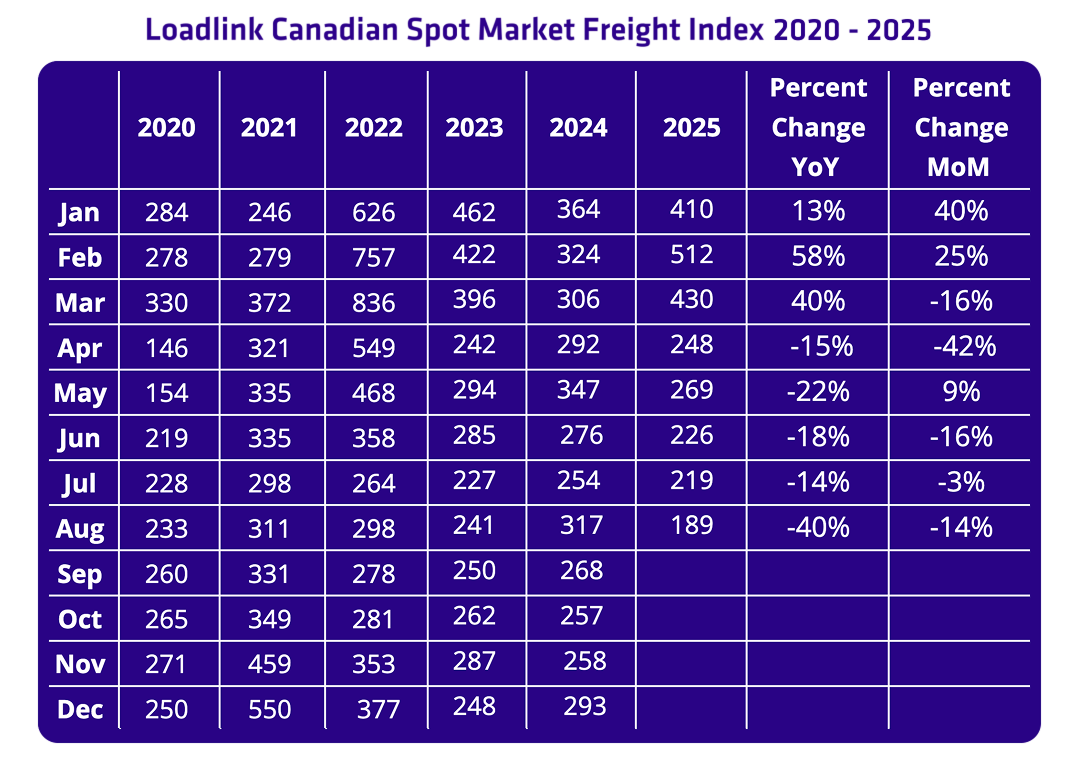

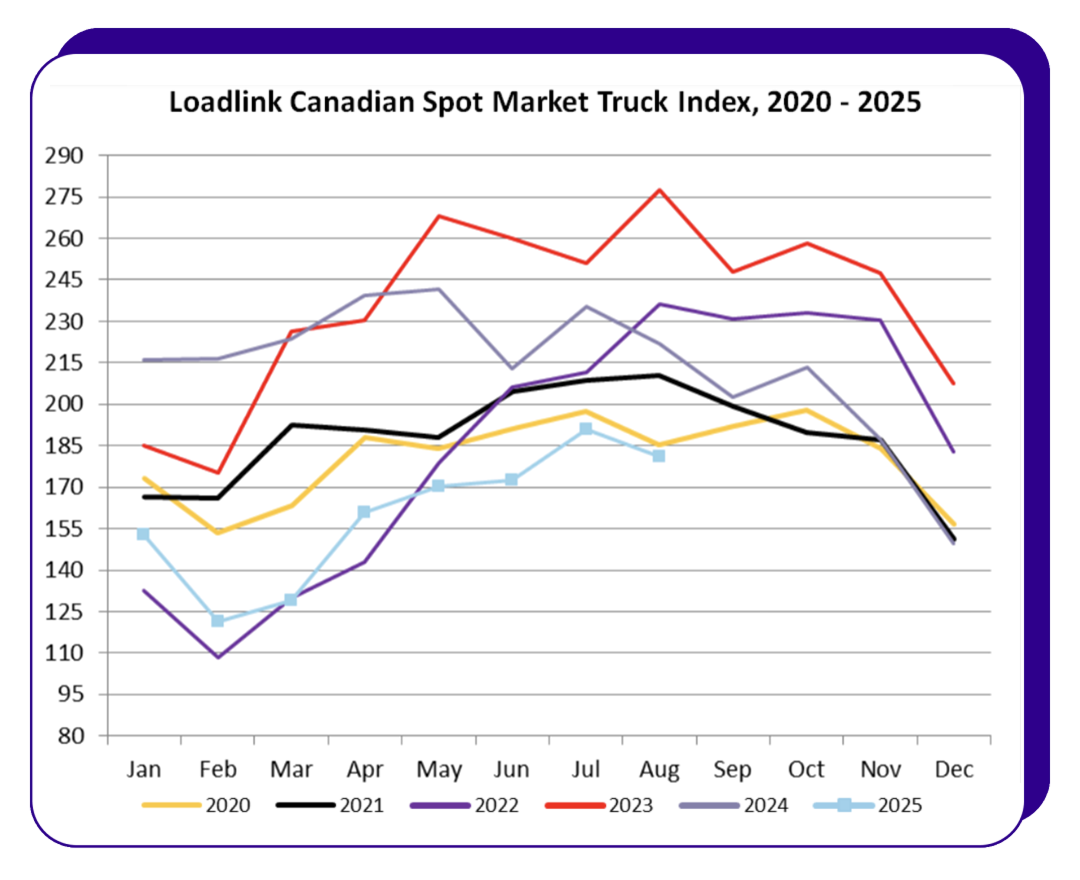

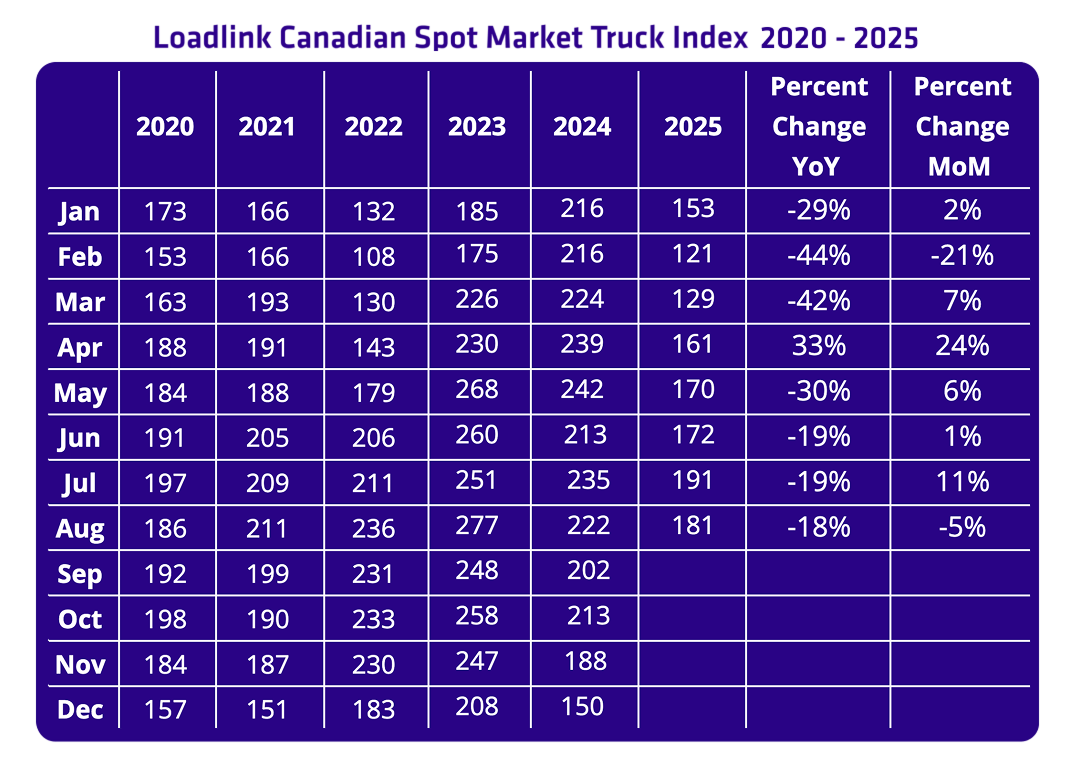

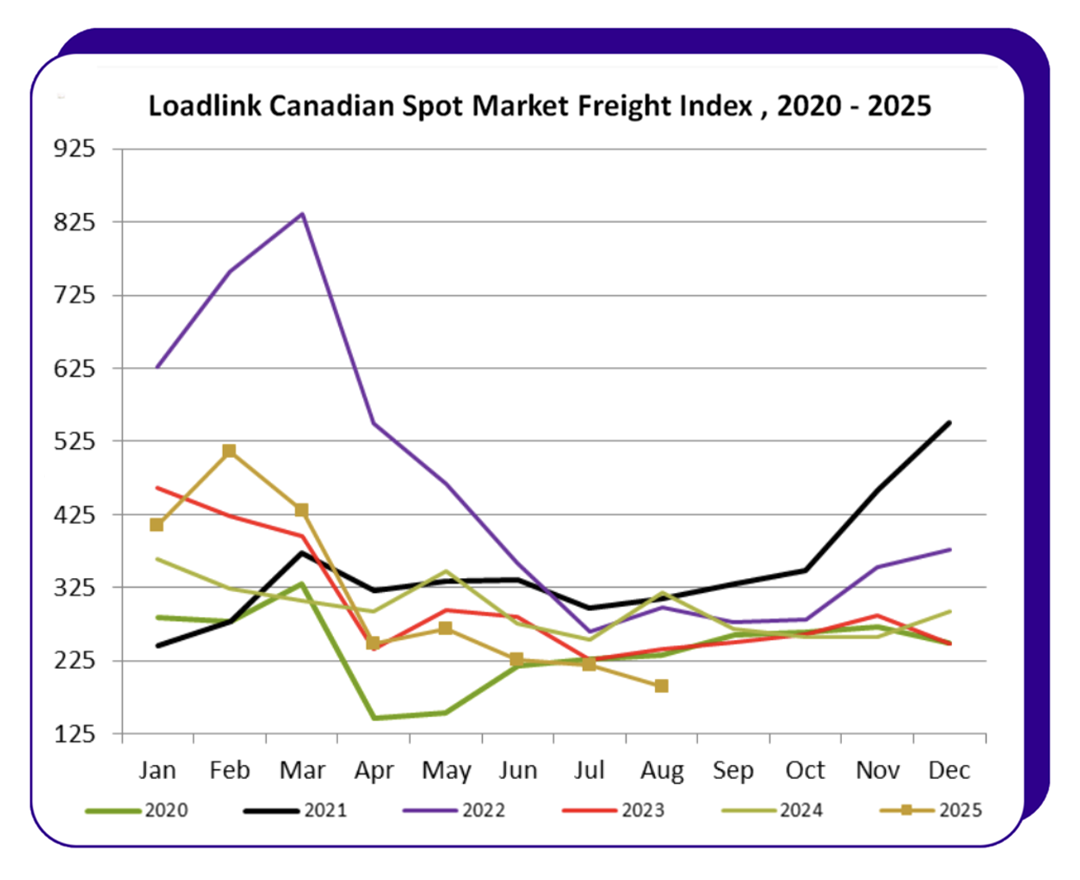

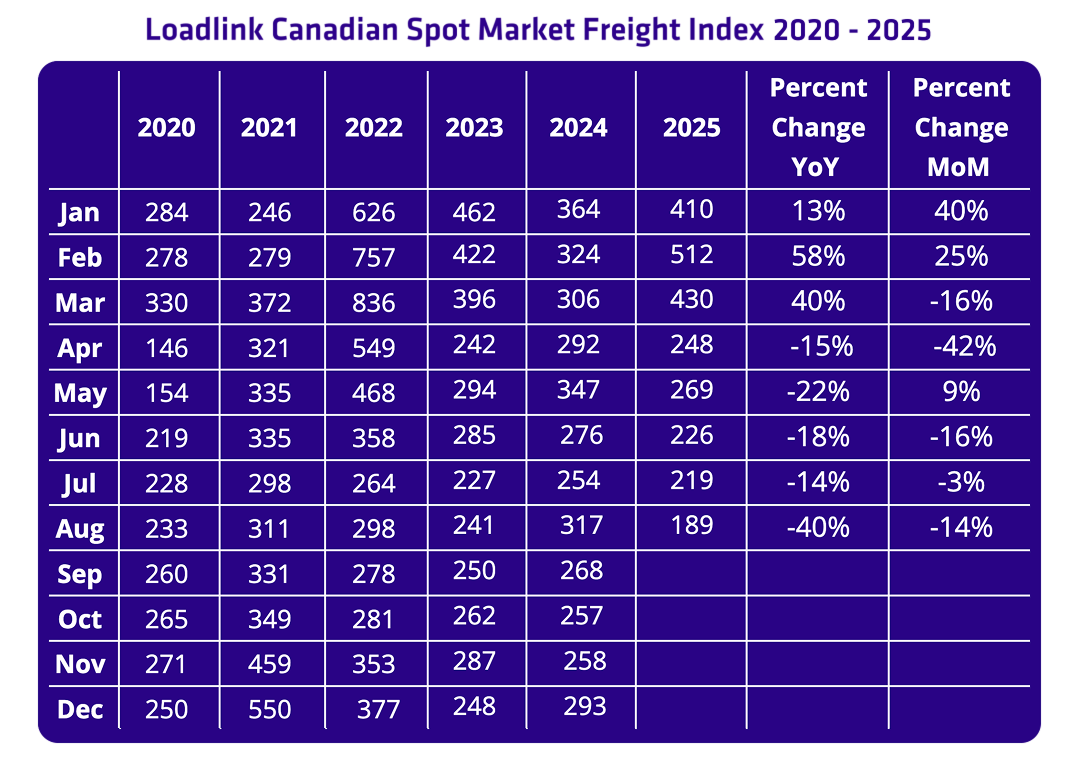

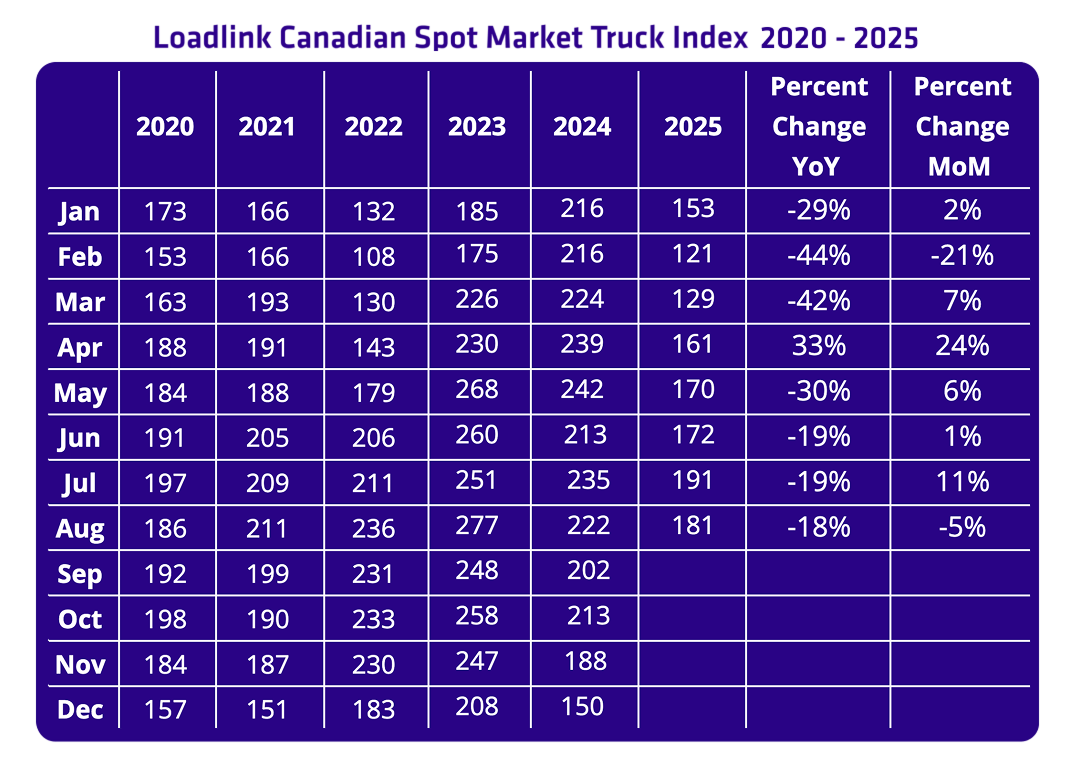

Freight activity eased in August, marking the quietest month of 2025 so far. Loadlink’s data shows overall postings declined 14% compared to July and were 40% lower than August 2024. Both domestic and cross-border markets saw softer volumes, and with fewer postings available, the truck-to-load ratio rose to its highest point this year.

Even with the slowdown, certain lanes continue to offer opportunities for carriers and brokers to secure freight in a steadier market.

Cross-Border Highlights

