The first quarter of 2025 showcased exceptionally favourable conditions for carriers, marked by significant year-over-year growth in load volumes and tightening truck availability. The quarter was characterized by robust cross-border activity, steady domestic freight, and some of the tightest capacity metrics since the peak pandemic shipping levels of early 2022.

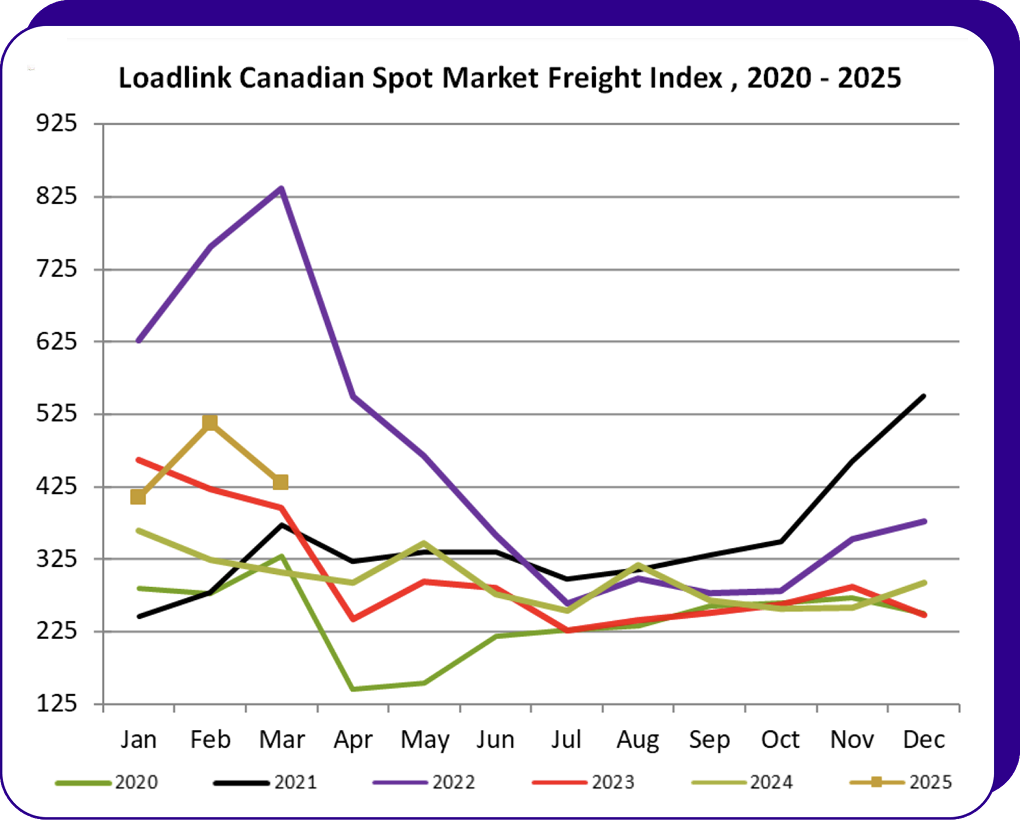

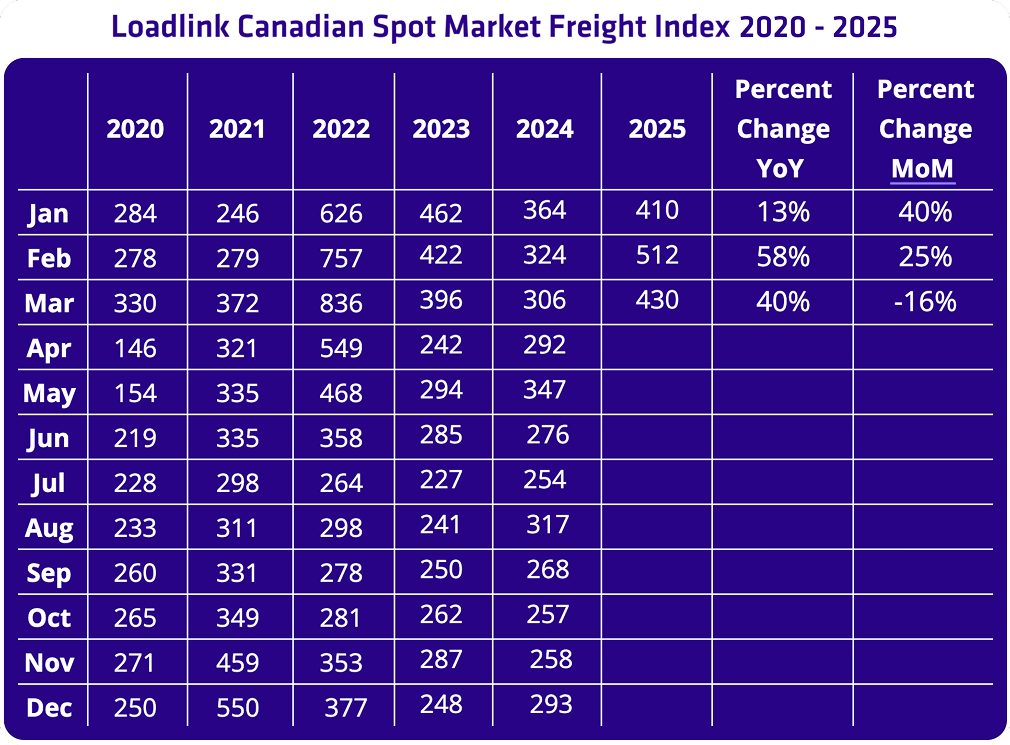

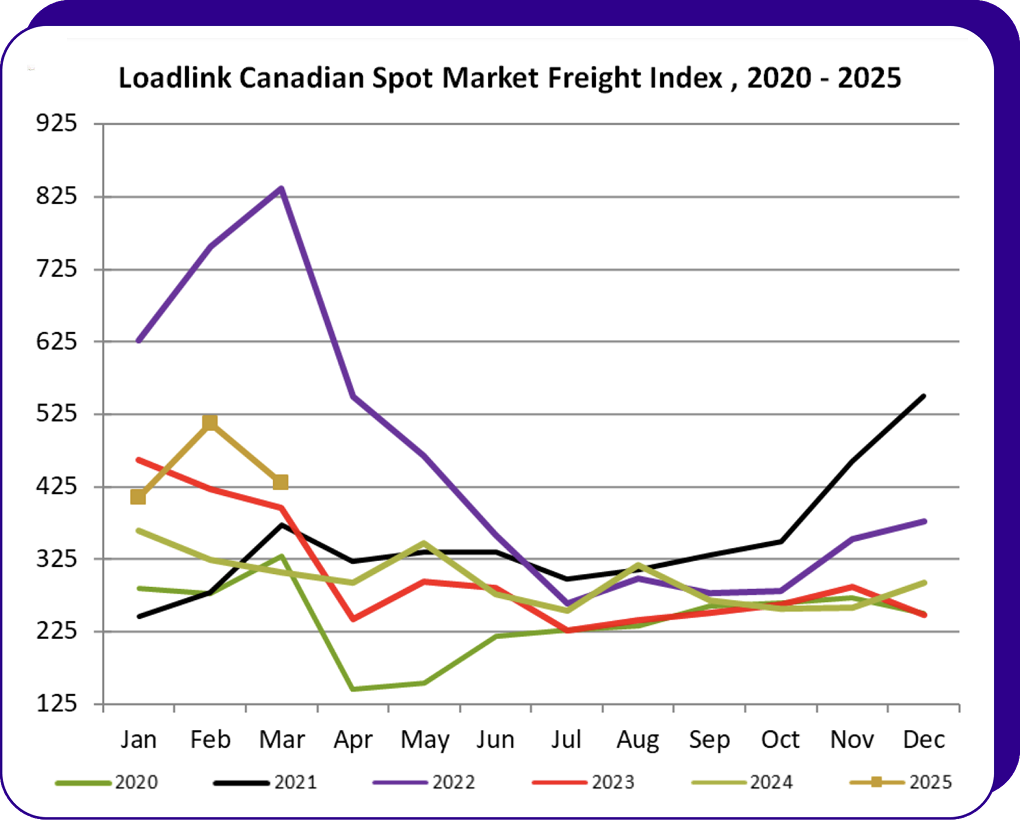

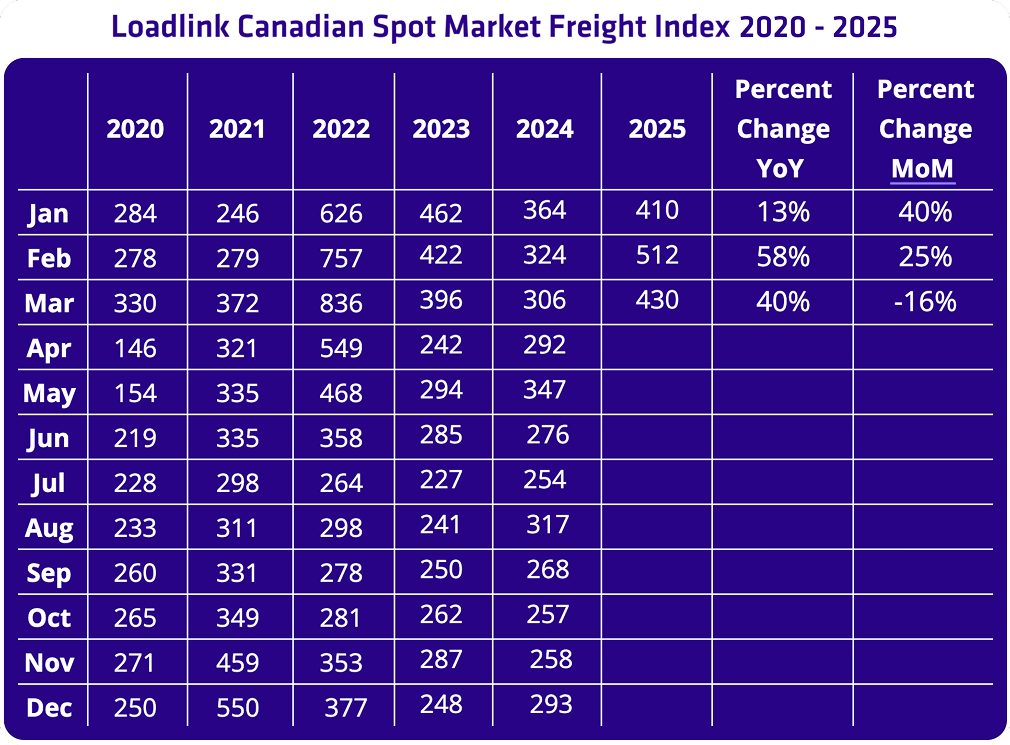

January freight volumes started to climb in anticipation of the pending tariffs. This dynamic environment set an optimistic tone for the freight landscape as 2025 began.

February 2025 continued the momentum established in January, showcasing robust growth. Freight volumes surged significantly, with a remarkable 25 percent month-over-month increase compared to January, with both U.S. and Canadian businesses stockpiling goods.

