Loadlink, the leading platform for freight matching in Canada, has released its October 2024 Canadian Freight Index, offering insights into the nation’s freight market.

Key Findings:

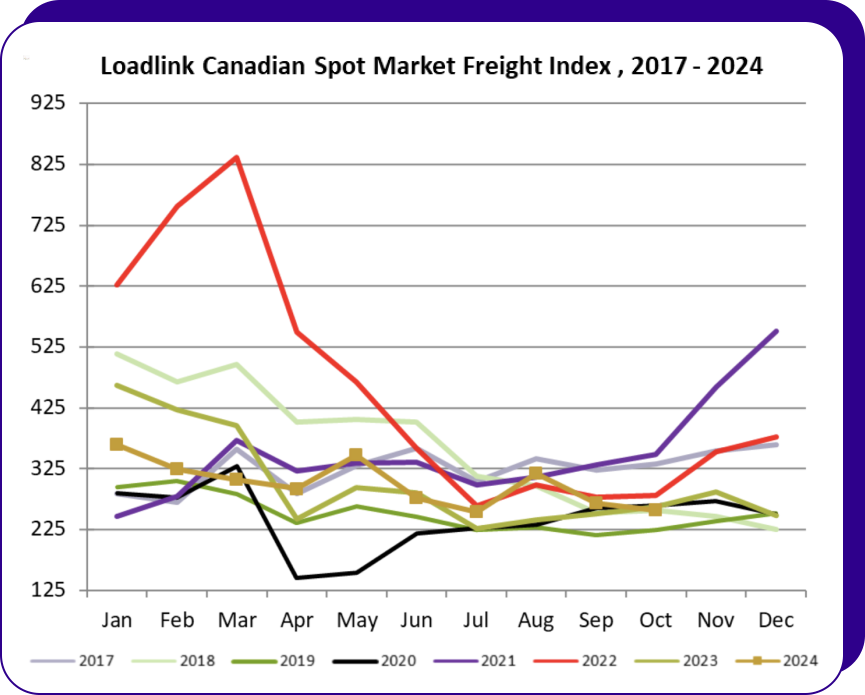

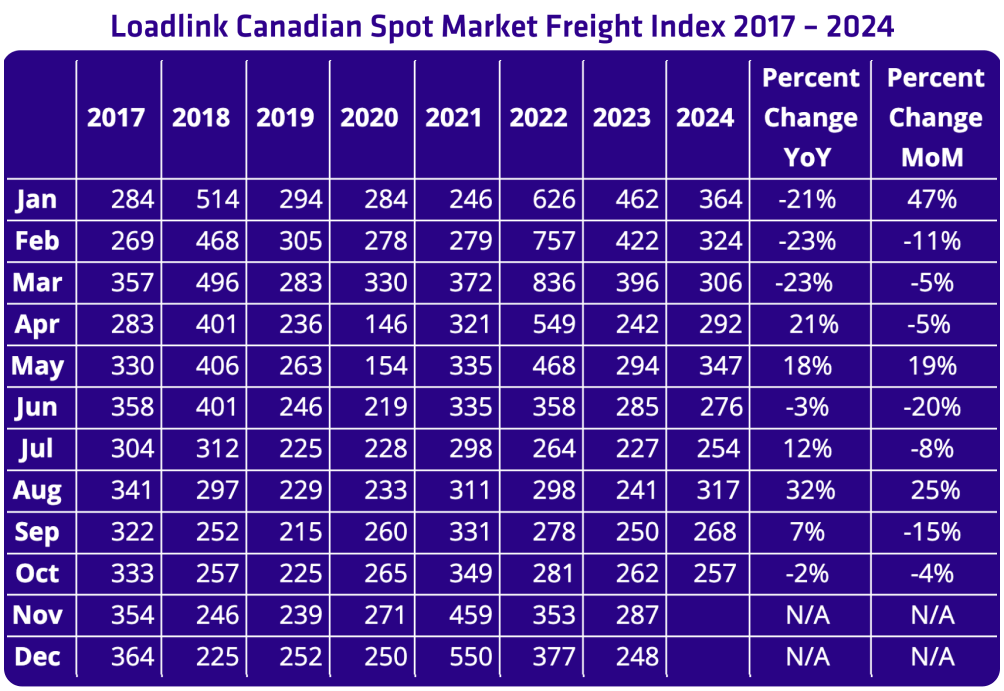

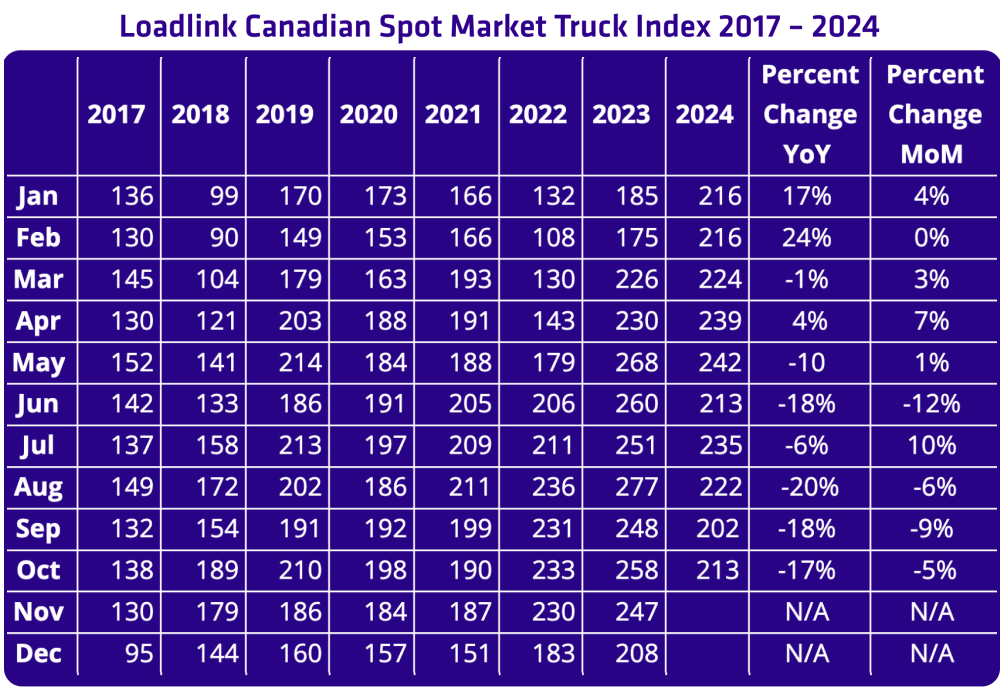

- Steady Year-Over-Year Performance: Despite the month-to-month decrease, year-over-year load volumes remained relatively stable, declining by only 2%. To date, average monthly load postings are nearly identical to 2023 levels.

- Total Cross-Border: Cross-border load postings accounted for 63 percent of all postings. Inbound cross-border loads from the U.S. increased by 3% year-over-year, while outbound loads to the U.S. decreased by 8%.

- Inbound Cross-Border: Loads entering Ontario drove most gains with a 12% increase in postings from last month. Quebec had the second-biggest increase with 7% more loads. Alberta and British Columbia both saw 11% less loads each, while Manitoba was down 27%.

- Outbound Cross-Border: Loads out of New Brunswick more than doubled from September (+149%) and Alberta outbound loads increased 39%. Ontario saw 19% less outbound freight, while Quebec decreased 21%.

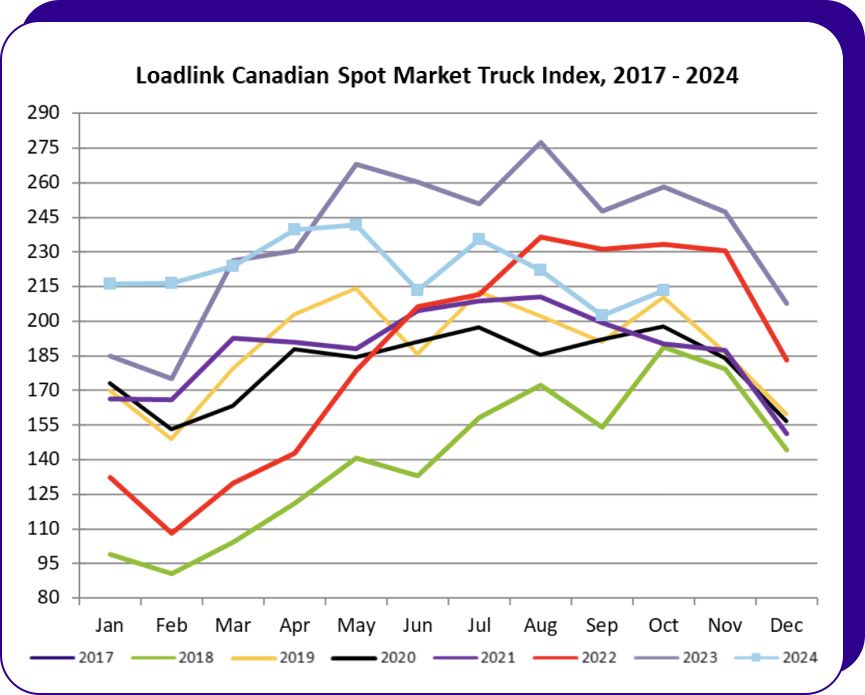

- Equipment Availability: Equipment postings improved by 5% from last month, but was down 17% from October 2023.

- Domestic Market: Intra-Canada loads comprised 36% of all postings and was down 5% month-over-month.

