TORONTO – TransCore Link Logistics’ Canadian spot market saw a dramatic shift from the norm in March, setting multiple new precedents during the month. For the first time in Loadlink history, load volumes in March were below that of the February preceding it.

Truck volumes climbed upwards to cement March 2019 as the month with the second highest total truck volumes in history, behind only October 2018. The highest number of truck postings ever recorded on Loadlink for a single day occurred on March 25, 2019.

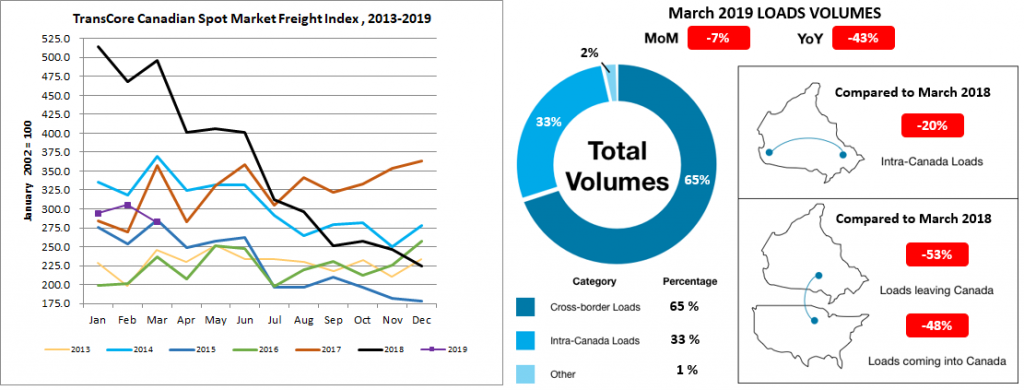

Month-over-month, March’s load volumes finished seven percent lower than February, while these numbers were down 43 percent year-over-year.

First Quarter Load and Truck Performance

First quarter load volumes were up 21 percent compared to the fourth quarter of 2018, but were down 40 percent from the historic numbers noted in the first quarter of 2018. The improvement on fourth quarter volumes is in line with historical trends where the new year usually surpasses the previous end-of-year in freight activity.

First quarter equipment postings were the strongest first quarter postings in Loadlink’s history. Overall, the first quarter of 2019 falls behind the fourth quarter of 2018, which saw very strong volumes in the month of October. This contributed to capacity peaking to an all-time high in the fourth quarter. Equipment volumes for first quarter 2019 were up a significant 70 percent year-over-year. In the first quarter of 2018, truck availability was very limited.

Intra-Canada loads accounted for 33 percent of the total volumes. Load postings within Canada decreased three percent compared to February and were down 20 percent year-over-year.

- Loads within Canada entering Ontario and Quebec decreased 11 and seven percent, respectively.

- Loads within Canada entering Atlantic Canada increased 44 percent, while loads entering Western Canada were relatively flat, increasing by one percent.

- Loads leaving Ontario and Quebec to the rest of Canada decreased six and 11 percent, respectively.

- Loads leaving Atlantic Canada to the rest of Canada increased 30 percent, while loads leaving Western Canada saw a small uptick of two percent.

Cross-border load postings represented 65 percent of the data submitted by Loadlink users.

An overall decline of 10 percent in cross-border load postings was observed in March, mainly due to a decrease in loads entering Ontario and Quebec, similar to declines noted in February.

- Loads leaving Canada to the United States decreased 14 percent; however, loads entering Canada from the U.S. slipped eight percent.

- Loads from the U.S. entering Ontario decreased 17 percent, while loads entering Quebec decreased seven percent.

- Loads from the U.S. entering Western Canada increased 16 percent, while loads entering Atlantic Canada increased 18 percent.

Overall, the decline in load volumes can be attributed to reduced freight activity originating from or destined for Ontario and Quebec.

Equipment Performance

March equipment numbers increased 21 percent while the daily average number of truck postings increased by nine percent. Compared to March 2018, capacity was up 72 percent year-over-year. Capacity for the month was the highest for any March ever recorded in Loadlink’s database.

Truck-to-Load Ratio

The truck-to-load ratio in March was 2.79. This 30 percent increase over February was driven by surging truck volumes, compounded by a surprising dip in load volumes during a period when load volumes typically exceed the preceding two months. Year-over-year, the average ratio increased 203 percent from 0.92 in March 2018.

About TransCore Indexes

Truckload spot rates in specific areas can be accessed from TransCore’s Rate Index truckload rating tool, and real-time and historical data on total truck and load volumes, as well as ratios in specific areas can be accessed from TransCore’s Posting Index.

TransCore’s Canadian Freight Index accurately measures trends in the truckload freight spot market. The components of the Freight Index are comprised from roughly 6,400 of Canada’s trucking companies and freight brokers; this data includes all domestic, cross-border and interstate data submitted by Loadlink customers.

About TransCore Link Logistics

Looking for a better way to match available freight loads with trucks, TransCore Link Logistics in 1990 developed Loadlink, a load board connecting brokers, carriers, owner operators and private fleets in Canada to a real-time database of 18 million loads, shipments and trucks – the largest in the industry. The monthly Canadian Freight Index now defines the freight movement spot market. The company also provides its customers with dispatch solutions, ACE/ACI eManifest, Posting Index, Rate Index, credit solutions, factoring, an online transportation job board, mileage software and more.

More information on TransCore Link Logistics can be found at www.transcore.ca, @loadlink on Twitter, on YouTube, on Facebook and on LinkedIn.