March freight volumes remained high throughout the month, but showed some softening compared to February’s pre-shipping surge. Load volumes were significantly higher than 2024, but both inbound and outbound load volumes declined following the implementation of the first round of tariffs on March 4. However, the quarter ended with 34 percent more loads in the last week of March compared to the previous week. This was likely in preparation for the upcoming April tariffs. Loadlink’s strong freight activity in the first quarter of the year shows that its healthy balance of capacity and loads continues to provide many opportunities for carriers operating on the Canadian spot market.

Cross-Border Activity

Cross-border freight accounted for 68 percent of all postings from Loadlink’s Canadian-based customers.

Loads:

Outbound loads from Canada to the U.S. decreased by 20 percent month-over-month but had an outstanding increase of 71 percent growth year-over-year. On a quarterly basis, Q1 2025 saw outbound loads to the U.S. increase by 64 percent compared to Q1 2024.

Inbound loads from the U.S. to Canada decreased by 21 percent month-over-month, while still having a strong increase of 38 percent year-over-year. On a quarterly basis, Q1 2025 saw inbound loads entering from the U.S. increase by 33 percent compared to Q1 2024.

Equipment:

Inbound equipment postings dropped 40 percent year-over-year but rose 6 percent month-over-month. On a quarterly basis, Q1 2025 saw inbound equipment from the U.S. decrease by 43 percent compared to Q1 2024.

Outbound equipment postings fell 47 percent year-over-year, with a slight 2 percent increase month-over-month. On a quarterly basis, Q1 2025 saw outbound equipment to the U.S. decrease by 34 percent compared to Q1 2024.

Intra-Canada Activity

Unlike the cross-border market, which experienced significant fluctuations, domestic volumes have shown stable, consistent improvements in the first quarter. In March, domestic freight accounted for 31 percent of all postings from Loadlink’s Canadian-based customers.