- Outbound Domestic: No provinces saw an increase in outbound loads.

- Inbound Domestic: Despite the minor overall decline in intra-Canadian freight, Alberta saw a notable 25% increase in loads. This was offset by 11% and 17% less loads entering Ontario and Quebec, respectively.

- Truck-to-load Ratio: The truck-to-load ratio continues to favour brokers, with a 10% jump to 3.64 trucks for every one load posted on Loadlink from September’s value of 3.31. However, year-over-year, the truck-to-load ratio decreased by 16% from a ratio of 4.33 in October 2023.

Market Outlook:

Historically, November has usually seen larger freight activity than October, much of it due to American Thanksgiving period impacting cross-border activity and the inbound holiday season in December. In the last decade, only 2014, 2015, and 2018 saw minor declines in month-over-month load volumes, while the remaining years averaged 14% more loads in November.

With the current ongoing Canada Post strike and container congestion from recent port strikes, there may be some short-term fluctuations in freight activity. If current load volumes trend remains consistent, 2024’s freight performance should end the year similarly to 2023 levels as load volumes.

Loadlink Technologies, with over 30 years of experience, continues to play a pivotal role in Canada’s freight movement by efficiently matching trucks with loads. Their reliable technology, data, and analytics ecosystem contribute to the industry’s largest and most efficient digital freight network.