Cross-border freight continued to represent the majority share, making up 58% of postings from Canadian-based customers.

· Outbound loads to the U.S. eased 8% compared to July and were down 39% year-over-year. Equipment postings for outbound hauls declined 10% month-over-month and 25% annually, indicating that truck postings adjusted alongside reduced volumes.

· Inbound loads from the U.S. fell 20% from July and were 45% lower compared to last year. Equipment availability eased 2% month-over-month, though it remained 18% lower year-over-year. The mix of lighter inbound freight and tighter outbound equipment availability may present selective opportunities for carriers on southbound lanes, where demand for trucks is less intense.

Intra-Canada Freight

Domestic activity made up 42% of total postings in August.

Load postings within Canada declined 13% from July and were 38% lower year-over-year. Equipment postings dipped 5% from last month and 14% compared to August 2024. While overall volumes cooled, the smaller pullback in equipment postings suggests shorter-haul or regional freight may offer more consistency for carriers operating within Canada.

Equipment Trends

The mix of equipment postings stayed consistent with recent months:

· Dry Vans: 55%

· Reefers: 24%

· Flatbeds: 17%

· Other: 4%

Dry vans and reefers remained the most common trailer types, reflecting steady demand even as overall volumes softened.

Truck-to-Load Ratio

The truck-to-load ratio rose to 4.20 in August, up from 3.83 in July, a 10% increase. Year-over-year, the ratio was 37% higher, pointing to more trucks available for each posting.

For brokers, this creates wider coverage options, while carriers face a more competitive environment when securing consistent freight.

Resetting Expectations and Positioning for Success

August reflected a quieter period for freight activity, with year-over-year declines across both cross-border and domestic markets. The higher truck-to-load ratio indicates that more equipment is available, providing brokers with stronger access to capacity while requiring carriers to be more selective in choosing their lanes.

“August was a softer month, and we understand the adjustments carriers and brokers are making. Our goal is to provide insights that help our members navigate these shifts, so they’re prepared and ready to act when opportunities arise.” said James Reyes, General Manager at Loadlink Technologies.

As 2025 approaches its final quarter, Loadlink will continue to deliver the visibility and insights carriers and brokers need to track market changes, plan with confidence, and stay competitive in a shifting environment.

About Loadlink Technologies

Loadlink Technologies is Canada’s leading freight matching platform. By connecting brokers and carriers, Loadlink helps businesses move freight efficiently and cost-effectively. Through innovative solutions, Loadlink supports the logistics sector by simplifying workflows and enhancing the capacity for freight movement across North America through our software.