Loads:

Intra-Canada load volumes rose 26 percent year-over-year, showing strong annual growth, but saw a 5 percent decrease month-over-month. On a quarterly basis, Q1 2025 saw intra-Canadian load postings increase by 22 percent compared to Q1 2024.

Equipment:

Equipment availability decreased by 41 percent year-over-year but increased by 11 percent month-over-month. On a quarterly basis, Q1 2025 saw intra-Canadian truck postings decrease by 39 percent compared to Q1 2024.

Equipment Trends

Dry vans accounted for 55 percent of all equipment postings, followed by reefers at 23 percent, flatbeds at 18 percent, and other equipment at 4 percent.

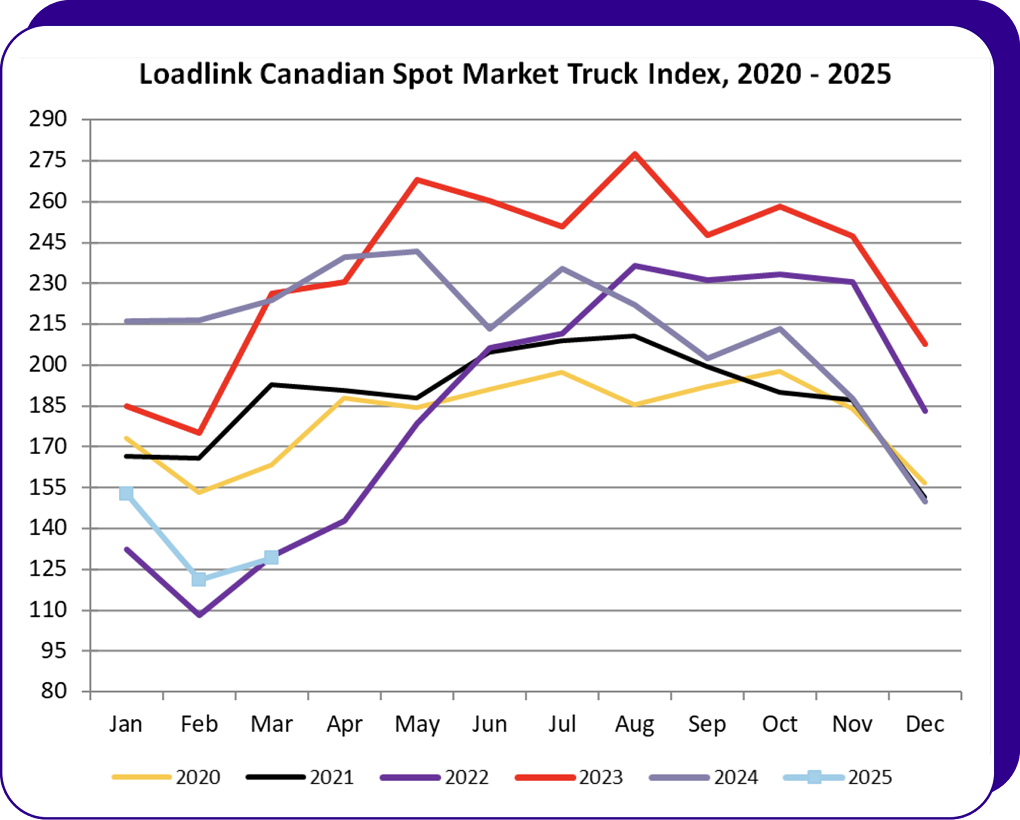

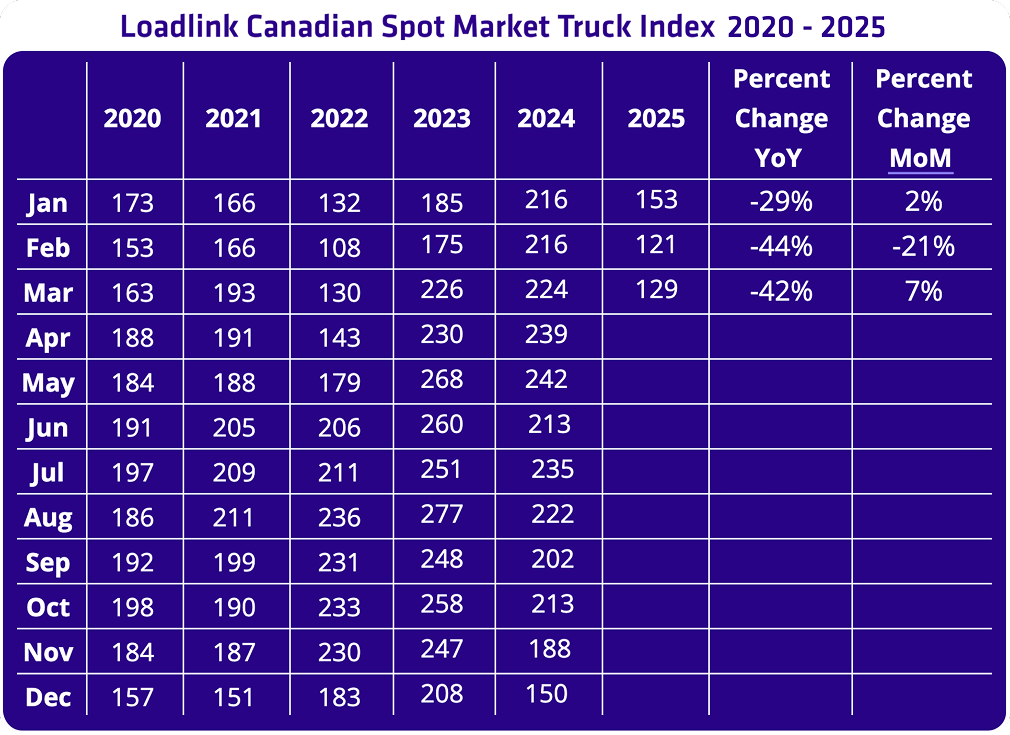

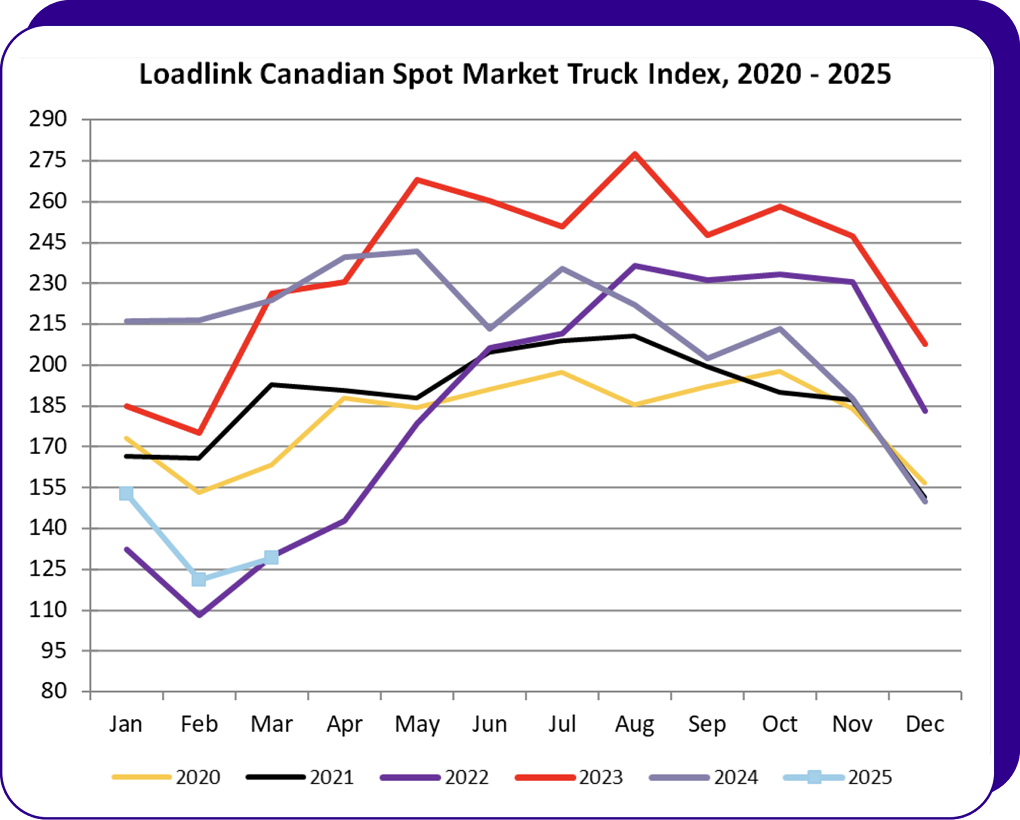

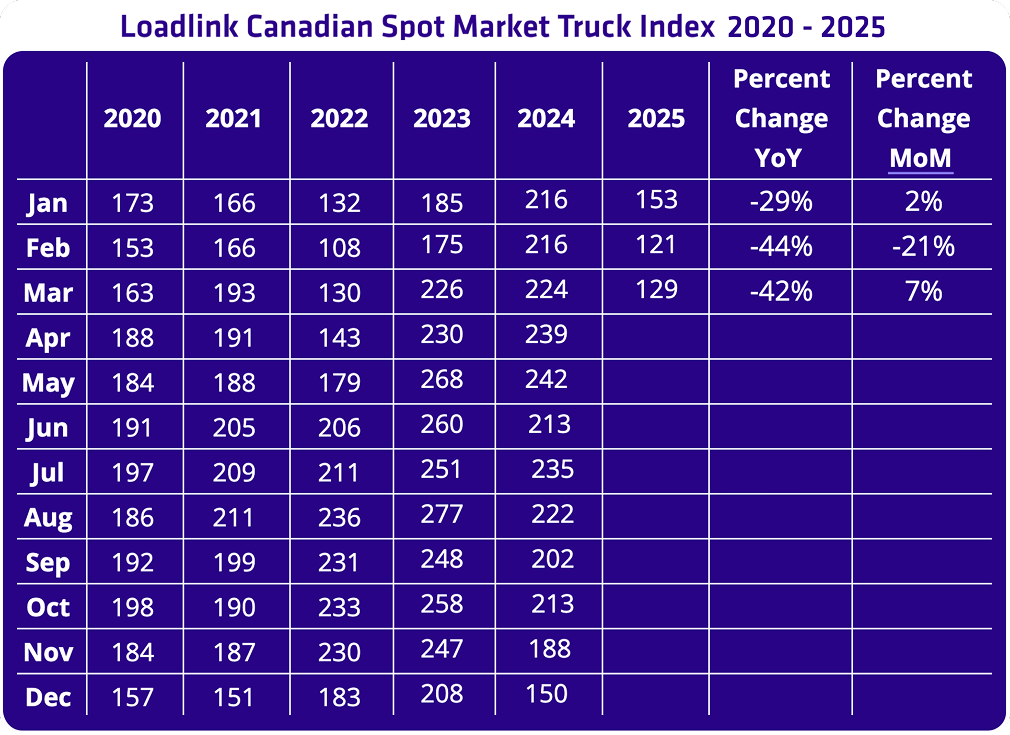

Average Truck-to-Load Ratios

The truck-to-load ratio improved with a 60 percent year-over-year decline from the March 2024 ratio of 3.21. It now stands at an impressive 1.32 trucks for every load posted on Loadlink. This reduction signals a more carrier-favoured market from last year.

The average ratio for the first quarter was 1.31, representing volumes that have not been observed since the peak shipping levels during the COVID-19 pandemic in early 2022.

Looking Ahead: Larger Focus on Canada during Tariff Uncertainty The Canadian freight market has seen impressive growth so far in 2025, as both domestic and cross-border freight volumes jumped from last year’s volumes. March alone saw a 40 percent increase in freight volumes compared to the same time last year. While there was a 16 percent decline from February, this follows usual seasonal patterns, where demand usually dips after the early year surge.

Although the first quarter saw tremendous improvement, the recent tariffs have exerted uncertainty and pressure on carriers, brokers, and manufacturers alike. As a result, cross-border trade will be severely impacted and reduced cross-border demand may follow soon. Due to enhanced inspections and border-crossing complexities from the tariffs, freight processing may be slower, and more trucks could be gridlocked, which will negatively impact delivery schedules. The volatility and uncertainty of these impacts can be either a benefit or a drawback. Shippers and brokers may require more capacity to overcome possible delays and ensure operations continue smoothly, or the opposite is possible where they reduce operations to limit risk exposure.

As Canada’s leading spot freight market, Loadlink offers the most freight and capacity available across Canada, which could see boosts in volumes as more businesses look toward local suppliers in the country. Carriers and brokers can look towards Canadian providers for their operations, which may lead to a short-term increase in intra-Canadian truck and load volumes while the cross-border situation resolves.

About Loadlink Technologies

Loadlink Technologies is Canada’s leading freight matching platform. By connecting brokers and carriers, Loadlink helps businesses move freight efficiently and cost-effectively. Through innovative solutions, Loadlink supports the logistics sector by simplifying workflows and enhancing the capacity for freight movement across North America through our software.